Gold Price Forecast: XAU/USD set to fall? Technicals to outweigh Evergrande risks

- Gold price looks to resume the downside after Monday’s rebound.

- Risk tone improves amid turnaround Tuesday, downs the USD, lifts yields.

- Gold’s daily technical setup to outweigh Evergrande risks, pre-Fed anxiety.

Gold price staged a solid comeback from six-week lows of $1742, as the underlying risk-off theme triggered a flight to safety for the ultimate safe haven. Tensions escalated over a potential default story of indebted China’s Evergrande property development group, which fuelled risks of spillover and a global economic slowdown. The broader risk aversion boosted safe-haven flows into the US Treasury bonds while downing the yields and global equities, which boded well for gold price. The retreat in the US dollar across the board, dragged lower by the yields also collaborated with the recovery in the metal. However, gold’s recovery faced stiff resistance just below the $1770 level, as Fed’s tapering expectations continued to weigh on traders’ minds.

As the Fed commences its two-day monetary policy meeting this Tuesday, gold price has returned to the red. A minor improvement in the risk sentiment amid stabilizing Hong Kong equities and conciliatory comments from China Evergrande Chief caps gold’s recovery gains. Meanwhile, the US Treasury yields rebound across the curve as the Fed’s tapering plan appears intact, despite the latest China worries. In the day ahead, the risk rebound could pick up pace, extending the rebound in the Treasury yields while lifting the demand for the greenback once again. In such a case, gold price will likely resume its downside. The US docket remains light, leaving gold price at the mercy of the risk sentiment and Fed speculations.

Gold Price Chart - Technical outlook

Gold: Daily chart

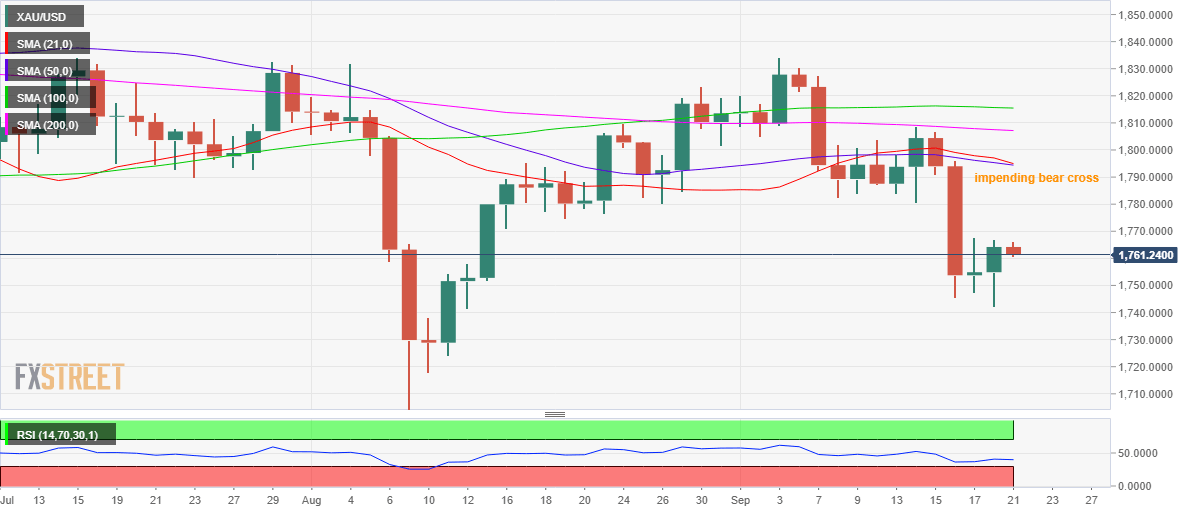

As observed on the daily chart, gold price has turned lower after failing to find acceptance above $1767 on multiple occasions.

The 21-Daily Moving Average (DMA) is set to pierce the 50-DMA from above. If such a move materializes, then it would confirm a bear cross, opening floors for a fresh downswing towards the multi-week troughs near $1740.

The 14-day Relative Strength Index (RSI) is edging lower below the midline, allowing room for more declines.

The $1700 psychological magnate will be on the sellers’ radars should the monthly lows give way.

Alternatively, a sustained move above the $1767 supply zone is needed to unleash the recovery gains towards the 21 and 50-DMA confluence near $1795.

Gold bulls will then aim for the horizontal 200-DMA at $1807, as the next upside target.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.