Gold Price Forecast: XAU/USD upside appears limited amid triangle breakdown

- Gold price attempts a bounce from three-week lows of $1,933 early Thursday.

- Strong US jobs data outweighed fiscal concerns, drove US Dollar, Treasury bond yields higher.

- Gold price awaits Bank of England verdict and US ISM Services PMI for further downside.

Gold price is seeing a dead cat bounce from three-week troughs of $1,933 set on Wednesday, as the United States Dollar (USD) rally takes a breather. Gold traders await the Bank of England (BoE) policy announcements and the US ISM Services PMI data for fresh trading impetus.

Will Bank of England and US ISM Services PMI rescue Gold price?

Gold price is licking it wounds following a two-day downtrend, as the US Dollar has paused its recent upbeat momentum, despite a cautious market mood. Investors turn cautious amidst the revival of the hawkish Federal Reserve (Fed) expectations and fiscal worries in the United States, as they brace for the BoE interest rate decision and key US ISM data and tech earnings report.

An unexpected improvement in the Chinese Caixin Services PMI also aids the Gold price, as China is the world’s biggest Gold consumer. China's Services Purchasing Managers' Index (PMI) rose to 54.1 in July, compared with a 53.9 expansion seen in June. The gauge was expected to drop to 52.5 in the reported month.

Later in the day, if the Bank of England (BoE) delivers a 25 basis points (bps) rate hike, with a hawkish message, the non-interest-bearing Gold price is likely to come under renewed selling pressure, refreshing multi-week lows. Further, the upbeat US ISM Services PMI could add to recent signs of economic resilience, providing a fresh boost to the US Dollar at the expense of the Gold price.

On Wednesday, the US Dollar rallied to fresh monthly highs against its six major rival currencies after the benchmark 10-year US Treasury bond yields reached a nine-month peak on another stunning US ADP jobs report. US private sector employment gains in July totaled 324,000, compared with the expected 189,000 job additions in the reported month.

Strong US JOTLS job openings and ADP Employment Change data indicate that the country’s labor market conditions remain tight, backing the case for further rate hikes by the Federal Reserve. The US economic resilience overweighed concerns over the country’s debt rating downgrade by Fitch.

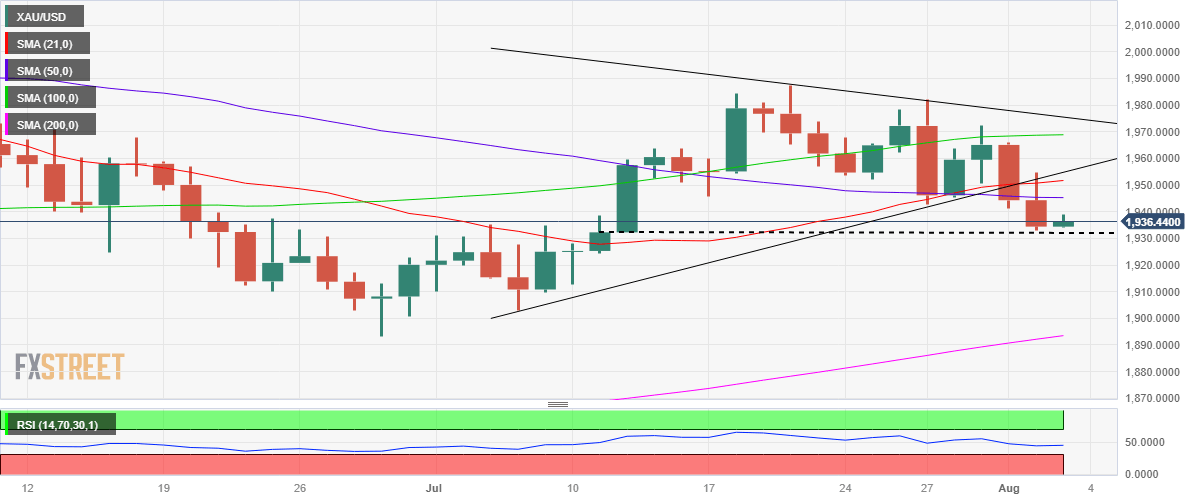

Gold price technical analysis: Daily chart

Having confirmed a symmetrical triangle breakdown on the daily sticks on Tuesday, Gold price extended its bearish momentum into the second straight trading day.

In doing so, Gold price sought a daily close below the critical horizontal 50-Daily Moving Averages (DMA) at $1,945, keeping the downside exposed amid a beairsh 14-day Relative Strength Index (RSI) indicator.

Gold buyers seem to have found a temporary support at the July 12 low of $1,932, at the moment. But Gold sellers are likely to regain poise, sending rates back toward the static support seen around $1,925.

The additional decline will challenge the early July lows around the $1,910 region.

Alternatively, Gold buyers will find immediate upside barrier at the 50 DMA of $1,945, above which strong resistance near $1,952 will come into play. That supply zone is the confluence of the triangle support and the mildly bullish 21 DMA.

Acceptance above the latter could trigger a meaningful recovery toward the flattish 100 DMA at $1,969.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.