Gold Price Forecast: XAU/USD slips after Trump tariffs threat on BRICS lifts US Dollar

- Gold price kicks off the US Nonfarm Payrolls week on a negative note on Monday.

- US Dollar finds haven demand following Trump’s 100% tariffs threat on BRICS nations.

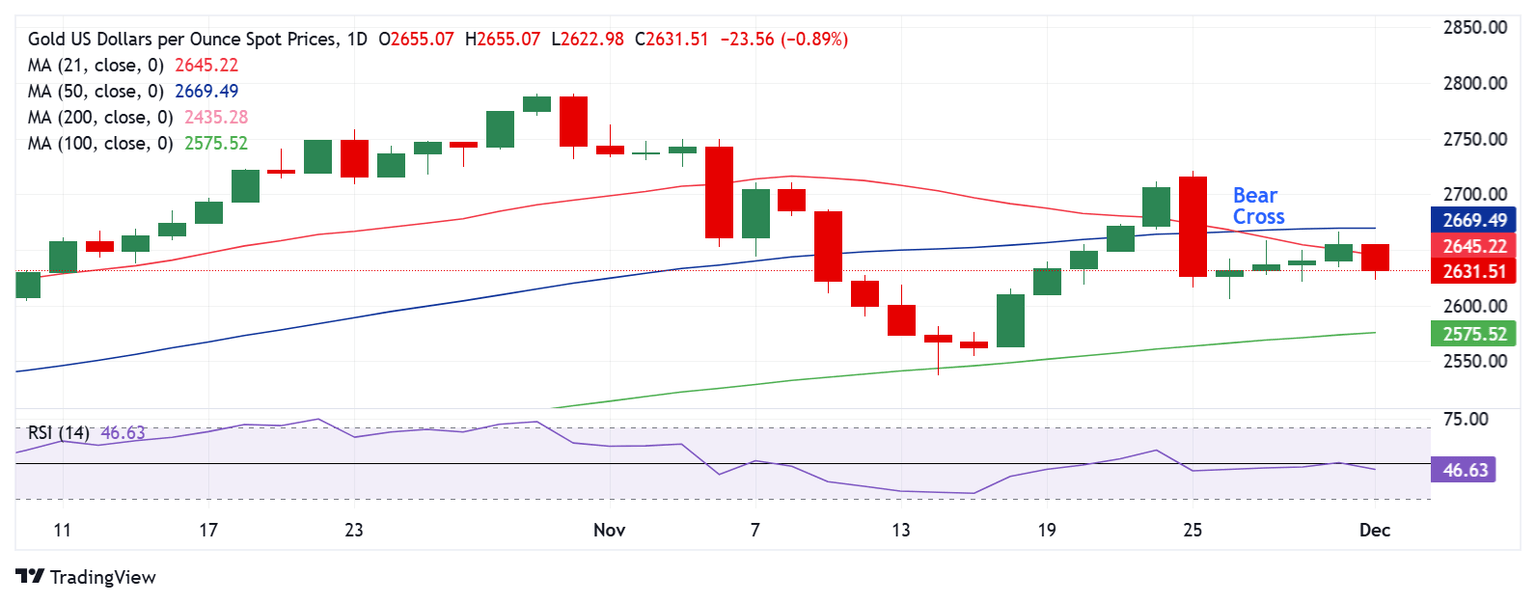

- Technically, Gold price surrenders 21-day SMA at $2,645 after facing rejection at 50-day SMA of $2,670.

Gold price is back in the red for the first time in five trading days early Monday, looking to extend the previous week’s decline. Resurgent demand for the US Dollar (USD) across the board as a safe-haven asset, trumping Gold price as a traditional safety bet at the start of the US Nonfarm Payrolls (NFP) week.

Gold price looks to US ISM data amid looming Trump threat

USD traders take account of US President-elect Donald Trump's weekend warning against the so-called 'BRICS' nations, threatening 100% tariffs on Brazil, Russia, India, China and South Africa if they create a new currency or support another currency that would replace the Greenback.

Amid mounting fears of a global tariff war, the optimism over robust Chinese Manufacturing PMI data wanes, unable to support Gold price. China is the world’s biggest Gold consumer.

However, the downside appears cushioned in Gold price amid sustained bets for a 25 basis points (bps) interest rate cut by the US Federal Reserve (Fed) this month. Markets price in about a 65% chance of a December Fed rate reduction, the CME Group’s FedWatch Tool showed early Monday.

Markets also remain wary of the ongoing geopolitical tensions between Russia and Ukraine while digesting the insurgent activity by Jihadist-led rebels in the Syrian city of Aleppo on Friday night. This occurred after a rapid offensive launched Wednesday, coinciding with a ceasefire in neighbouring Lebanon. Russia, a key ally of the Syrian government, responded with its first airstrikes on Aleppo since 2016.

In response, Israeli Prime Minister Benjamin Netanyahu said Sunday that Israel is monitoring the situation in Syria. A fresh escalation in the Middle East geopolitical conflict could revive Gold’s appeal as a traditional safe-haven asset.

Gold traders also look forward to the US ISM Manufacturing PMI data due later on Monday before a series of employment data trickling in later this week. The US data will be key to gauging expectations for future Fed rate cuts, eventually impacting the non-interest-bearing Gold price.

Gold price technical analysis: Daily chart

Technically, Gold sellers will likely retain control as the 14-day Relative Strength Index (RSI) drops back below the 50 level.

The previous week’s Bear Cross remains in play, maintaining the downside risks for Gold price.

The immediate support aligns at the previous week’s low of $2,605, below which a drop toward the 100-day Simple Moving Average (SMA) at $2,576 cannot be ruled out.

Alternatively, the initial supply zone appears at the 21-day SMA support-turned-resistance at $2,645, above which a 50-day SMA at $2,670 is critical to scale for a sustained move higher.

A daily candlestick closing above the latter is needed take on the uptrend toward $2,700.

BRICS FAQs

The BRICS is the acronym denoting the grouping of Brazil, Russia, India, China and South Africa. The name was created by Goldman Sachs’ economist Jim O’Neill in 2001, years before the alliance between these countries was formally established, to refer to a group of developing economies that were predicted back then to lead the global economy by 2050. The bloc is seen as a counterweight to the G7, the group of developed economies formed by Canada, France, Germany, Italy, Japan, the United Kingdom and the United States.

The BRICS is a bloc which intends to give voice to the so-called “Global South”. The alliance tends to have similar views on geopolitical and diplomatic issues, but still lacks a clear economic integration as the governing systems and cultural divergence between its members is significant. Still, it holds yearly summits at the highest level, coordinates multilateral policies and has implemented initiatives such as the creation of a joint development bank. Egypt, Ethiopia, Iran and the United Arab Emirates joined the group in January 2024.

The five founding members of the BRICS alliance account for 32% of the global economy measured at purchasing power parity as of April 2023, according to data from the International Monetary Fund. This compares with the 30% of the G7 group.

There has been increasing speculation about the BRICS alliance creating a currency backed by some sort of commodity like Gold. The proposal is meant to reduce the use of the dominant US Dollar in cross-border economic exchanges. In the BRICS’ 2023 summit, the group stressed the importance of encouraging the use of local currencies in international trade and financial transactions between the members of the bloc as well as their trading partners. The group also tasked finance ministers and central bank governors “to consider the issue of local currencies, payment instruments and platforms” for this purpose. Even if the bloc’s de-dollarization strategy looks clear, the creation and implementation of a new currency seems to have a long way to go.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.