Gold Price Forecast: XAU/USD’s recovery stalls ahead of $3,400

XAU/USD Current price: $3,371.67

- United States President Donald Trump threatens additional tariffs on India.

- The ISM Services PMI is expected to have improved in July to 51.5.

- XAU/USD aims to extend its advance, yet lacks enough momentum.

Spot Gold extended its Friday recovery, peaking at $3,385.41 after Wall Street’s opening. The US Dollar (USD) maintained the sour tone triggered by dismal United States (US) employment-related data, which fueled hopes the Federal Reserve (Fed) could trim the benchmark interest rate when it meets in September.

Additionally, US President Donald Trump announced it will “substantially” raise tariffs on India amid the latter buying Russian oil and selling it into the Open Market, according to a post shared in Truth Social. Earlier in the day, Trump claimed the July Nonfarm Payrolls (NFP) was rigged, to make “a great Republican Success look less stellar!!!,” once again, subtly threatening to replace Fed Chair Jerome Powell.

Data-wise, the US reported that June Factory Orders shrank by 4.8% slightly better than the 4.9% decline anticipated, although much worse than the May 8.3% advance. Other than that, financial markets seem to have finished digesting the poor employment report, with global stocks turning green.

The focus on Tuesday will be on the US ISM Services Purchasing Managers’ Index (PMI). The index is foreseen at 51.5 in July, improving from the 50.8 posted in June.

XAU/USD short-term technical outlook

The daily chart for XAU/USD shows bulls hold the grip, but lack conviction. Gold trades above all its moving averages, with a flat 20 Simple Moving Average (SMA) providing intraday support at around $3,345. The 100 and 200 SMAs, in the meantime, maintain their upward slopes below the shorter one. Technical indicators, however, have lost their bullish strength within neutral levels, barely holding above their midlines.

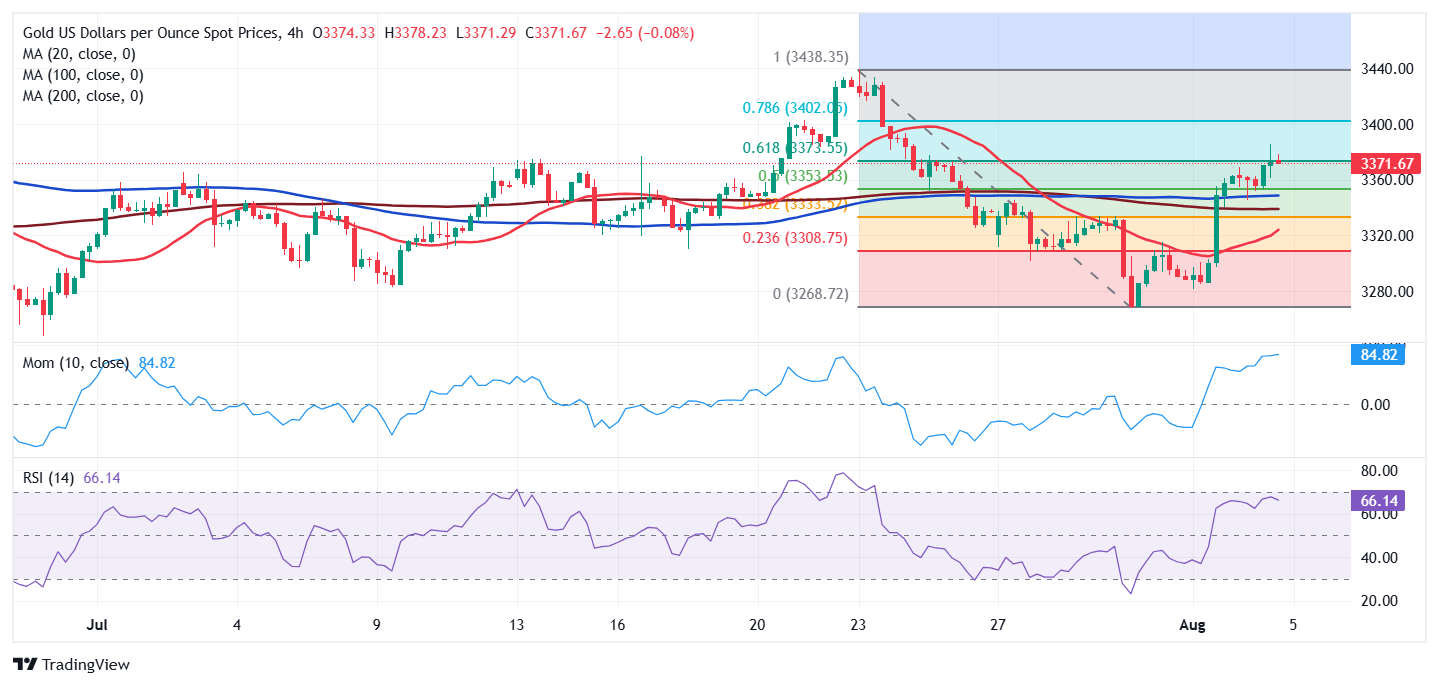

The XAU/USD pair trades well above all its moving averages in the 4-hour chart, with a bullish 20 SMA advancing below directionless 100 and 200 SMAs. Technical indicators, in the meantime, have lost their upward strength, but hold near overbought readings. The 100 SMA, in the meantime, lies at around $3,348, reinforcing the support area.

Support levels: 3,362.10 3,345.00 3.338.60

Resistance levels: 3,385.20 3,396.90 3,407.75

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.