Gold remains stuck in tight range, awaits Jackson Hole triggers

- Gold is trading in a familiar narrow range between $3330 support and $3342 resistance.

- Markets await clues from upcoming Jackson Hole Symposium on 21--23 August.

- Jerome Powell is expected to make some announcements on possibilities of interest rate decision.

- Dollar recovery lacks conviction as long term downtrend remains intact.

- Scenario on Geo political fronts remain on edge as Trump-Zelensky meet take centre stage.

Price action bias

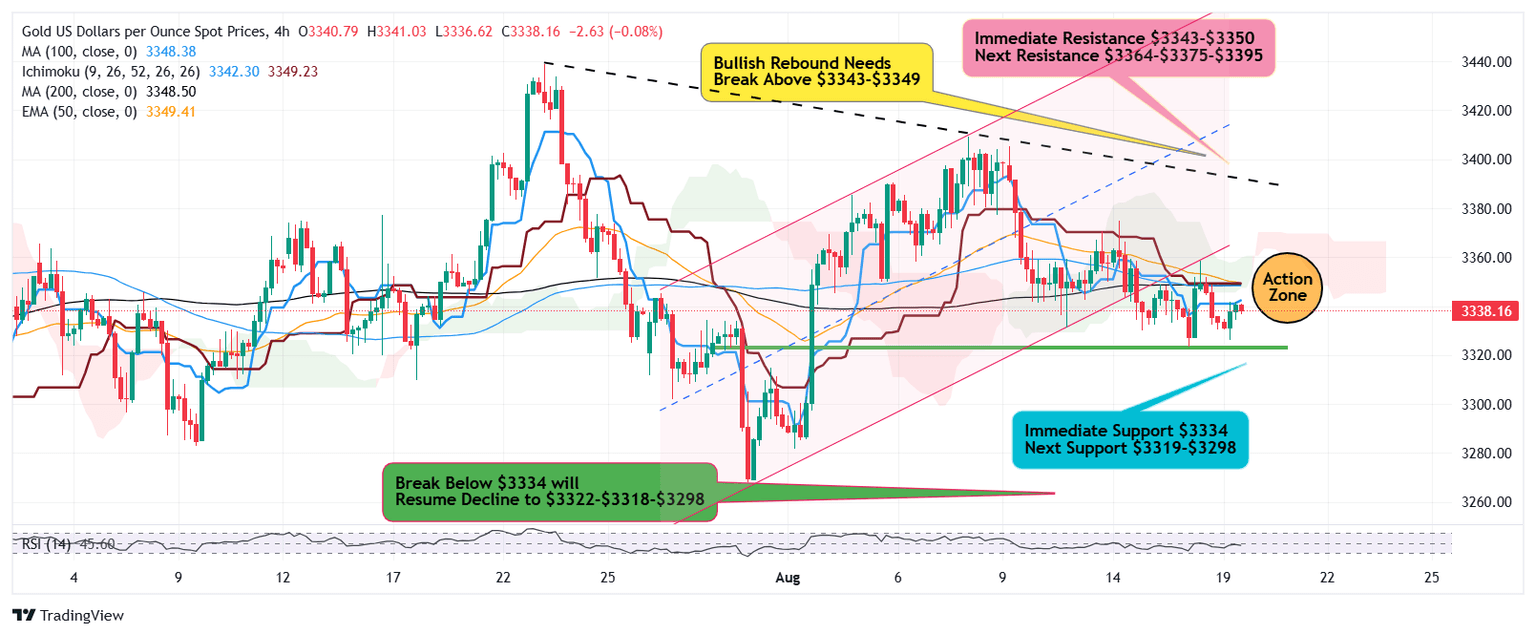

Gold continues to maintain stability below immediate hurdle $3343 and more important 4 hourly 50 EMA $3350 which keeps momentum under bearish domination.

Unless Gold manages to break and sustain above $3343 and make strong and decisive break above $3350, chances of break below $3334-$3328 remains high, exposing further decline towards $3322-$3318-$3312

On the other hand, a consolidated and strong momentum driven break above $3343 followed by break above $3350 will put Gold on way to strategic resistance and swing high $3358 which again is a turning point for further acceleration towards next leg higher $3364-$3368-$3375

Technical Indicators suggest a mixed and cautious indecision outlook as 4 hourly RSI reading of 45 remains below neutrality of 50 while 1 hourly RSI reading of 51 reflects bullish potential.

All the same, price action reigns supreme and bullish developments require clear break above $3343-$3350 with strategic turning point at $3358

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.