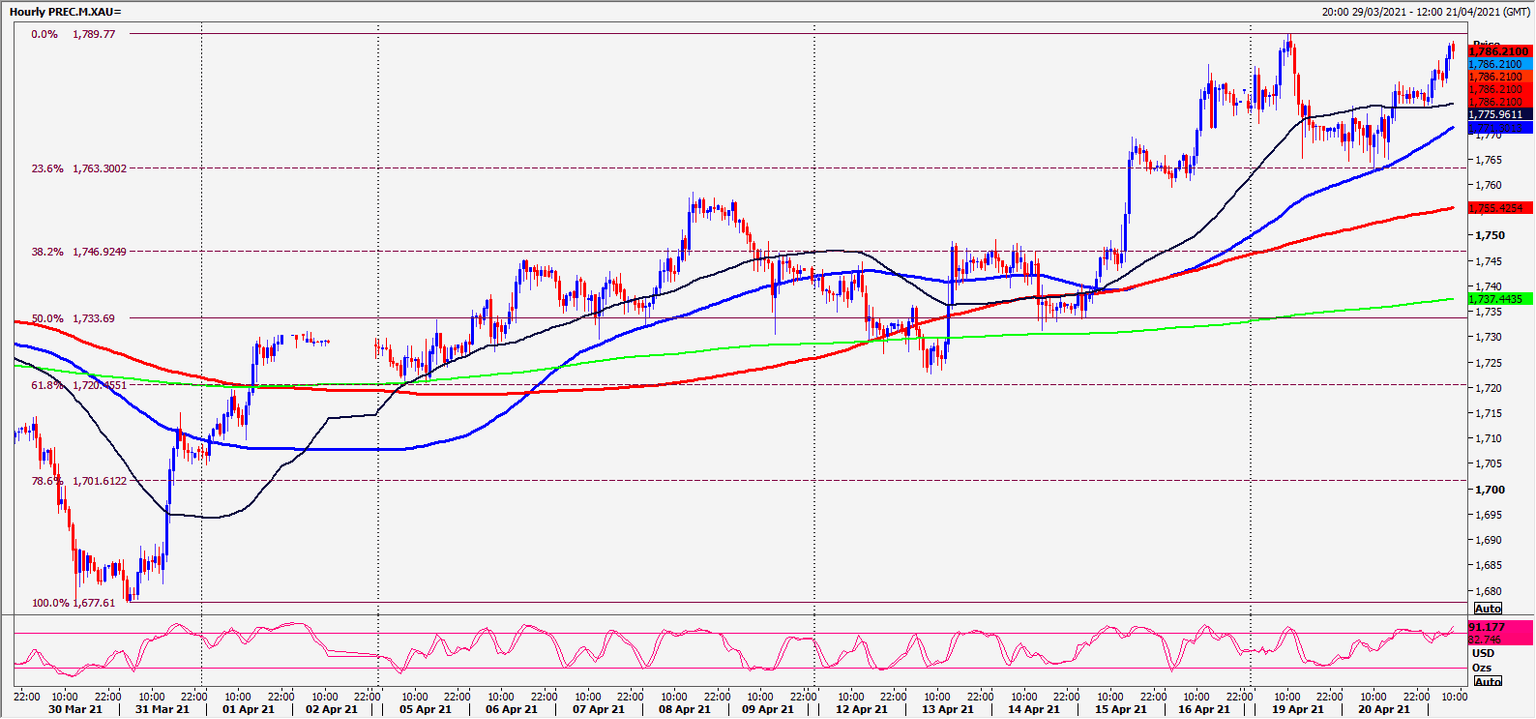

Gold recovers to the first target of 1775/80

Gold, Silver, WTI Crude

Gold Spot bottomed exactly at best support at 1764/61. Longs worked perfectly on the 20 point bounce to 1784.

Silver Spot still holding the next target of 2610/20 as we trade sideways all through April.

WTI Crude JUNE Future collapsed from the next target & resistance at 6380/6400 to break 1st support at 6300/6280. However, we bottomed exactly at the next target & support at 6185/65.

Daily analysis

Gold minor support at 1772/70, then strong support again at 1764/61. Longs need stops below 1759. A break lower targets 1756/55 with support at 1748/46.

Gold recovers to the first target of 1775/80 as we look for a retest of this week’s high of 1788/90 now. A break higher today targets minor resistance at 1792/96 before strong 100 days moving average resistance at 1803/05.

Silver hit the next target of 2610/20 & topped exactly here as expected over the past 2 days. However a break above 2630 this week targets 2650/60, perhaps as far as 2685/95.

Strong support at 2575/65 saw a low for the day exactly as predicted. Longs need stops below 2755 today. Strong support at 2540/30 but longs need stops below 2510.

WTI Crude first support at 6185/65. A break lower to targets supports at 6075/65. If we continue lower look for 6020/00.

Minor resistance at 6265/75. Strong resistance again at 6380/6400. A break above 6435 targets 6480/85 with strong resistance at 6535/65.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk