Gold Price Forecast: XAU/USD uptrend appears uninterrupted on PMI day

- Gold price sits at two-week highs near $3,350 ahead of PMI data on Thursday.

- The US Dollar extends its losing streak on increased geopolitical and fiscal concerns.

- Gold price eyes a break above the key falling trendline resistance at $3,380 amid bullish RSI.

Gold price is on a roll higher for the fourth straight day on Thursday, flirting with two-week highs near the $3,350 mark. Buyers now look forward to the preliminary readings of the S&P Global US PMI due later in the day for the next leg higher.

Gold price eyes US PMI data and more upside

Fundamentally, fading optimism over a likely Russia-Ukraine ceasefire, persistent US-China trade concerns and worries about US fiscal health continue to remain the main underlying theme this week, keeping the bearish pressures intact on the US Dollar (USD). This, in turn, remains supportive of the latest uptrend in Gold price.

Amidst the latest news, the House Rules Committee approved US President Donald Trump's sweeping tax-cut bill, setting the stage for a full house floor vote in the coming hours. The passage of the bill is expected to widen the country’s fiscal deficit, adding credence to the ‘Sell American’ campaign and the USD downfall.

Meanwhile, citing three people familiar with the conversation, the Wall Street Journal (WSJ) reported late Wednesday that “on a call Monday, President Trump told European leaders that Russian President Vladimir Putin isn’t ready to end the war because he thinks he is winning.”

China’s Commerce Ministry said on Wednesday, “anyone who helps the US restrict Huawei’s chips could face legal trouble under China’s Anti-Foreign Sanctions Law.” This came after The US said that using Huawei chips in any country would go against its rules, as per reports.

Attention now turns to the flash PMI readings due for release from the Euro area and the US. The US business PMI data could shed fresh light on the health of the economy, having a significant impact on the market expectations of the Federal Reserve’s (Fed) interest rates outlook.

The S&P Global Manufacturing PMI is seen easing to 50.1 in May from 50.2 in April. The Services PMI index is set to stay at 50.8 in the same period. Weaker-than-expected data could aggravate US economic concerns, calling for more Fed rate cuts and boosting Gold price at the expense of the USD.

Fedspeak and the US House vote on Trump’s tax-cut bill will also remain in focus.

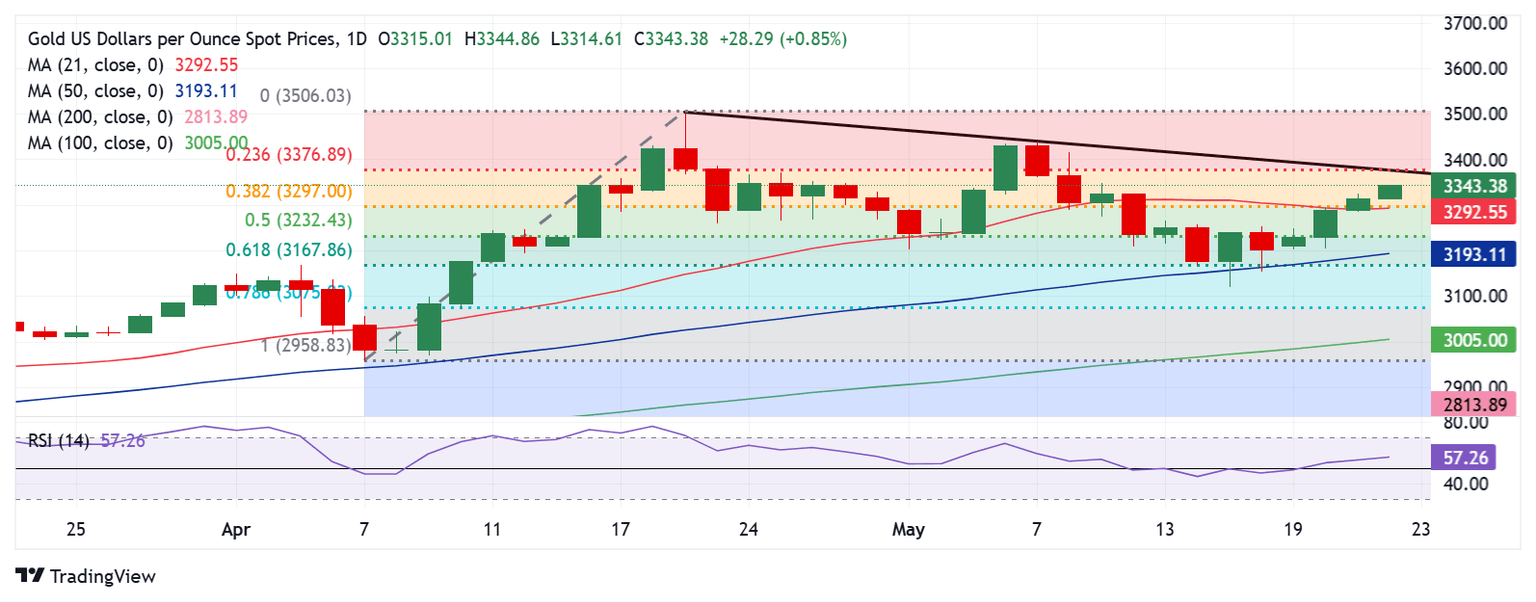

Gold price technical analysis: Daily chart

Gold price extended the break higher from the range play between the 21-day Simple Moving Average (SMA) and 50-day SMA.

The 14-day Relative Strength Index (RSI) holds firm above the midline, currently near 57.50, pointing to more upside.

Gold buyers look to take out the falling trendline resistance at $3,380 on a daily candlestick closing basis to flex their muscles toward the $3,400 level.

The next target will be the record high of $3,500.

On the flip side, strong support aligns near $3,295, the confluence of the 21-day SMA and the 38.2% Fibonacci Retracement (Fibo) level of April’s record rally.

A decisive move below that level will threaten the 50% Fibo level at $3,232, below which a fresh decline will unfold, targeting the 50-day SMA at $3,193.

Al in all, buyers will likely remain in control so long as the throwback support near $3,165, the 61.8% Fibo level holds.

Economic Indicator

S&P Global Manufacturing PMI

The S&P Global Manufacturing Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US manufacturing sector. The data is derived from surveys of senior executives at private-sector companies from the manufacturing sector. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity in the manufacturing sector is generally declining, which is seen as bearish for USD.

Read more.Next release: Thu May 22, 2025 13:45 (Prel)

Frequency: Monthly

Consensus: 50.1

Previous: 50.2

Source: S&P Global

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.