Gold Price Forecast: XAU/USD testing critical topside hurdle ahead of Powell’s speech

- Gold keeps on printing new record highs beyond the $4,100 threshold; focus shifts to Powell’s speech.

- US Dollar pauses overnight rebound, led by easing signs of US-China trade tensions.

- Gold stays within the rising channel on the daily chart, with RSI back in the extreme overbought conditions.

Gold is stretching its record-setting run early Tuesday, as the bullish sentiment remains unabated amid looming US-China trade risks and in anticipation of US Federal Reserve (Fed) Chair Jerome Powell’s speech later in the day.

Gold remains a ‘buy-on-pullbacks’ trade

Amidst a pause in the US Dollar’s (USD) overnight rebound and ongoing US-China trade talks, Gold buyers flex their muscles.

China’s Commerce Ministry confirmed early Tuesday that it had notified the US. in advance of its new rare earth export controls and held working-level talks on Monday under existing trade consultation channels.

Meanwhile, US Treasury Secretary Scott Bessent said on Monday that President Donald Trump remains on track to meet Chinese leader Xi Jinping in South Korea in late October.

The underlying positive factors, such as persistent expectations that the Fed will deliver two interest rate cuts this year, the extended US government shutdown and potential US-China trade war escalation continue to lend support to buyers.

Gold’s record-setting advance remains powered by the bullish inertia, in the absence of any bearish fundamentals.

Traders now look forward to a slew of speeches from the Fed officials, including Chairman Jerome Powell’s, for fresh hints on the scope of rate cuts by the year-end.

Powell is due to speak about the “Economic Outlook and Monetary Policy” at the National Association for Business Economics (NABE) Annual Meeting, Philadelphia.

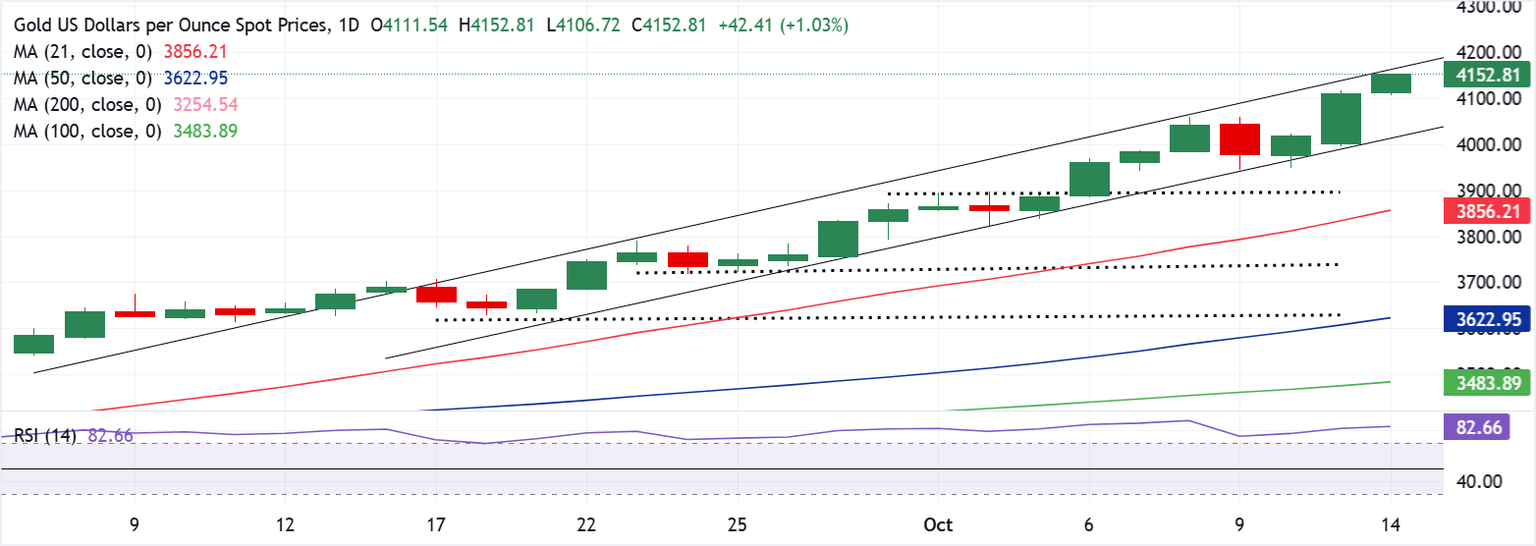

Gold price technical analysis: Daily chart

The daily chart shows that the 14-day Relative Strength Index (RSI) is back into the extreme overbought zone, currently near 82.50,

Meanwhile, Gold buyers are once again challenging the upper boundary of the month-long rising channel, now at $4,162.

Gold could see a brief corrective pullback if it faces rejection at the abovementioned level amid heavily overbought RSI conditions.

In that case, sellers could attack the lower boundary of the rising channel at $4,014.

A daily candlestick closing basis below the latter would confirm a downside break from the channel, fuelling further correction toward the $3,950 psychological mark.

Further south, the $3,895 supply zone (October 1 and 2 highs) could come into play.

However, if buyers manage to take out the topside hurdle of the channel at $4,162 on a sustained basis, the record-setting rally could extend toward the $4,200 round level.

Economic Indicator

Fed's Chair Powell speech

Jerome H. Powell took office as a member of the Board of Governors of the Federal Reserve System on May 25, 2012, to fill an unexpired term. On November 2, 2017, President Donald Trump nominated Powell to serve as the next Chairman of the Federal Reserve. Powell assumed office as Chair on February 5, 2018.

Read more.Next release: Tue Oct 14, 2025 16:20

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.