Gold Price Weekly Forecast: Bulls retain control ahead of key US inflation data

- Gold price registered gains for the third straight week.

- Near-term technical outlook suggests that XAU/USD's bullish bias stays intact.

- Consumer Price Index (CPI) data from the US could be next week's big market-moving event.

Gold price started the new year in a volatile manner as investors reassessed the US Federal Reserve (Fed)’s policy outlook following the latest data releases. After having touched its highest level since early June above $1,860 mid-week, XAU/USD fell sharply on Thursday but managed to hold above $1,830. With the US December jobs report and the disappointing ISM Services PMI survey weighing on US Treasury bond yields, the pair regained its traction on Friday and closed the third straight week in positive territory.

What happened last week?

Trading action in financial markets remained subdued on Monday with stock and bond markets in major economies remaining closed in observance of the New Year holiday.

As trading conditions started to normalize on Tuesday, inter-market correlations weakened. Despite the positive shift witnessed in risk sentiment, the US Dollar outperformed its major rivals, including Gold. The benchmark 10-year US Treasury bond yield, however, fell more than 2% on the day and allowed XAU/USD to gather bullish momentum.

The data published by the ISM revealed on Wednesday that the business activity in the manufacturing sector contracted for the second straight month in December. The Employment Index of the ISM’s PMI survey unexpectedly recovered above 5, helping the US Dollar stay resilient and limiting XAU/USD’s upside.

On Thursday, ADP reported that employment in the US private sector rose by 235,000 in December. This reading came in much better than the market expectation of 150,000 and caused investors to reassess the Federal Reserve’s policy outlook. The CME Group FedWatch Tool’s probability of a 25 basis points (bps) rate hike in February declined to 57% from 73% earlier in the week after this data. In turn, the benchmark 10-year US Treasury bond yield staged a rebound and forced the negatively-correlated XAU/USD to erase a portion of its weekly gains.

The US Bureau of Labor Statistics announced on Friday that Nonfarm Payrolls (NFP) rose by 223,000 in December, compared to the market expectation of 200,000. Further details of the report showed that the Average Hourly Earnings declined to 4.6% from 4.8% (revised from 5.1%) in November. Despite the upbeat NFP print, soft wage inflation caused the 10-year US T-bond yield to turn south and opened the door for a rebound in XAU/USD. Finally, the ISM Services PMI declined to 49.6 in December from 56.5 in November. More importantly, the inflation component, Prices Paid Index, dropped to 67.6 from 70 and came in much lower than the market expectation of 71.5. The mixed jobs report and the dismal PMI survey caused the US Dollar to weaken against its rivals and fueled another leg higher in XAU/USD.

Next week

The United States economic docket will not offer any high-impact macroeconomic data releases in the first half of next week. On Thursday, the US Bureau of Labor Statistics (BLS) will release the Consumer Price Index data for December. On a monthly basis, the Core CPI, which excludes volatile food and energy prices, is expected to rise by 0.3% following November’s increase of 0.2%.

In October and November, monthly Core CPI rose at a softer pace than expected and investors decided that it was time for the Federal Reserve to take its foot off the gas pedal. Although Fed policymakers have been reiterating that they are not expecting a rate cut in 2023, one more soft core inflation reading should weigh on the US Dollar and trigger another leg higher in XAU/USD.

The minutes of the December policy meeting revealed earlier in the week that most policymakers welcomed inflation easing in October and November but agreed that it would take "substantially more evidence" of progress to confirm the downward path.

On the other hand, a monthly increase of 0.5% or higher in core inflation should lift US Treasury bond yields and cause Gold price to turn bearish.

Ahead of the weekend, the University of Michigan’s preliminary Consumer Sentiment Survey for January will be looked upon for fresh impetus. Rather than the headline Consumer Confidence Index, market participants are likely to pay close attention to the 5-year Consumer Inflation Expectation component, which stood at 2.9% in December. It’s unlikely to see a significant change in that number but a short-lived and straightforward market reaction could be witnessed with an uptick in the long-run inflation expectation lifting the US Dollar against Gold and vice versa.

Gold price technical outlook

XAU/USD's near-term technical outlook remains bullish with the Relative Strength Index (RSI) indicator on the daily chart rising above 60. Additionally, the pair holds comfortably above the 20-day Simple Moving Average (SMA) while continuing to follow the ascending trend line.

The $1,860 static level aligns as the first resistance. Once XAU/USD confirms that level as support, it could target $1,880 (Fibonacci 61.8% retracement of the long-term downtrend), $1,900 (psychological level) and $1,920 (former support, static level).

In case Gold price falls below $1,810 (20-day SMA), the downward correction could extend toward $1,800 and $1,780 (Fibonacci 38.2% retracement, 200-day SMA).

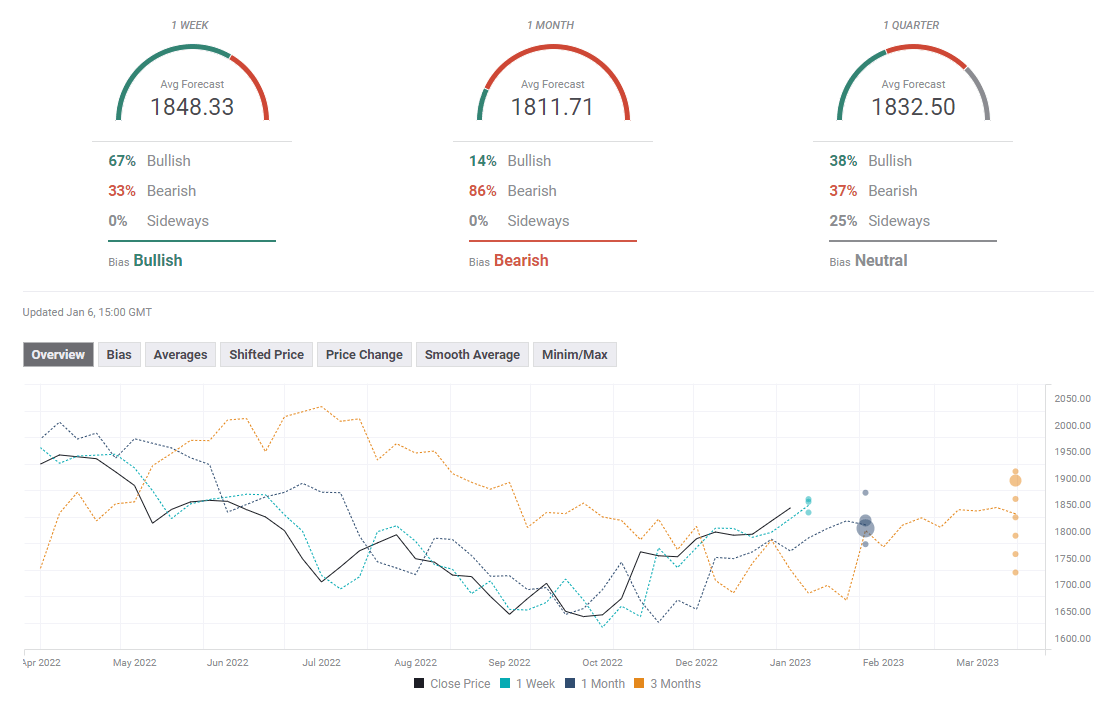

Gold price forecast poll

Despite XAU/USD's bullish start to the year, the FXStreet Forecast Poll points to a bearish bias over the one-month outlook with the average target sitting at $1,811.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.