Gold Price Forecast: XAU/USD to extend choppy trading, awaiting a fresh catalyst

- Gold price has paused its rebound as US Dollar finds its feet on Wednesday.

- Ongoing upswing in the US Treasury bond yields poses a threat to Gold price.

- XAU/USD recaptures 23.6% Fibo level, looks to $2,000 next amid bullish RSI.

Gold price has paused the previous rebound early Wednesday, as the United States Dollar (USD) seems to have found its feet following a rough start to the week. However, the underlying strength in the US Treasury bond yields so far this week could limit the Gold price advance.

Gold price eases as risk-flows return

Gold price is on the back foot amid a risk-friendly market environment, as investors breathe a sigh of relief amid ebbing global banking sector fears. Asian shares advance, cheering Alibaba's, the internet behemoth, plans to split into six units.

Meanwhile, the US Dollar is attempting a tepid recovery after two straight days of losses, drawing support from the ongoing upswing in the US Treasury bond yields. The benchmark 10-year US Treasury bond yields are holding close to a five-day high of 3.58%, somewhat weighing negatively on the non-interest-bearing Gold price.

Meanwhile, a slight decline in the odds of a US Federal Reserve (Fed) rate hike pause in May also keeps the Gold price in check. According to the CME Group’s FedWatch Tool, markets are now seeing a 58% probability of the Federal Reserve making no changes to its interest rate next month, compared with over 60% odds seen earlier this week.

Eyes United States housing data and Federal Reserve speeches

With the banking sector crisis in the back seat, all eyes will now remain on the fundamentals, in order to gauge the next Federal Reserve policy move. The United States Pending Home Sales data is next of relevance for the US Dollar valuations, eventually impacting the Gold price.

Meanwhile, developments surrounding the global banking crisis and the speeches from the Federal Reserve policymakers will be also closely followed ahead of Thursday’s final US Q4 Gross Domestic Product (GDP) data release.

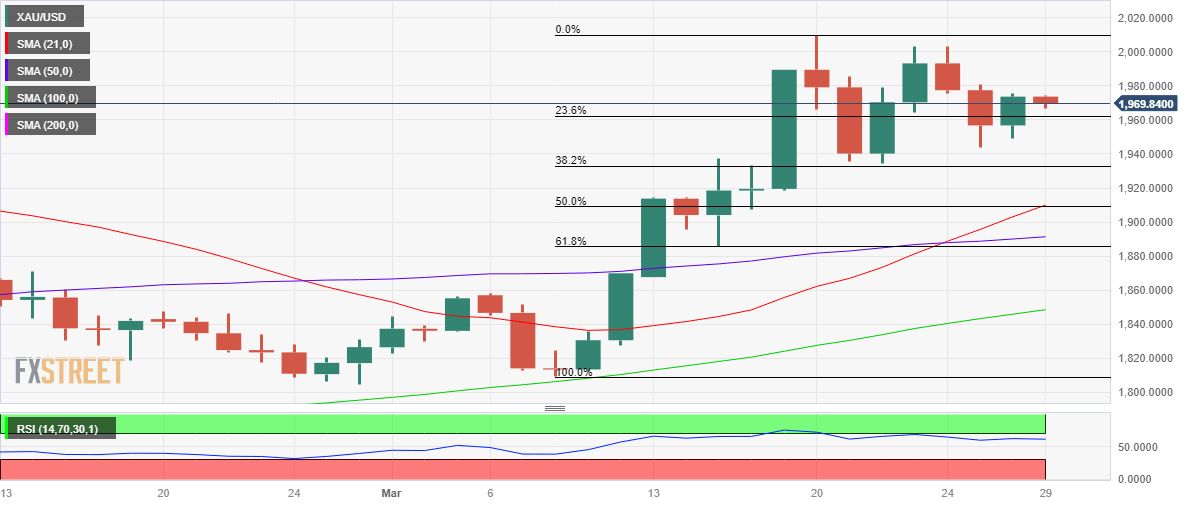

Gold price technical analysis: Daily chart

Gold price recaptured the 23.6% Fibonacci Retracement (Fibo) level of the March advance, pegged at $1,963, on a daily closing basis on Tuesday.

However, Gold bulls have paused for a cause, awaiting a fresh catalyst to resume its upside, as the 14-day Relative Strength Index (RSI) is holding comfortably above the midline.

If the 23.6% Fibo resistance-turned-support holds the fort, Gold price could turn higher to challenge Monday’s high at $1,981. The next significant resistance for Gold buyers is seen at the $2,000 mark.

Alternatively, a breach of the abovementioned Fibo support will recall Gold sellers for a test of the $1,950 psychological level.

Further south, $1,934, which is the 38.2% Fibo level of the same ascent, will challenge bullish commitments.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.