Gold rally pauses at $4,060 as markets await Powell's speech

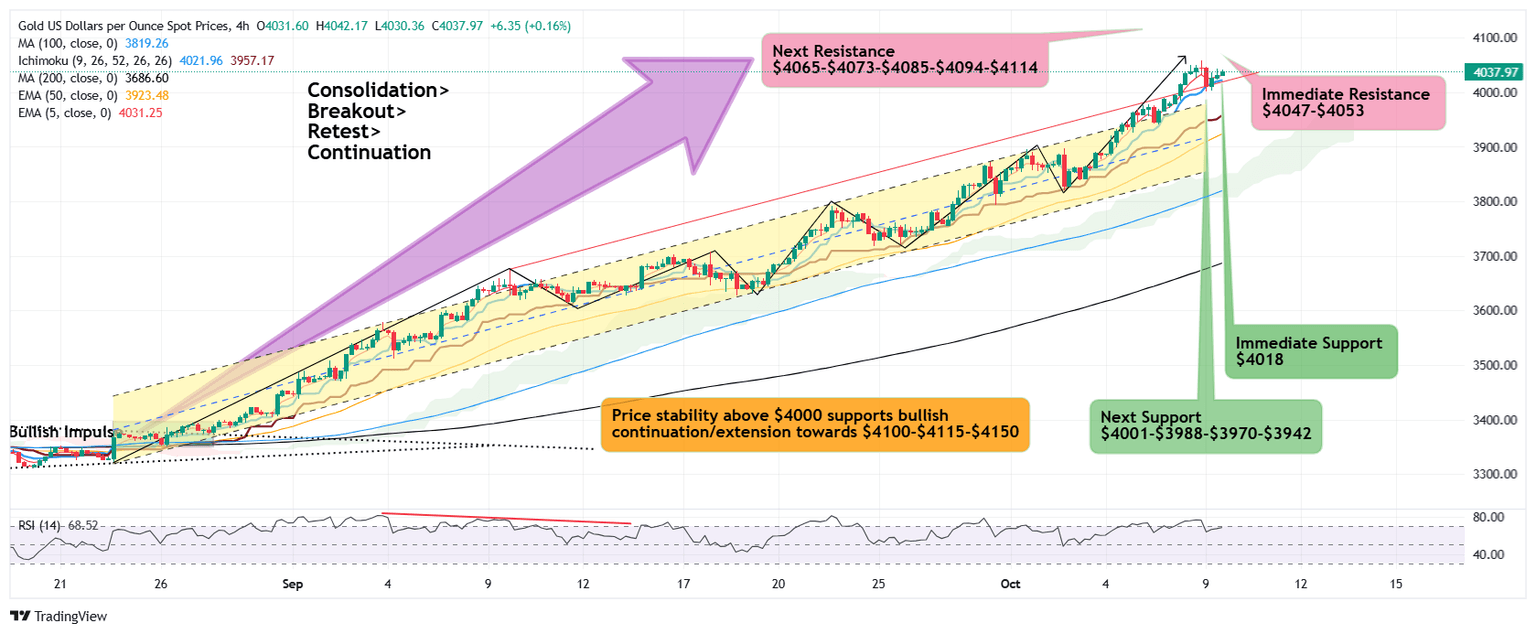

Gold continues to extend its scorching bullish momentum reaching $4060 yesterday. Today's early Asian session witnessed mild pullback towards psychological zone $4000 and the dip was quickly absorbed by bargain hunters. The recovery seems capped at overhead resistance $4048-$4053 which bulls need to clear for resuming upside momentum that targets $4065-$4073-$4085-$4095 above which next leg higher may reach $4115 aligning with 261.8% Fibonacci extension.

Fundamental drivers

The US Government shutdown continues with no clear signs of agreement in Congress about debt ceiling and spending limits raising concerns among investors and elevated risk sentiments which further boost safe haven demand for Gold.

Fed minutes hint at relatively dovish bias suggesting policymakers are more concerned about growth risks than inflationary pressures which add to safe haven appeal for Gold. Markets eagerly await speech by Federal Reserve Chairman J Powell for further clues on interest rate cuts.

Geopolitical risks remain on edge as Middle East tensions and European political woes continue to be matters of global concern.

Global central banks continue to accumulate Gold despite record high prices which create strong structural demand for the metal in the long run.

Bond yields have been dull making non-yield Gold attractive for store of value.

Technical drivers

Gold continues to maintain a strong bullish market structure supported by price stability above psychological zone $4000 and further confirmed by a precise sequence of Higher Highs and Higher Lows which is essentially a clear evidence of bullish rally continuation.

Each correctional decline has been quickly bought and absorbed around liquidity zones implying smart money flow controlling the bullish momentum.

Immediate resistance $4048-$4053 caps upward bounce attempts which bulls need to clear through for further advance towards next leg higher.

4 hourly 5 EMA at $4032 is carrying immediate bullish momentum below which $4018-$4008 may offer another value buying opportunity.

RSI readings of 90 on Daily time frame as well as Monthly time frame are showing overbought conditions urging caution on heights and vulnerability of a sharp price correction either from these areas or from next bullish leg $4115.

Overall outlook

Gold remains extremely bullish in line with the primary trend. However, it looks like the bullish momentum is approaching point of inflection with growing possibilities of a price correction somewhere nearby, possibly $4115 or earlier. Any news of agreement to resolve the US Government shutdown will witness a sizeable price rebalancing at the drop of a hat.

For now, as long as the sequence of Higher Highs and Higher Lows remain intact, the bullish rally keeps going.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.