Gold Price Forecast: XAU/USD stable above $2,500 and looking for fresh record highs

XAU/USD Current price: $2,506.95

- The Jackson Hole Symposium will host global policymakers by the end of the week.

- The US Dollar extends its recent slide as the optimistic mood persists on Monday.

- XAU/USD pressures record highs with a near-term bullish stance.

Spot Gold trades near a record high of $2,509.80 achieved at the beginning of the week, helped by sluggish US Dollar demand. XAU/USD barely surpassed its Friday’s high before retreating, but buyers added on dips, helping the bright metal to retain the $2,500 mark. The positive tone of equities maintains the USD subdued as Wall Street extends its recent gains, while the absence of macroeconomic data limits the intraday range.

This week's focus will be on the Jackson Hole Symposium, hosting policymakers from around the globe. The event will take place over the weekend, with Federal Reserve (Fed) Chairman Jerome Powell speaking on Friday.

Central banks are still the main market driver, with the main focus on the Fed, as the central bank is still to decide on an interest rate cut. Indeed, US policymakers have been paving the way towards such a movement, but with the most cautious stance. Early on Monday, Fed Bank of Minneapolis President Neel Kashkari spoke to the Wall Street Journal and said tha inflation is making progress, although the labor market is showing some concerning signs. “The balance of risks has shifted more towards labor market and away from inflation side of our dual mandate,” Kashkari added.

Ahead of the event, S&P Global will release the preliminary estimates of the August Purchasing Managers Indexes (PMIs).

XAU/USD short-term technical outlook

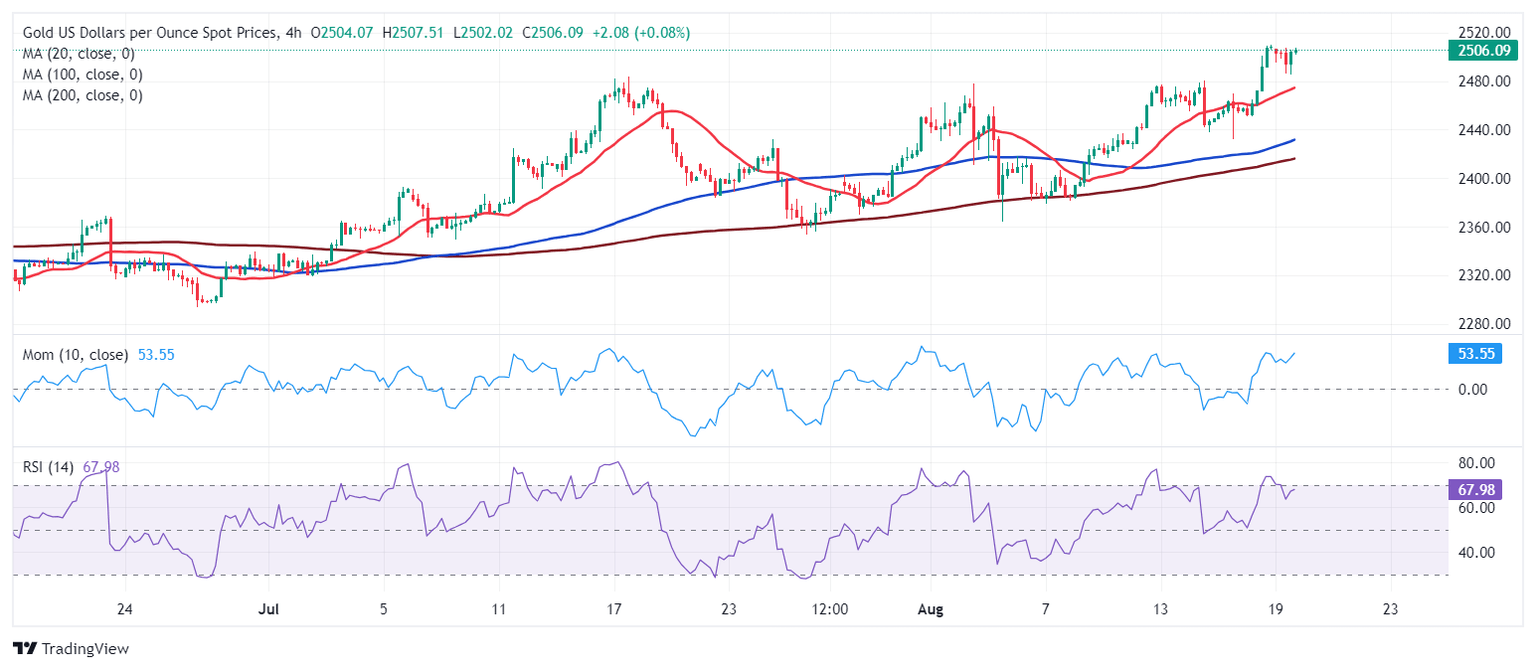

The XAU/USD pair pressures its record high, and the daily chart shows it is consolidating its recent gains. An intraday slide met buyers in the $2,385 price zone, which resulted in a quick recovery, suggesting speculative interest is willing to add on dips. Technical indicators in the mentioned time-frame retreated just modestly from near overbought reading, but the pair develops above bullish moving averages, with the 20 Simple Moving Average (SMA) providing dynamic support at around $2,429.00.

In the near term, and according to the 4-hour chart, the risk is skewed to the upside. XAU/USD trades well above all its moving averages, which picked up bullish momentum far below the current level. At the same time, technical indicators resumed their advances after a modest downward correction, reflecting bulls’ dominance.

Support levels: 2,496.40 2,485.10 2,427.20

Resistance levels: 2,510.00 2,523.50 2,535.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.