Gold Price Forecast: XAU/USD stuck between $1890-$1850, awaits a range breakout

- Gold stuck in an $1890-1850 range after Monday’s 5% slump.

- Traders divided between rising covid infections, vaccine optimism.

- Four-hour chart warrants caution while below $1900 mark.

Gold’s (XAU/USD) posted a green candle on Thursday, having risen 0.60% to finish around $1875. Despite the uptick, the bright metal remained trapped in its recent range between $1890-$1850. Gold benefited from increasing concerns over the global economic recovery, in the wake of the continued rise in coronavirus, which negated the optimism over the vaccine progress. The US Treasury yields fell 10 basis points on Thursday on economic growth concerns and lifted the demand for the yieldless gold. Although the gains in the metal remained capped, as the US dollar held steady in the upper bound of this week’s range on fresh concerns over the fiscal stimulus and Wall Street tumble.

Heading into a weekly close this Friday, gold traders await a strong catalyst to break free from the range trade, as covid updates from across the globe will continue to influence the broader market sentiment and dollar flows. Also, the US Michigan Consumer Sentiment data will be closely eyed alongside reports of potential restrictions likely to be imposed in the US states.

Gold: Short-tern technical outlook

Four-hour chart

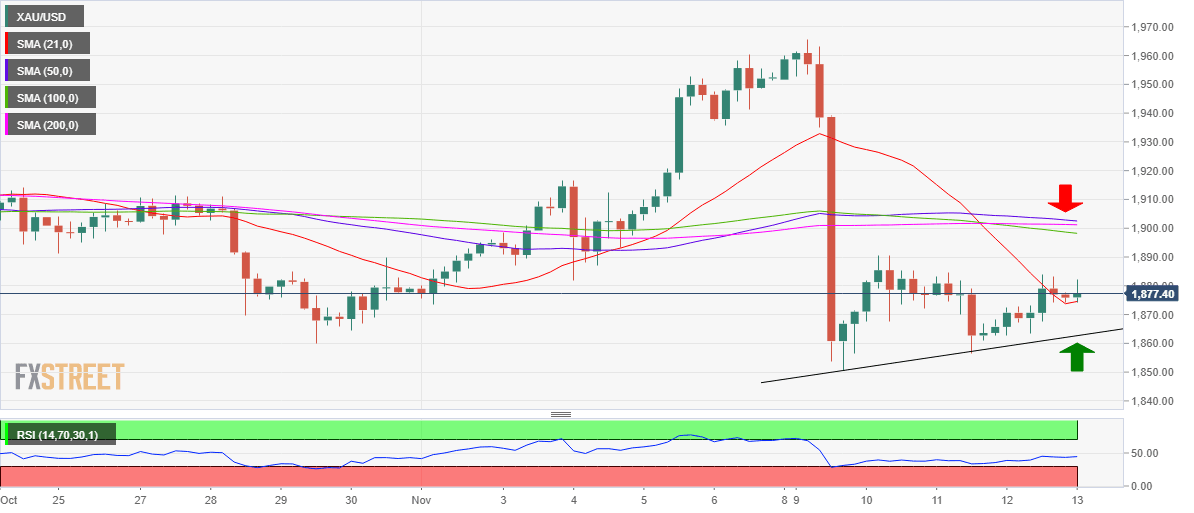

Looking at the four-hour (4H) chart, gold extends its downside consolidation phase following the 5% slump seen on Monday.

Although higher lows are seen over the past hours, the risks remain skewed to the downside, as the Relative Strength Index (RSI) remains in the bearish territory, currently at 44.55.

To the upside, the convergence of the 50, 100 and 200-4H Simple Moving Averages (SMA) around the $1900 level is the level to beat for the bulls.

The bearish bias remains intact so long as the price stays below the aforesaid critical resistance. A daily closing above the latter is needed to negate the downside bias.

Alternatively, a breach of the rising trendline support at $1863 and a subsequent daily closing below it could recall the strong $1850 support. The next downside target awaits at $1800 – psychological level.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.