Gold Price Forecast: XAU/USD sellers to remain in control whilst below 200 DMA at $1,922

- Gold price rebounds but not out of the woods yet, as ECB decision, US data loom.

- US Dollar, US Treasury bond yields stay defensive, as hot US inflation data fail to alter Fed’s outlook.

- Gold sellers are likely to keep charge so long as the 200-Daily Moving Average holds.

Gold price is attempting a tepid bounce, snapping a two-day downtrend to three-week lows of $1,906 on Thursday. Gold price is finding a floor, courtesy of a minor pullback in the United States Dollar (USD) alongside the US Treasury bond yields, as Wednesday’s in-line with estimates US Consumer Price Index (CPI) inflation data failed to have any impact on the US Federal Reserve’s (Fed) interest rate expectations.

ECB, US Retail Sales and PPI in focus

The annual United States inflation gauge rose 3.7% in August, compared with a 3.6% rise expected. The CPI rose 0.6% in August, its biggest monthly gain of 2023 and matched the market estimates. The core CPI increased 0.3% and 4.3% respectively, against estimates for 0.2% and 4.3%.

Despite an uptick in the headline CPI figures, overall the data came in line with expectations, confirming that the inflationary pressures in the US are softening. The data offered little for the Fed hawks to cheer, as markets continued to price a Fed rate hike pause at next week’s meeting while predicting a 40% probability of a rate increase in November.

The US Dollar spiked with the US Treasury bond yields in an initial reaction to the US inflation data, prompting Gold price to renew three-month lows. However, the uptick in the US Dollar was short-lived, as investors weighed the Fed interest rate prospects amid no big surprises to the US CPI data release. Gold price managed to move slightly away from multi-month lows into Wednesday’s closing.

Looking ahead, all eyes remain on the European Central Bank (ECB) interest rate decision, which is likely to be an interesting one. ECB President Christine Lagarde faces a tough call, as the old continent risks stagnation while inflation remains more than double the central bank’s 2.0% target. A hawkish pause, with Lagarde leaving the door open for more rate hikes, will likely fuel a sharp rally in the EUR/USD pair at the expense of the US Dollar. In such a case, Gold price could capitalize on the US Dollar weakness and extend its rebound toward the critical 200-Daily Moving Average (DMA) at $1,922.

However, Gold traders will also pay close attention to the US Retail Sales and Producer Price Index data for fresh US Dollar valuations. All in all, Gold price braces for another day of volatile trading on the ECB verdict and the US economic data releases.

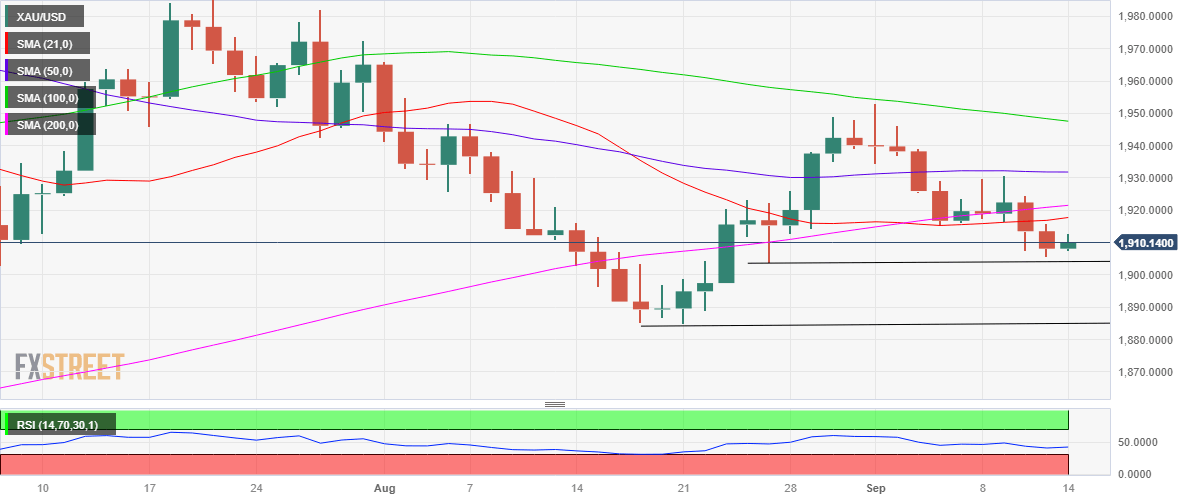

Gold price technical analysis: Daily chart

Gold price once again found fresh buyers just above the $1,900 mark. Therefore, Gold sellers need to crack the latter to initiate a fresh downtrend toward the static support at $1,885.

Further down, the $1,870 round level will come to Gold buyers’ rescue. The downside appears more appealing for Gold traders, as the 14-day Relative Strength Index (RSI) indicator continues to hold ground below the 50 level.

On the flip side, the immediate upside barrier is seen at the 21 DMA of $1,918, above which the 200 DMA hurdle at $1,922 will be a tough nut to crack for Gold buyers.

Daily closing above the latter is critical to unleashing the additional recovery toward the 50 DMA at $1,932.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.