Gold Price Forecast: XAUUSD needs to crack this level to take on the $2,000 mark

- Gold Price looks north as investors seek refuge amid inflation, growth risks.

- XAUUSD shrugs off firmer US dollar, yields on hawkish Fed’s outlook.

- Gold bulls keep their sight on $2,000 but acceptance above $1,990 is critical.

Having booked the second straight weekly gain, gold price is setting off a new week on the right footing, as bulls regather strength after Good Friday’s brief pullback. XAUUSD is sitting at the highest level since March 14 at $1,989, as the increased demand for safety outweighs the ongoing rally in the US Treasury yields alongside the dollar. With no end in sight to the Russia-Ukraine war and a likelihood of a European Union (EU) embargo on the Russian gas, commodities prices have shot through the roof, intensifying fears over inflation and its impact on the global economy.

That said, investors also remain worried about the risks to growth, as major central banks embark upon the path of policy normalization to curb raging inflation. Markets failed to find any comfort from the stronger China’s Q1 GDP data, as investors assess the impact of the recent covid lockdowns and the PBOC’s RRR cut.

Meanwhile, the dollar and the yields keep the upside rolling, as a 50-bps May Fed rate hike seems a done deal. The Fed commentary last week hinted that the world’s most powerful central bank looks to return to neutral rates sooner (than later). The ECB’s dovish surprise widened the yield differential in the favor of the dollar and provided extra legs to the upside in the US rates.

Also read: Chart of the Week, Gold: XAU/USD on verge of a 38.25% Fibo correction

Looking forward, the negative tone in the market sentiment will continue to keep the haven demand for Gold Price underpinned, although bulls could face an uphill battle should the dollar and yields continue firming up. The speech from the St. Louis Fed President James Bullard will stand out amid a data-scarce US docket and Easter Monday-led thin market conditions.

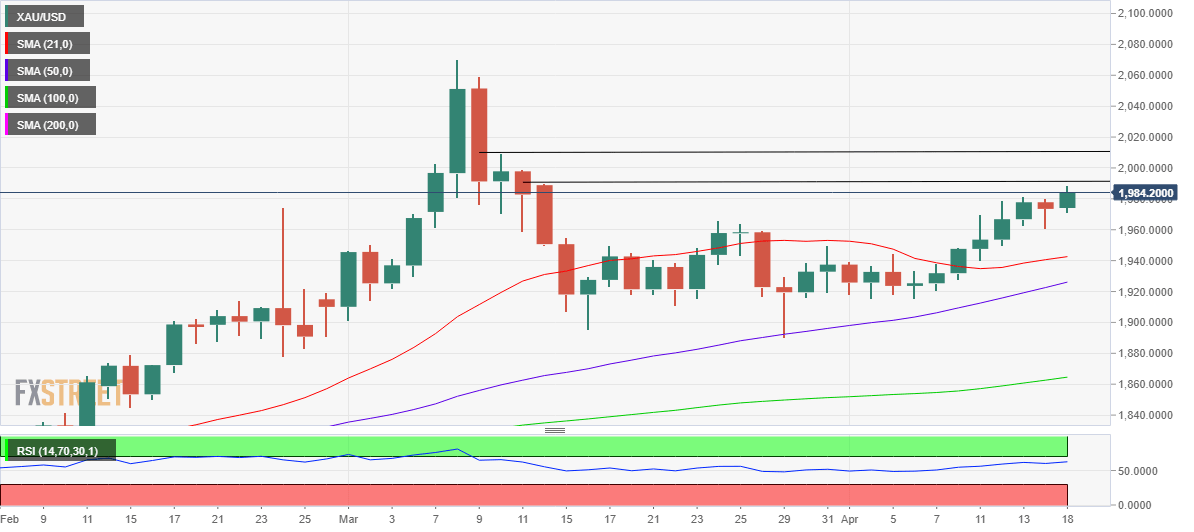

Gold Price: Daily chart

Gold’s daily chart shows that the price is facing stiff resistance at the March 14 highs of $1,990.

If the latter is scaled, then a retest of the $2,000 mark remains inevitable. The further upside will challenge the March 10 highs at $2,009.

The 14-day Relative Strength Index (RSI) is inching higher above the midline, justifying the bullish undertone in Gold Price.

Alternatively, a failure to surpass the $1,990 barrier will recall sellers, exposing Friday’s low of $1,961.

Ahead of that, the intraday lows of $1,971 will offer strong support to gold bulls.

Should the corrective decline pick up pace XAUUSD will then seek a test of the bullish 21-Dailoy Moving Average (DMA) at $1,943.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.