Gold Price Forecast: XAU/USD steadies around $2,420 ahead of FOMC Minutes

XAU/USD Current price: $2,419.95

- Fed’s Economic Well-Being of US Households report brought discouraging news.

- The focus shifts to the FOMC Meeting Minutes scheduled for Wednesday.

- XAU/USD under mild selling pressure, could retest the $2,400 price zone.

Spot Gold trades marginally lower on Tuesday as the US Dollar benefited just modestly from a sour market mood. XAU/USD hovers around $2,420 after posting an intraday low of $2,406.10. Asian and European indexes edged lower as investors took profit ahead of earnings reports while lacking fresh catalysts. The macroeconomic calendar had nothing relevant to offer on Tuesday, with another batch of speeches from Federal Reserve (Fed) officials failing to impress.

Meanwhile, the Fed Board issued its Economic Well-Being of US Households in 2023 report, which examines the financial circumstances of US adults and their families. The document showed that overall, “financial well-being was nearly unchanged from 2022 as higher prices remained a challenge for most households and workers continued to benefit from a strong labor market.” The news is quite discouraging, moreover considering inflation picked up in the first quarter of the year, further diluting the odds for multiple rate cuts throughout the rest of the year.

Looking ahead, the United States (US) Federal Open Market Committee (FOMC) will release the Minutes of its latest meeting on Wednesday. Market players hope for clarity over the timing of a monetary policy pivot, which policymakers have refused to provide so far.

XAU/USD short-term technical outlook

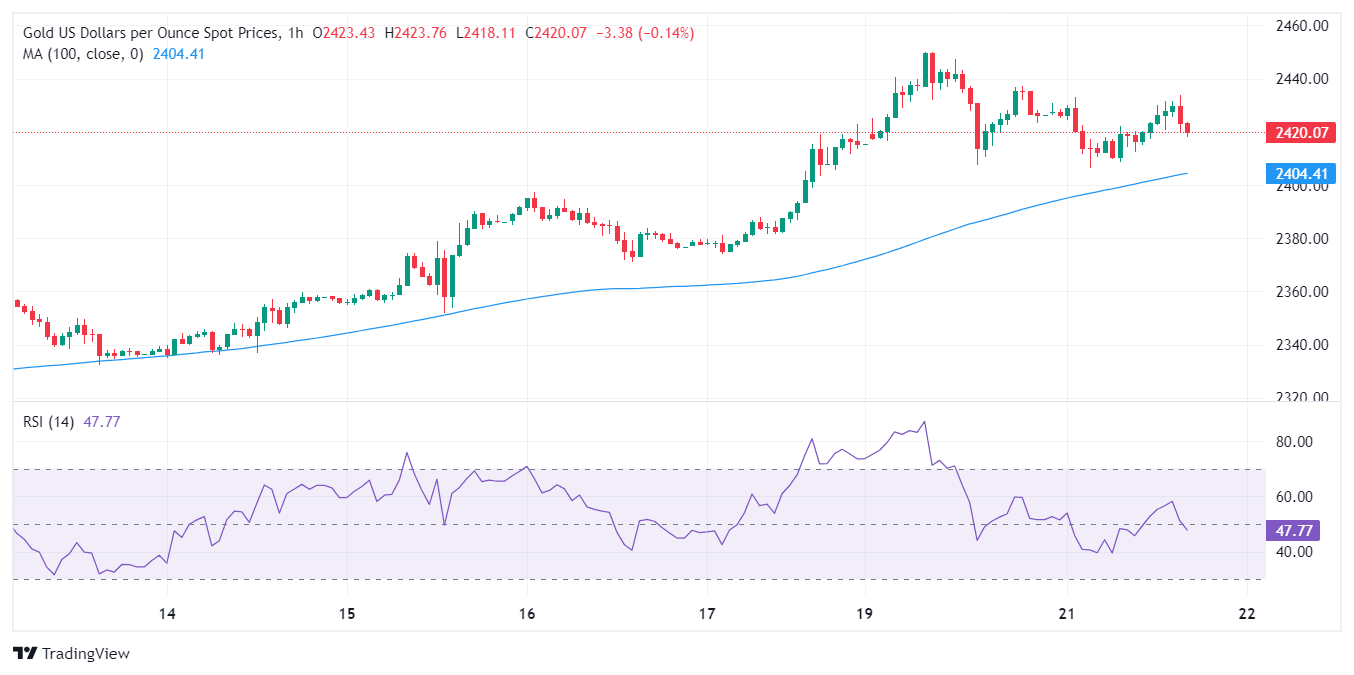

From a technical point of view, XAU/USD holds near fresh record highs posted on Monday, losing its bullish momentum but far from turning bearish. The daily chart shows that the pair remains far above a marginally bullish 20 Simple Moving Average (SMA), which currently stands at around $2,345. The longer moving averages maintain their bullish slopes below the shorter one. However, technical indicators retreat from near overbought readings, although without actual bearish strength.

Technical readings in the 4-hour chart suggest the XAU/USD pair can remain under mild pressure in the near term. Technical indicators keep retreating within positive levels, although a bullish 20 SMA provides intraday support, now at around $2,408.40. Finally, the 100 and 200 SMAs maintain modest bullish slopes over $100 below the current price, too far to become relevant.

Support levels: 2,406.50 2,393.20 2,375.10

Resistance levels: 2,431.90 2,450.00 2,465.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.