Gold Price Weekly Forecast: $2,000 proves to be a tough resistance to crack

- Gold price benefited from global financial turmoil and climbed to $2,000 area.

- XAU/USD could stage a technical correction if $2,000 stays intact as resistance.

- Markets will continue to keep a close eye on banking stocks and global yields.

Gold price advanced beyond $2,000 to start the week but staged a deep correction afterwards. The Federal Reserve’s dovish surprise combined with the souring market mood, however, helped XAU/USD regain its traction in the second half of the week. Market participants will keep a close eye on global yields next week as the precious metal looks to continue to shine as the go-to asset amid the ongoing turmoil in the global financial sector.

What happened last week?

Although risk flows dominated the markets at the beginning of the week, global yields fell sharply following the European opening and Gold price surged above $2,000 for the first time in a year on Monday.

Over the weekend, Swiss authorities persuaded UBS Group AG to buy Credit Suisse Group AG to contain the banking crisis that spooked investors. Additionally, the Federal Reserve (Fed) announced that it will offer daily swaps to the Bank of Canada (BoC), the Bank of Japan (BoJ), the Swiss National Bank (SNB) and the European Central Bank (ECB) to ensure they have enough liquidity to continue operations. Investors may have assessed the Fed’s action as a sign that financing conditions are worse than they appear to be. In turn, the benchmark 10-year US Treasury bond yield fell to its lowest level since September below 3.3%, fueling XAU/USD rally.

Nevertheless, the late rebound witnessed in Wall Street’s main indexes and the US T-bond yields forced XAU/USD to erase its daily gains. On Tuesday, US T-bond yields continued to push higher on growing expectations for a hawkish Federal Reserve (Fed) policy stance. Gold price extended its correction and declined all the way below $1,950.

On Wednesday, the Fed announced that it raised its policy rate by 25 basis points to the range of 4.75-5% as expected. In its policy statement, the Fed changed its language and said “some additional policy firming may be appropriate” instead of calling for "ongoing increases" in rates. Moreover, the Summary of Economic Projections revealed that the terminal rate projection remained unchanged at 5.1%. The dovish dot plot and the cautious tone in the Fed’s statement triggered a US Dollar sell-off, providing a boost to Gold price in the American session.

During the press conference, FOMC Chairman Jerome Powell reiterated that they were not forecasting a rate cut in 2023 and noted that they have not talked about the balance sheet reduction strategy. These comments sounded slightly hawkish but they did little to nothing to help the USD shake off the selling pressure.

After having gained 1.5% on Wednesday, XAU/USD preserved its bullish momentum on Thursday and climbed above $1,980. The 10-year US T-bond yield, which fell nearly 5% after the Fed event, struggled to stage a rebound and allowed Gold price to stretch higher. The data from the US showed that there were 191,000 Initial Jobless Claims in the week ending March 18 but failed to have a noticeable impact on the USD’s valuation.

XAU/USD continued to build on Thursday’s gains early Friday as global yields, once again, fell sharply on resurfacing fears over a global financial crisis. European banking stocks suffered heavy losses after the opening bell as Deutsche Bank shares fell more than 10% following a spike in credit default swaps and Commerzbank shares dropped nearly 10%. In turn, Gold price climbed above $2,000. However, the safe-haven USD capitalized on the intense flight to safety and limited XAU/USD’s upside heading into the weekend.

The data from the US revealed that the economic activity in the private sector expanded at an accelerating pace in early March with the S&P Global's Composite PMI rising to 53.3 from 50.1 in February. The USD kept its footing after this data and made it difficult for XAU/USD to regather its bullish momentum.

Next week

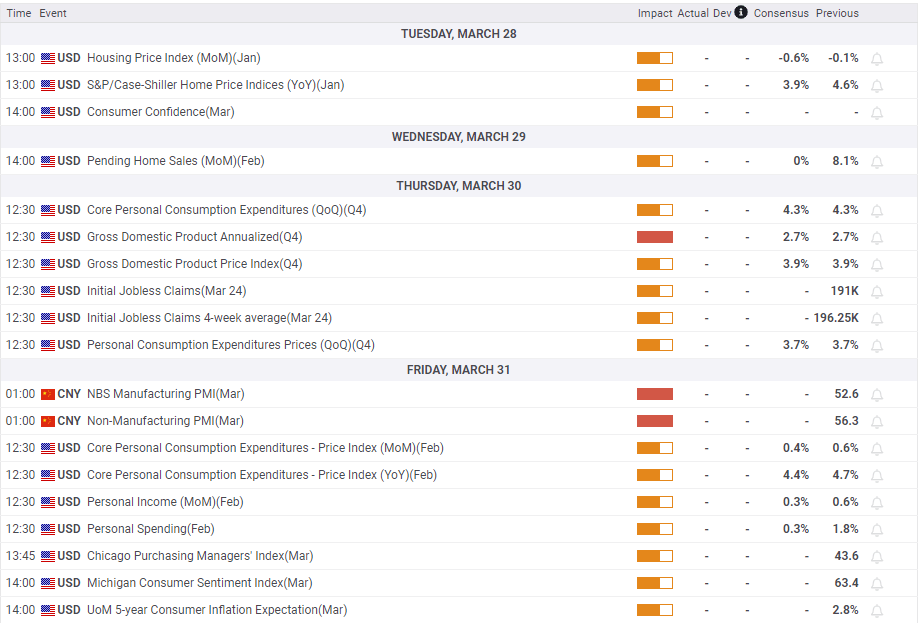

On Wednesday, the US Bureau of Economic Analysis (BEA) will release the Gross Domestic Product growth for the fourth quarter. Since this data will be a revision, it is unlikely to garner attention

Early Friday, the NBS Manufacturing PMI and Non-Manufacturing PMI data from China will be watched closely by market participants. Following February’s decisive rebound, another increase in headline PMIs could help XAU/USD gather bullish momentum, pointing to an improving demand outlook in China, the world’s biggest gold consumer.

Finally, the Personal Consumption Expenditure (PCE) Price Index data will be featured in the US economic docket ahead of the weekend. The annual Core PCE Price Index, the Fed’s preferred gauge of inflation, is forecast to edge lower to 4.4% in February from 4.7% in January.

The next FOMC meeting will take place in early May and the CME Group FedWatch Tool shows that markets are pricing in a 60% probability that the Fed will keep its policy rate unchanged. Although the April jobs report and Consumer Price Index (CPI) figures are likely to steer market expectations, a stronger than anticipated Core PCE inflation reading could bring back hawkish Fed bets and force XAU/USD to end the week on the back foot.

Meanwhile, investors will pay close attention to comments from Fed officials now that the blackout period is over. Furthermore, Friday’s panic mode in markets showed that investors remain on the lookout for signs of stress in the banking sector. Hence, Gold price could benefit from another slide in global yields.

Gold price technical outlook

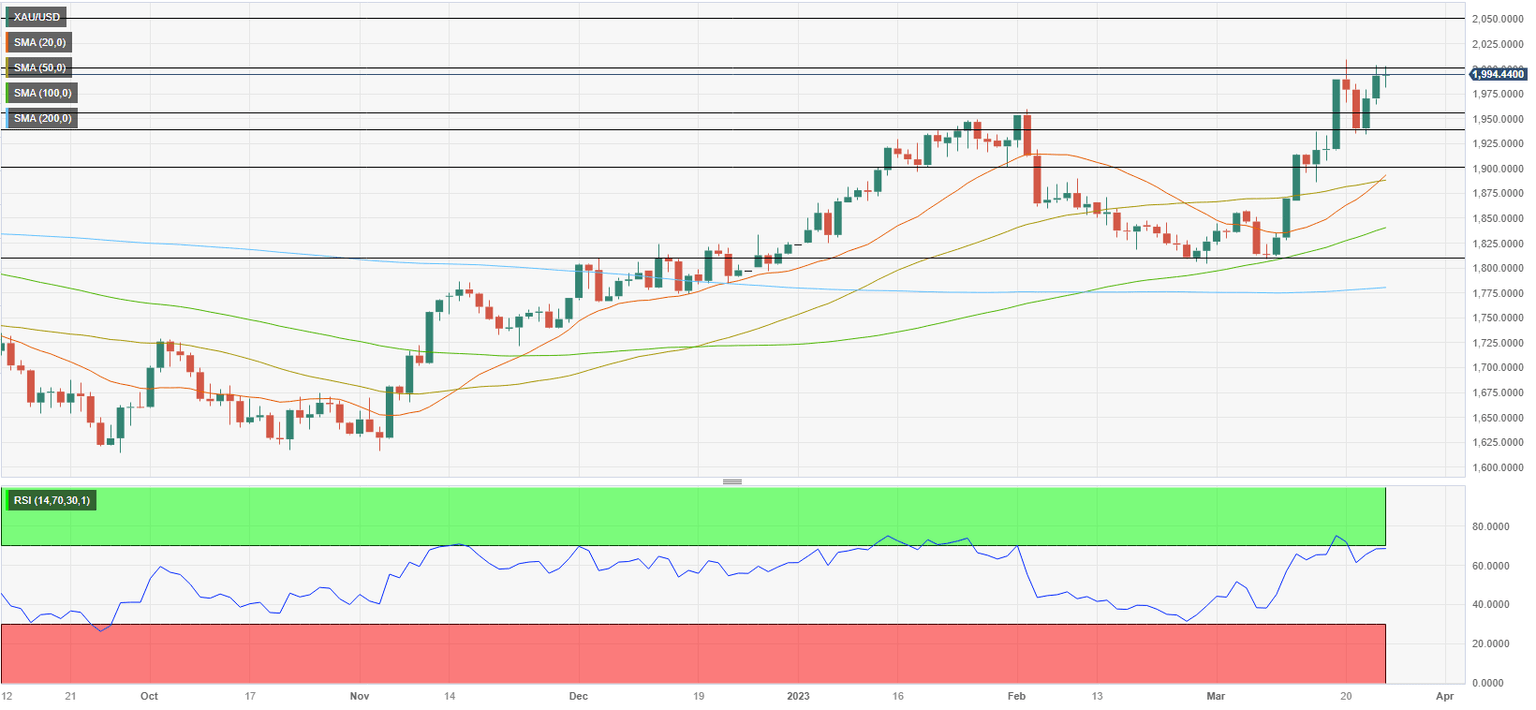

The $2,000 area (psychological level, static level) proved to be a tough resistance to crack this past week. In case this level stays intact and global yields stage a rebound, Gold price is likely to make a technical correction. The Relative Strength Index (RSI) indicator on the daily chart is also about to cross above 70, pointing to overbought conditions. In that scenario, $1,960 (former resistance, static level) aligns as the first bearish target before $1,940 (static level). A daily close below the latter could open the door for an extended correction toward $1,900 (psychological level, static level).

On the upside, technical buying pressure could gather strength if XAU/USD manages to stabilize above $2,000. In that case, $2,050 (static level) and $2,070 (March 2022 high) could be seen as next bullish targets.

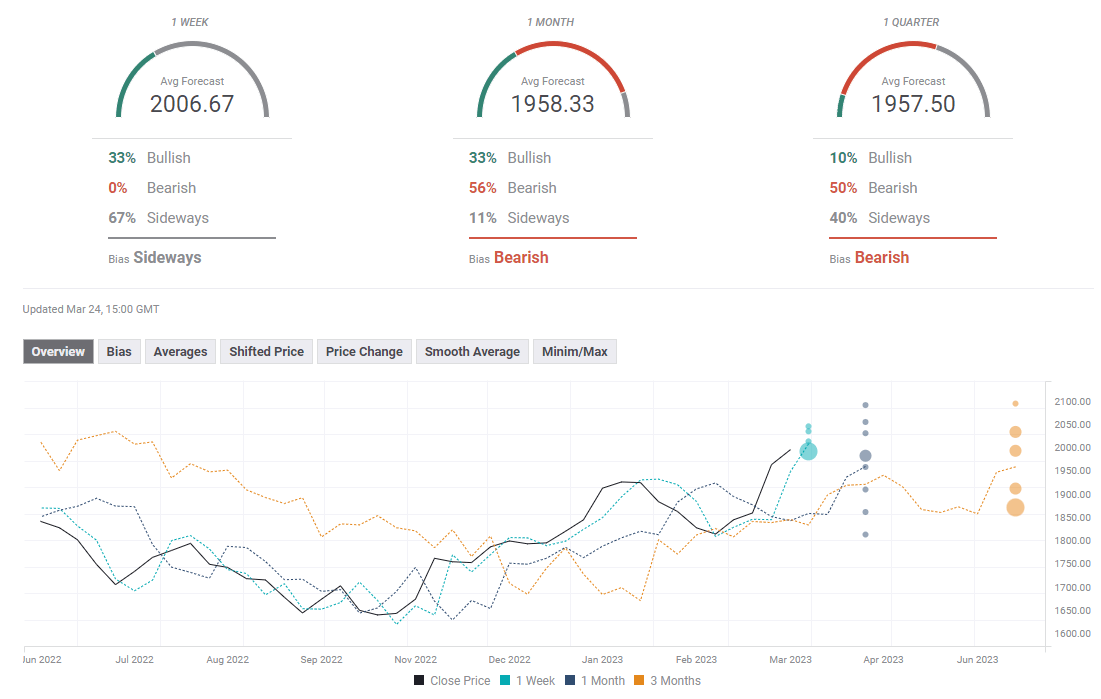

Gold price forecast poll

A majority of experts polled by FXStreet forecast Gold price to stay in a consolidation phase in the near term. The one-month outlook, however, reveals a bearish bias, with the average target sitting at $1,958.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.