Gold shows positive vibes, bulls face challenge at $3,340

Fundamental study

- Dollar Index takes a pause after climbing to 100 Day SMA 99.10

- Trade Deal between the US and Japan, EU improves global economic optimism.

- Trump Tariff deadline of August 1 keeps markets on edge.

- Upcoming Federal Reserve Interest Decision urges caution.

Technical study

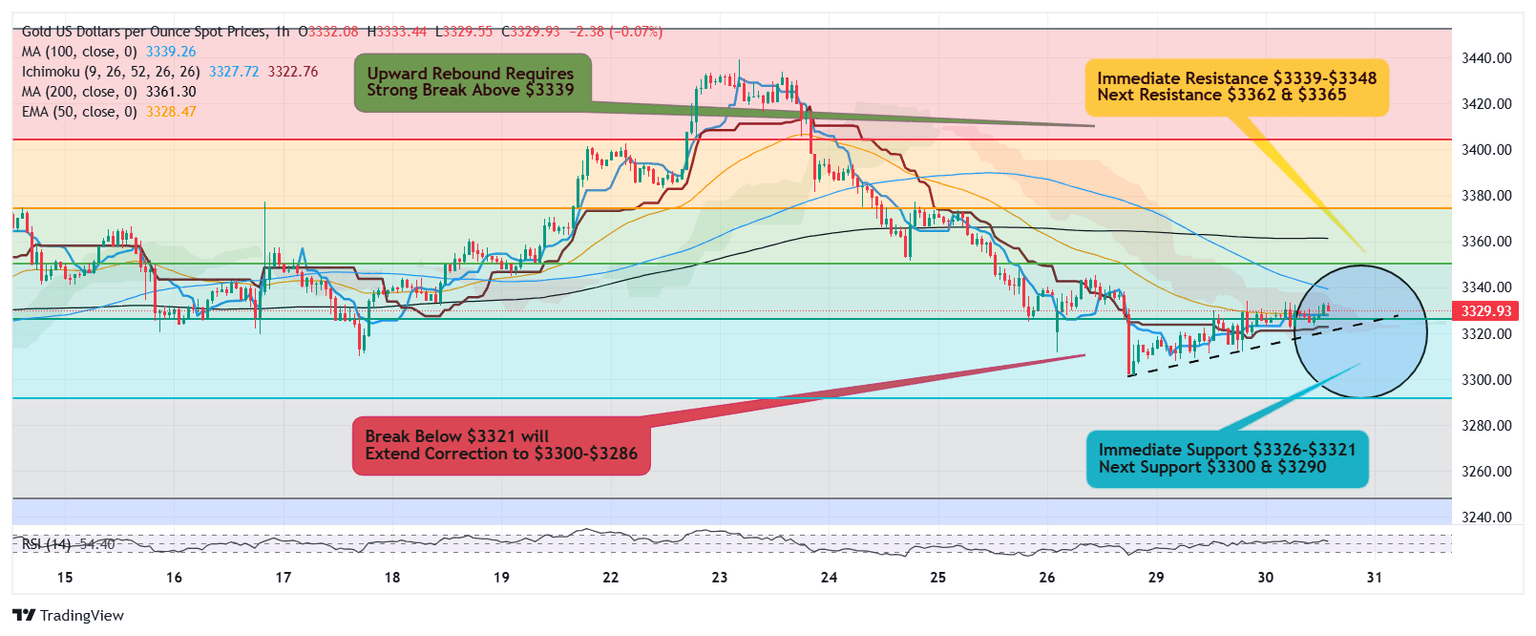

- Gold shows some rebound attempts off the lows of $3300 areas.

- Immediate resistance sits at $3339, followed by next hurdle $3350-$3365.

- Immediate support $3326-$3321 carries prevailing upward bias.

- Break below $3321 likely to extend downward momentum shift towards $3310-$3300.

- Selling pressure below $3300 may extend decline to $3290-$3286.

Broader outlook: What's going on with Gold?

The recent sell off in Gold from $3439 reached psychological zone $3300 but rebound attempts lack strong conviction and immediate resistance sits at $3339 which bulls need to clear and further reclaim next hurdle at $3350 to establish a decisive rebound that initially targets $3365.

Rejection from resistance zone will eventually resume downward correctional wave retesting $3300 while further break below $3300 will expose $3290-$3286.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.