Gold rallies above $2,700: Is softer inflation setting the stage for rate cuts?

Gold prices have surged past the $2,700 mark, continuing their climb after a period of volatility. This latest rally, stretching into a third consecutive day of gains, has been sparked by a key shift in market expectations.

As U.S. inflation data reveals signs of cooling, investors are once again turning to gold, speculating that this could signal a turning point in the Federal Reserve's aggressive interest rate hikes. But with the Fed still cautious and global uncertainties lingering, one crucial question emerges: Is softer inflation now setting the stage for rate cuts that could propel gold even higher?

Softer inflation fuels hopes for rate cuts

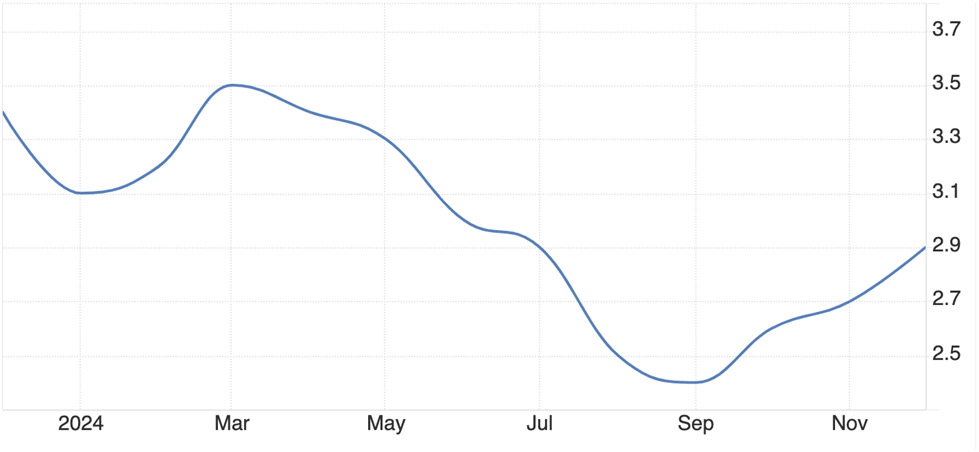

The December U.S. Consumer Price Index (CPI) provided a mixed but ultimately optimistic view on inflation. While the headline CPI showed a slight acceleration, reaching 2.9% year-on-year (up from 2.7% in November), the core CPI-which excludes volatile food and energy prices-rose at a slower pace than anticipated.

Source: U.S. Bureau of Labor Statistics

The core CPI registered 3.2% annually, a slight miss against expectations of 3.3%. This softening in core inflation provided investors with a glimmer of hope that the Federal Reserve might slow its pace of tightening monetary policy.

The reaction in financial markets was swift and pronounced. With inflation showing signs of abating, the probability of the Federal Reserve cutting rates by 25 basis points in June increased significantly.

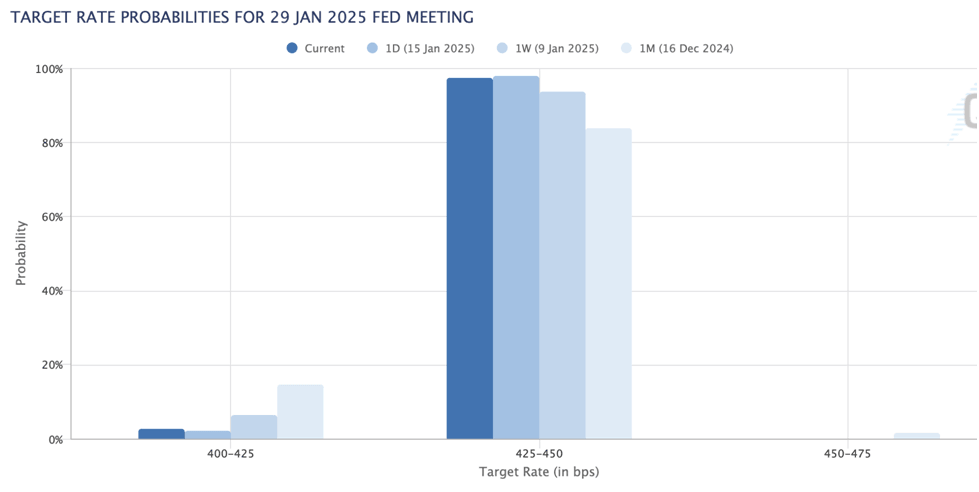

According to the CME FedWatch tool, investors are now anticipating a nearly 98% likelihood that the Fed will maintain current interest rates during its January meeting. This shift in expectations has set the stage for gold to capitalize on a potential dovish turn in Fed policy.

Source: CME FedWatch Tool.

Gold’s safe-haven appeal in a shifting economic landscape

Gold, traditionally viewed as a safe-haven asset, tends to benefit in times of uncertainty or economic instability. Its appeal grows when inflation pressures rise, as investors seek a hedge against declining purchasing power. But as inflation cools and interest rates fall, gold's appeal strengthens even further. This is because the opportunity cost of holding non-yielding assets like gold diminishes when bond yields and interest rates decline.

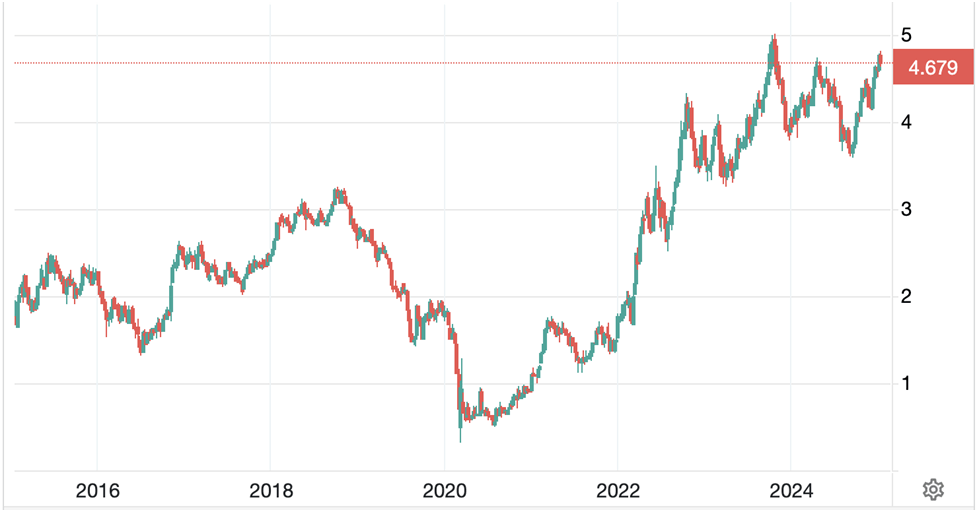

The recent drop in U.S. Treasury yields, particularly the 10-year yield, which has retreated below 4.70%, further fuels gold's momentum.

Source: Trading economics

When bond yields fall, gold becomes more attractive as an investment, as it does not pay interest but can serve as a store of value. As the bond market adjusts to the expectation of a potential rate cut, gold prices have surged, taking advantage of this shift in the economic landscape.

Despite these developments, the Federal Reserve remains cautious. Richmond Fed President Tom Barkin recently acknowledged that while progress is being made toward reducing inflation, there is still a long way to go before reaching the Fed’s 2% inflation target. Barkin and other officials have suggested that interest rates should remain restrictive to ensure inflation continues to decline. This hawkish tone is at odds with the market's expectations for a policy pivot. However, the prevailing sentiment in the markets is that as inflation continues to show signs of easing, the Fed may soon be compelled to cut rates, which would further support gold’s upward trajectory.

Geopolitical tensions and Gold’s safe-haven demand

In addition to economic data, global geopolitical tensions continue to influence gold prices. Ongoing instability in Ukraine, the Middle East, and concerns over potential tariff escalations tied to former President Donald Trump’s re-election campaign add a layer of uncertainty to the global outlook. As these risks persist, investors are likely to turn to gold as a hedge against global instability.

Gold’s traditional role as a safe-haven asset is magnified in times of geopolitical unrest, where it often experiences demand from risk-averse investors looking to protect their wealth. As tensions rise around the world, gold’s status as a store of value remains a key factor driving its price.

The road ahead: Can Gold sustain its rally?

With gold now slightly above $2,700, traders are closely watching the next moves from the Fed and how inflationary trends unfold. Will the Fed adjust its policy in response to cooling inflation, or will global risks continue to overshadow domestic economic trends? The next few months are crucial in determining whether the recent rally in gold is sustainable or if it will face a setback.

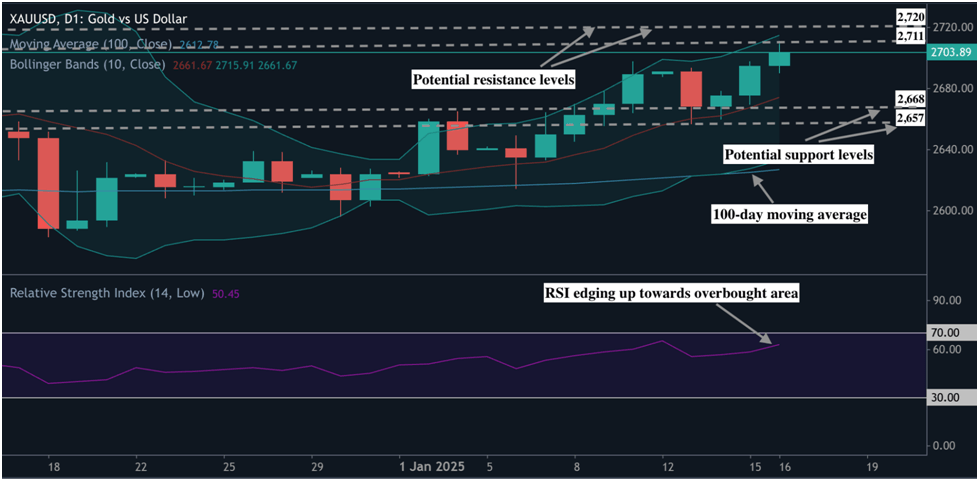

At the time of writing, Gold is hovering just above $2700, with a buy-side bias evident on the daily chart as prices remain above the moving average. However, prices edging towards the upper boundary of the bollinger bands, hints at potential overbought conditions. The RSI also sharply edging towards overbought territory adds to the narrative that a slow-down could be in the offing.

Buyers could find resistance at the $2,711 and $2,720 price levels. On the downside, sellers could find support at the $2,668 and $2,657 price levels.

Source: Deriv MT5

Author

Prakash Bhudia

Deriv

Prakash Bhudia, HOD – Product & Growth at Deriv, provides strategic leadership across crucial trading functions, including operations, risk management, and main marketing channels.