Gold Price Forecast: XAU/USD’s continued rejection at $1800 keeps buyers on the edge

- Gold attempts a tepid recovery after the Yellen-induced blow.

- 4H chart shows the tide is turning once again in favor of XAU bears.

- US ADP jobs data and ISM Services PMI data eyed.

Gold (XAU/USD) showed good two-way price movements on Tuesday, settling in the red around $1780. Despite some volatility, the price of gold remained confined within its recent trading range. The metal rallied to test $1800 earlier in the day but faced rejection once again at that level and fell steeply to the $1770 support area after US Treasury Secretary Janet Yellen talked up rate hike expectations and hammered Wall Street indices. Investors scurried to the safe-haven US dollar, downing the USD-denominated commodity. However, Yellen quickly ate up her words while the Fed policymaker Neil Kashkari pour cold water on expectations of monetary policy normalization. Strong US Factory Orders data also added to the upbeat sentiment around the greenback. However, the fall in the US rates helped gold to recover towards the closing.

Gold’s rebound could gain traction if the risk recovery picks up momentum and weighs further on the dollar in the day ahead. However, upbeat US ADP jobs and ISM Services PMI could revive the bullish undertone in the US currency, limiting gold’s advance. Further, if the Wall Street slide extends into Wednesday, it could likely trigger a flight to safety, lifting the dollar’s haven demand once again.

Gold Price Chart - Technical outlook

Gold: Four-hourly chart

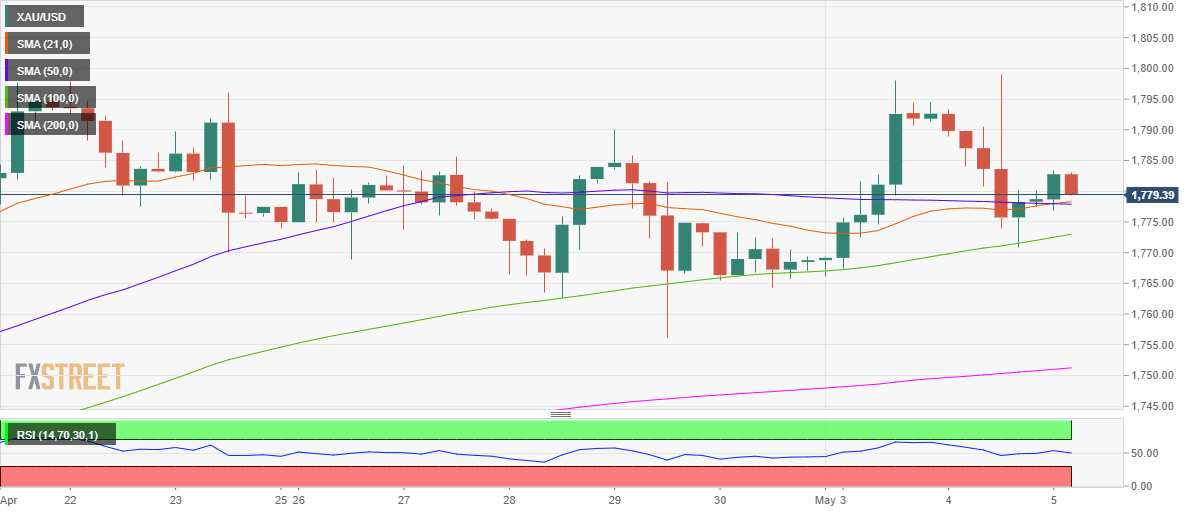

Looking at the four-hourly chart, gold’s recovery appears at risk, given that the Relative Strength Index (RSI) has flipped into the bearish territory, currently standing at 49.85.

The sellers have defied the odds of a potential move higher after a bull cross was spotted on the said time frame last hours. The 21-simple moving average (SMA) cut above the 50-SMA, presenting a bullish crossover.

Therefore, immediate support at $1778 appears to get tested. That level is the meeting point of the 21 and 50-SMAs.

Further south, the ascending 100-SMA at $1773 could help slow down the decline, below which Tuesday’s low of $1770 will be challenged.

On the flip side, a sustained recovery above $1884 could reinforce the uptrend towards $1800. The range play is likely to continue below $1800 unless a daily close above the latter is witnessed.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.