Gold rally extends on geopolitical fears and Fed uncertainty

Gold is holding near record levels as global uncertainty continues to fuel safe-haven demand. Rising geopolitical tensions, growing political risks, and shifting expectations for U.S. monetary policy are driving market sentiment. These dynamics are weighing on the U.S. dollar and boosting the appeal of non-yielding assets. Gold remains well-supported in this environment, with markets closely watching for new catalysts that could extend the rally.

Gold supported by geopolitical instability and shifting U.S. outlook

Gold is holding near recent highs as rising geopolitical tensions continue to boost safe-haven demand. Over the weekend, reports indicated that U.S. President Donald Trump is considering military action against Iran amid ongoing civil unrest and the potential use of force by the regime. The prospect of renewed conflict in the Middle East has heightened market caution and strengthened gold’s defensive appeal.

At the same time, tensions in Ukraine are intensifying. Russia’s use of the new Oreshnik hypersonic missile in a major strike has raised international concern. In response, the United Nations Security Council held an emergency meeting, highlighting growing geopolitical instability. These events have deepened the risk-off sentiment across markets, driving increased flows into safe-haven assets like gold.

Meanwhile, political concerns in the U.S. are adding to market uncertainty. A criminal investigation involving Fed Chair Jerome Powell has raised questions about the Federal Reserve’s independence. This has fueled unease over the central bank’s ability to conduct policy without political pressure. Combined with weaker labor data and growing expectations of rate cuts, the situation has weighed on the U.S. dollar and added to gold’s upward momentum.

Gold extends rally within ascending channel toward key resistance

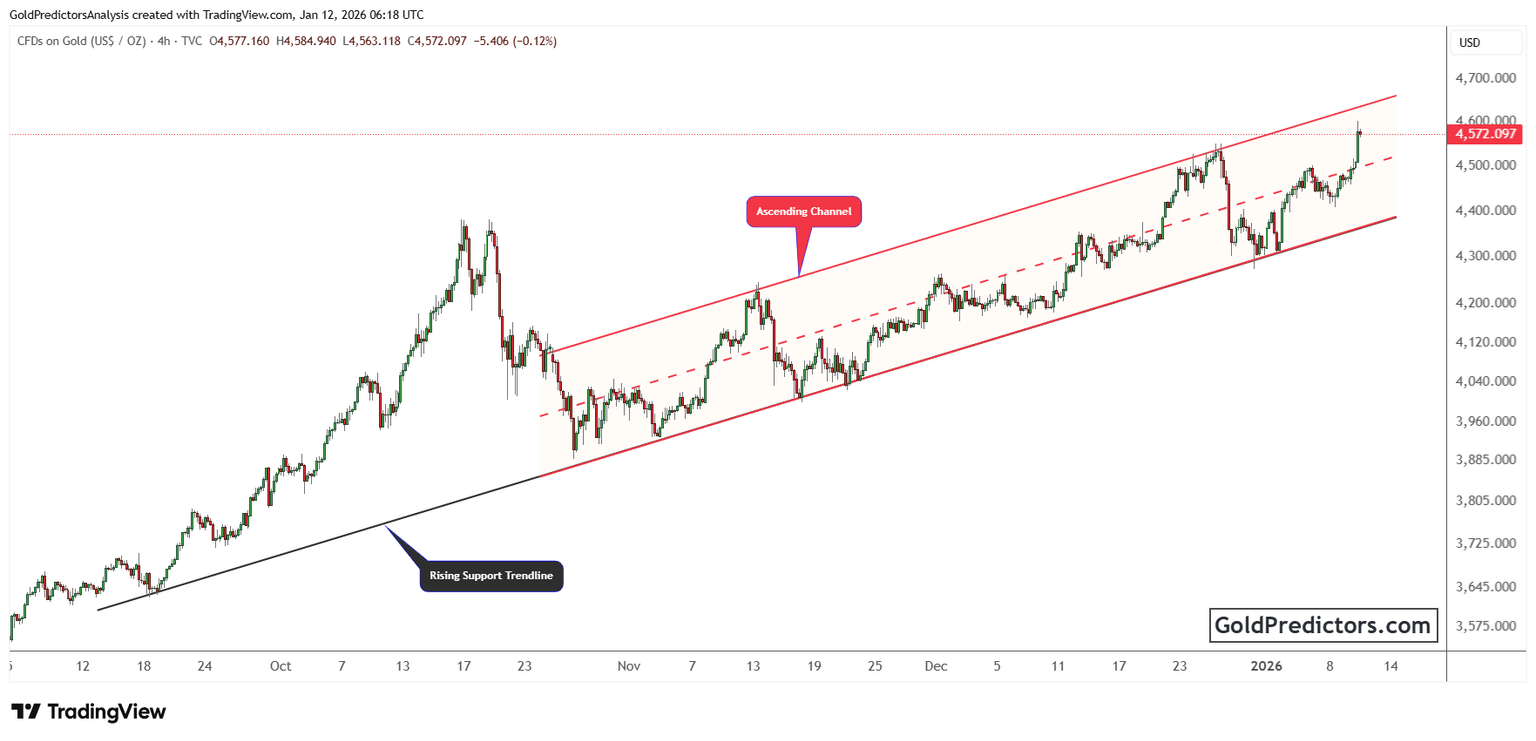

The gold chart below shows price climbing within a well-defined ascending channel that has been in place since September. Following a brief pullback in late October, the metal rebounded sharply, forming a series of higher highs and higher lows. The channel’s lower boundary has repeatedly provided support, absorbing short-term declines and maintaining the broader uptrend.

In late December, gold found support near the lower edge of the channel and began a steady move toward the channel’s midline. Each dip along the way was brief, reflecting firm underlying demand. The move above $4,500 confirmed renewed bullish momentum, with price now approaching the channel’s upper resistance zone.

Additionally, the rising support trendline from earlier price action offered further confirmation of structural strength. Its intersection with the lower boundary of the current ascending channel formed a strong base for gold’s latest upward move. With price now hovering near $4,560, just below channel resistance, a breakout remains possible if supportive macro conditions persist.

Gold outlook: Technical strength and global uncertainty support further upside

Gold remains well-positioned for further gains as geopolitical tensions, domestic political uncertainty, and weakening economic indicators drive continued safe-haven demand. The combination of rising conflict risks, concerns over the Fed’s independence, and softening labor data has created strong tailwinds for gold. With price action supported by a firm technical structure and macro conditions still evolving, gold could soon attempt a breakout above key resistance levels.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.