Gold Price Forecast: XAU/USD risks further falls as technical setup turns bearish

- Gold price testing bearish commitments amid mixed market mood.

- Growing inflation concerns counter stronger US economic data.

- Gold to remain at the mercy of the risk trends and dollar dynamics.

Gold price (XAU/USD) retreated sharply from five-month highs of $1917 and finished Tuesday at $1900, as stronger US economic data pointed to a strengthening recovery. The optimism over the US economy lifted the Treasury yields alongside the dollar, as the Fed’s tapering bets resurfaced. US ISM PMI showed a pick up in the manufacturing activity in May. However, growing concerns over higher price pressures continued to overwhelm investors, which kept a floor under gold price. Eurozone inflation exceeded ECB’s target range last month, which is likely to spell trouble for the central bank any time soon.

Gold price extends Tuesday’s weakness into early Europe this Wednesday, pressured by a broadly firmer US dollar while covid concerns in Asia continue to cushion the downside. Looking ahead, if the risk-off mood intensifies, the US dollar is likely to catch a fresh bid wave, exacerbating the pain in gold. Meanwhile, an uptick in the Treasury yields, amid a potential revival of the risk-on trades, could also exert downside pressure on the yiedless gold. The metal will remain at the mercy of the dynamics in the dollar and yields, taking cues from the broader market sentiment, in absence of relevant US macro news.

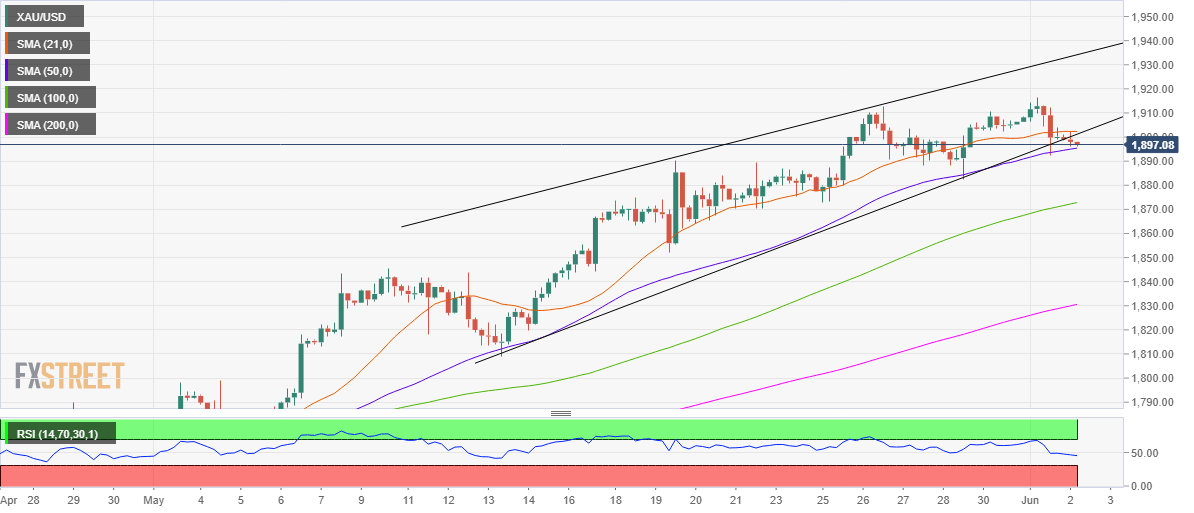

Gold Price Chart - Technical outlook

Gold: Four-hour chart

Gold’s four-hour chart confirmed a rising wedge breakdown earlier this Wednesday, following a sustained break below the rising trendline support at $1900.

Gold price is challenging critical 50-simple moving average (SMA) support at $1895, below which a sharp sell-off towards the bullish 100-SMA at $1873 cannot be ruled out.

The Relative Strength Index (RSI) shows that the tide has turned in favor of the bears, as it has pierced through the midline to now trade in the bearish region.

Alternatively, acceptance above powerful support turned resistance at $1901 is critical to negate the downside bias in the near term.

The next stop for the buyers is seen at the $1910 round number.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.