Gold Price Forecast: XAU/USD to remain choppy ahead of critical NATO Summit on Ukraine

- Gold bulls were rescued by a pause in the US bond rout and renewed Ukraine concerns.

- Gold price needs a sustained break above this key hurdle on the 4H chart.

- Attention turns towards the US top-tier events ahead of the key NATO meeting.

Gold price defied the bearish odds and rebounded firmly towards $1,950 on Wednesday, as the extended rout in the US Treasuries halted, as the yields tumbled and dragged the US dollar lower alongside. The market mood turned sour after fresh tensions between the West, Russia and Ukraine resurfaced after US Secretary of State Antony Blinken announced that the government formally accused Russian troops of committing war crimes in Ukraine. Adding fuel to the fire, the US and the UK offered additional military weapons help to Ukraine. In response, the Russian Foreign Ministry handed over a list of diplomats considered, “persona non grata” to the American Embassy in Moscow. Escalating tensions surrounding the Russia-Ukraine conflict revived gold and US government bonds amid renewed demand for safe havens.

For once, investors forgot about the hawkish Fed expectations and its encouraging outlook on the US economy, as the geopolitical tensions hogged the limelight. Attention now turns towards a batch of significant US economic releases, including the Durable Good Orders, Markit Preliminary Manufacturing and Services PMIs for fresh trading impetus in gold price.

The main event risk, however, for Thursday remains the NATO Summit on Ukraine, in which US President Joe Biden is set to attend with his European counterparts. Ukrainian President Volodymyr Zelensky is invited to address the summit via a video link.

Gold Price Chart - Technical outlook

Gold: Four-hour chart

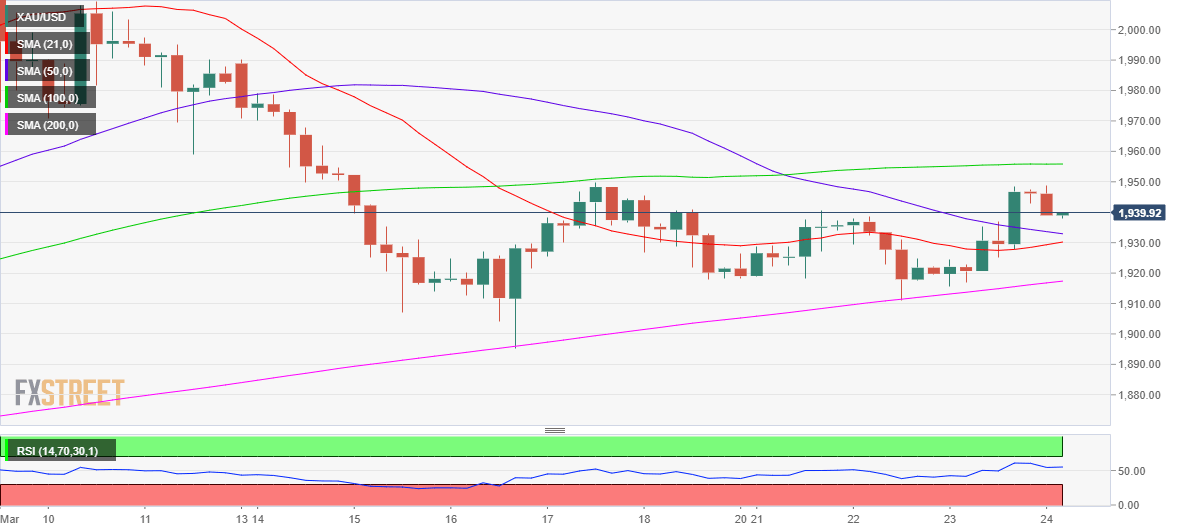

Gold price managed to defend the critical upward-sloping 200-Simple Moving Average (DMA), now at $1,917, on the four-hour chart a day before.

The tide turned suddenly in favor of gold bulls after the Relative Strength Index (RSI) pierced through the midline for the upside.

On buying resurgence, gold price took out the key upside hurdles in the form of the 21 and 50-SMAs, currently at $1,930 and $1,933 respectively.

If the bullish momentum picks up, then the bright metal could resume its upside towards the horizontal 100-SMA at $1,956.

Ahead of that, gold bulls need to clear the powerful resistance near $1,950 on a sustained basis.

On the downside, the abovementioned 21 and 50-SMAs will limit the declines, below which a retest of the 200-SMA will be on the cards.

The March 22 lows of $1,910 will be back on the sellers’ radars should the bears remain unstoppable.

The line in the sand for gold optimists emerge at the $1,900 round level.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.