Gold: Sells into strength again [Video]

![Gold: Sells into strength again [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-nuggets-14424039_XtraLarge.jpg)

Gold

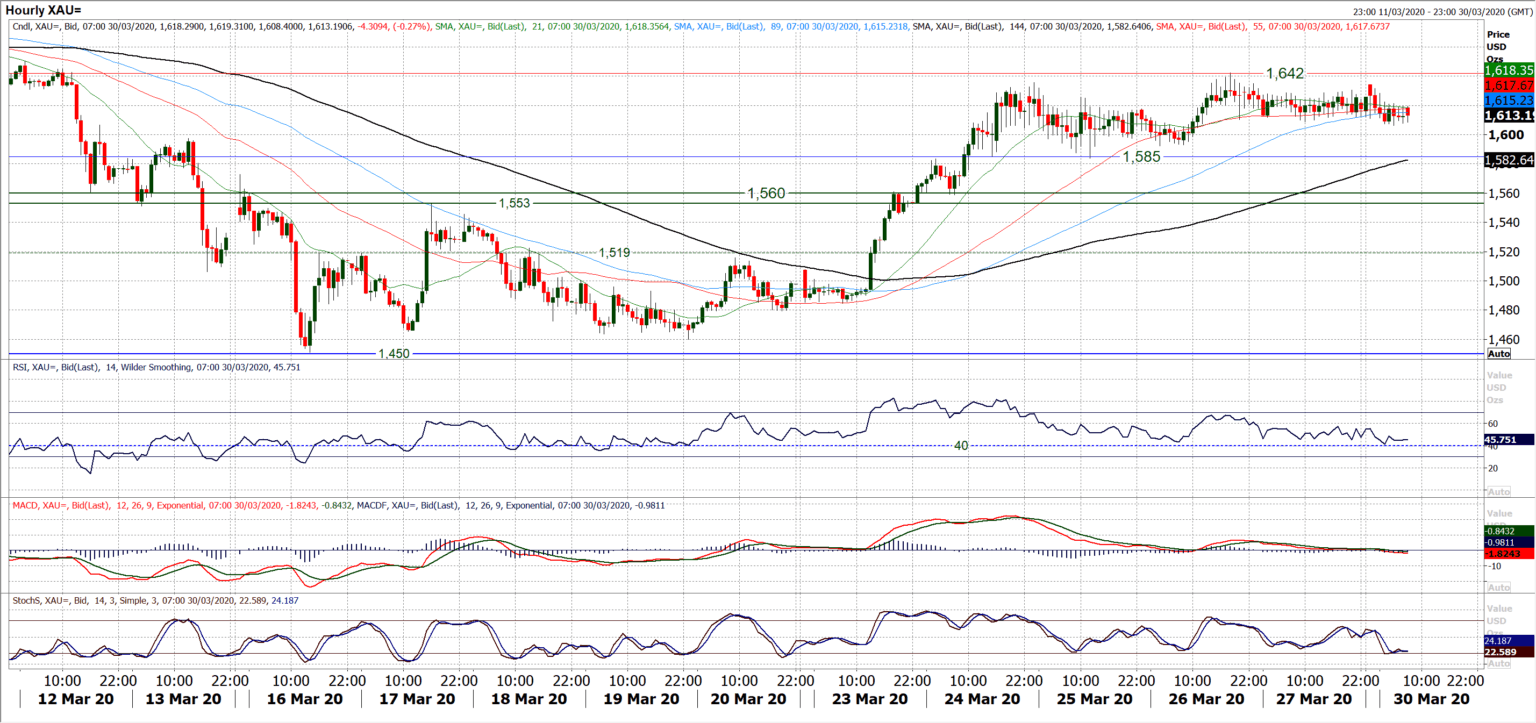

The consolidation that we have been seeing develop in the past few sessions, continues to impact on gold This means that the sharp rally has now hit the buffers around the 23.6% Fibonacci retracement (of the original bull run between $1445/$1702) at $1641. Tempering this rally in the past few sessions, is now seeing the momentum indicators moderate their advance. RSI has held around 55 whilst Stochastics are still advancing along with MACD. This leaves a mild positive bias although we are increasingly cautious of the advance now as the market again sells into strength early this morning. The prospective corrective move has yet to play out (holding above $1585 near term support), but if a second consecutive negative candle is formed today, then the move could begin to weigh on the recent recovery gains. The hourly chart shows a mini-range formation between $1585/$1642, but the hourly RSI moving below 40 would be an indication of the positive bias just slipping away again. A close below the 38.2% Fib at $1604 would begin to also weigh on sentiment. For now though gold is in consolidation.

Author

Richard Perry

Independent Analyst