Gold Price Forecast: XAU/USD unable to recover its shine in a risk-on environment

XAU/USD Current price: $3,358.48

- Political woes in the United States gather all the attention in the absence of macro news.

- Market participants keep beting on a Federal Reserve’s interest rate cut in September.

- XAU/USD is technically neutral and with the bullish potential limited.

Broad US Dollar (USD) weakness helped Gold price advance on Wednesday, with the XAU/USD pair peaking at $3,370.80 early in the American session. In the absence of fresh news, financial markets keep revolving around the latest United States (US) headlines and mounting speculation that the Federal Reserve (Fed) will cut the benchmark interest rate when it meets in September. Speculative interest maintains the upbeat mood, as seen in Wall Street’s behaviour, with the three major indexes extending their weekly advances.

Gold shed some ground amid its safe-haven status, but the slide was limited by the lack of interest in the USD. As the American session unfolds, the XAU/USD pair hovers around $3,360, little changed for a second consecutive day.

Meanwhile, investors keep an eye on US political developments. On the one hand, Russian President Vladimir Putin will meet his American counterpart, Donald Trump, in Alaska next Friday to discuss the end of the Russia-Ukraine war. Putin has claimed the Donbas region as a condition for further progress, something Ukrainian President Volodymyr Zelenskyy said won’t happen.

On the other hand, President Trump is busy planning the Fed Chair’s replacement. According to people familiar with the matter, the White House is considering eleven candidates, including Jefferies Chief Market Strategist David Zervos, former Fed Governor Larry Lindsey and Rick Rieder, chief investment officer for global fixed income at BlackRock. The list also includes actual Fed members, such as Michelle Bowman, Chris Waller and Philip Jefferson.

The macroeconomic calendar had little to offer on Wednesday, but it will become a bit more interesting in the next 24 hours. Australia will release its monthly employment report, while the United Kingdom (UK) will publish Gross Domestic Product (GDP) updates. Later in the day, the Eurozone will publish a Q2 GDP estimate, while the US will release the July Producer Price Index (PPI).

XAU/USD short-term technical outlook

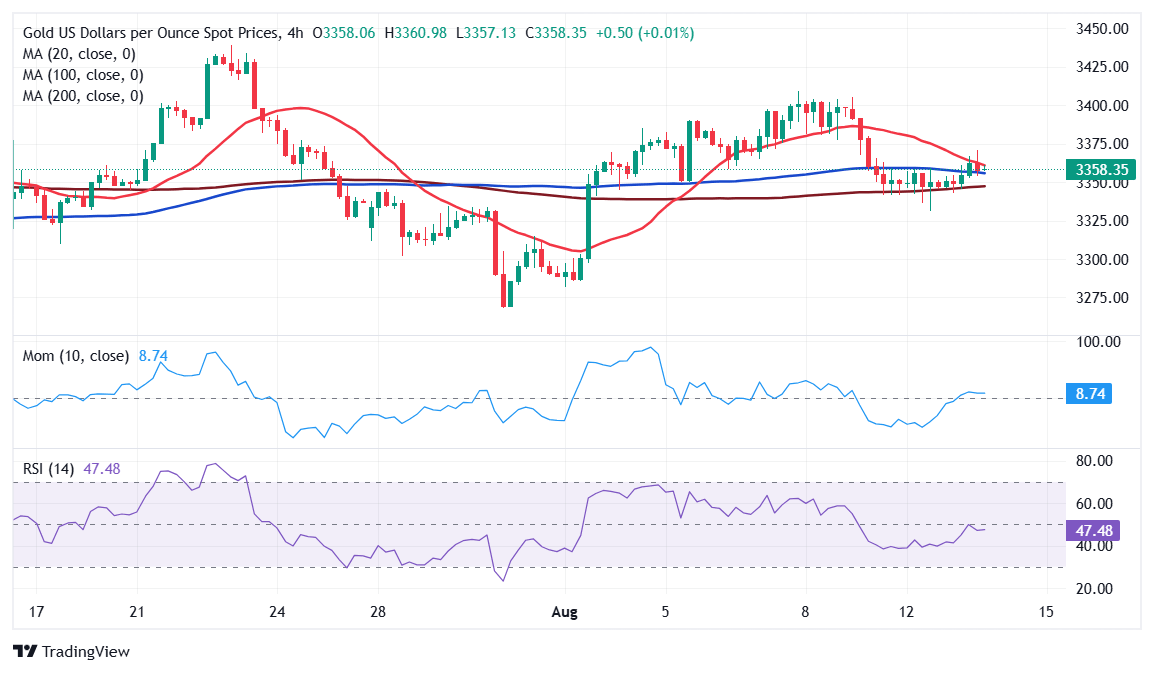

The daily chart for the XAU/USD pair shows that the pair remains stuck around a flat 20 Simple Moving Average (SMA), unable to run past the level. At the same time, the 100 and 200 SMAs maintain their upward slopes within positive levels, limiting the downside potential of Gold. Finally, technical indicators aim modestly higher at around their midlines, not enough to confirm another leg north.

In the near term, and according to the 4-hour chart, XAU/USD was unable to maintain gains beyond a bearish 20 SMA, suggesting buyers remain sidelined. At the same time, the pair is stuck around a flat 100 SMA, while the 200 SMA is also directionless, well below the shorter ones. As it happens in the wider time frame, technical indicators fall short of giving directional clues, as they hold around their midlines without clear directional strength.

Support levels: 3,349.00 3,331.10 3,312.25

Resistance levels: 3,372.30 3,389.85 3,402.70

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.