Gold Price Forecast: XAU/USD stable as Federal Reserve’s decision looms

XAU/USD Current price: $3,325.59

- Upbeat United States data was not enough to push the US Dollar further up.

- Market players await the Federal Reserve announcement and President Trump’s reaction to it.

- XAU/USD bullish potential limited, but buyers keep defending the $3,300 mark.

Spot Gold saw little action on Tuesday, holding within Monday’s range. The XAU/USD pair hovers around $3,320 during US trading hours, having found buyers on dips towards the $3,300 price zone. The US Dollar (USD) retained its positive momentum throughout the first half of the day, but paused after Wall Street’s opening, shedding some ground, but for the most part, consolidating as critical events loom.

In the meantime, mostly encouraging United States (US) data did little to support the Greenback or Wall Street, as the three major indexes trade in the red. The country reported that the flash June Goods Trade Balance posted a deficit of $85.9 billion according to preliminary estimates, better than the $98.4 billion loss expected. Additionally, the Conference Board Consumer Confidence Index improved by 2.0 points in July to 97.2 from 95.2 in June, while the latter was revised from a previous estimate of 93.

The focus now shifts to Wednesday. The US will publish the flash estimate of the Q2 Gross Domestic Product (GDP), which is expected to show that annualized growth picked up sharply after falling by 0.5% in the previous quarter. The report will include an update of the Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s (Fed) favorite inflation gauge.

Finally, the central bank will announce its monetary policy decision in the American afternoon. US President Donald Trump has demanded that interest rates come down, but Chair Jerome Powell is unlikely to give in to political pressure. Financial markets anticipate that the benchmark interest rate will remain on hold. The market’s reaction will likely be linked to whatever policymakers anticipate for the near future, and President Trump’s response to the decision.

XAU/USD short-term technical outlook

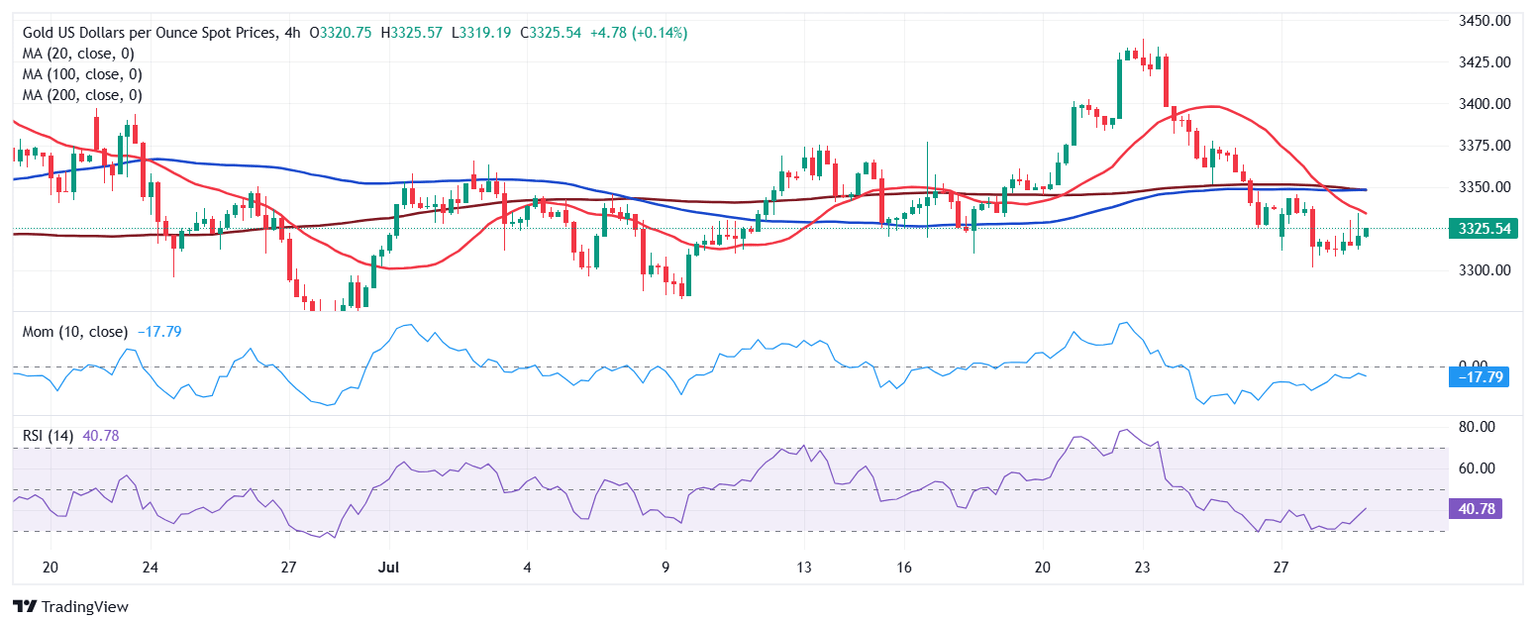

Technically, the XAU/USD pair is at risk of falling further, although the negative momentum eased. In the daily chart, a directionless 20 Simple Moving Average (SMA) keeps acting as dynamic resistance at around $3,345.00, while a bullish 100 SMA provides support at around $3,250. At the same time, the Momentum indicator keeps consolidating at around its 100 line, lacking directional momentum, while the Relative Strength Index (RSI) indicator also consolidates, yet around 46.

The near-term picture shows the bullish potential remains well-limited. In the 4-hour chart, XAU/USD stands below all its moving averages, with a firmly bearish 20 SMA extending its slide below converging and directionless 100 and 200 SMAs. Technical indicators, in the meantime, have stabilized within negative levels after recovering from near oversold readings.

Support levels: 3,301.90 3,287.30 3,274.05

Resistance levels: 3,345.00 3,361.80 3,377.15

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.