Gold Price Forecast: XAU/USD risks a sharp pullback if Trump’s ‘reciprocal tariffs’ disappoint

- Gold price finds fresh buyers near $3,110 on US President Trump’s ‘Liberation Day’.

- Investors prefer to seek safety in the traditional store of value, anticipating Trump’s tariffs.

- The daily RSI re-enters the heavily overbought zone, warranting caution for Gold buyers.

Gold price regains traction on ‘Liberation Day’, having found fresh demand near the $3,110 region. The further upside in Gold price hinges on the highly anticipated US President Donald Trump’s “reciprocal tariffs” later this Wednesday.

Gold price awaits Trump’s tariffs for a fresh directional impetus

In the countdown to Trump’s tariffs announcement from the Rose Garden at 20:00 GMT, the Gold price could take some cues from the upcoming US Automatic Data Processing (ADP) Employment Change for March. Markets are expecting the US private sector payrolls to rise by 105,000 after a modest gain of 77,000 in February.

Increased signs of US labor market slackening could reinforce interest rate cuts bets from the Federal Reserve (Fed), driving the non-yielding Gold price further north. However, any reaction to the US data will likely be short-lived as the main event risk on the so-called ‘Liberation Day’ is Trump’s big tariff reveal.

On Sunday, the Wall Street Journal (WSJ) reported that the White House is considering imposing global tariffs of up to 20% on almost all US trading partners. Late Monday, President Trump rejected plans for narrower tariffs

Meanwhile, US Treasury Secretary Scott Bessent singled out what he called the “Dirty 15” — the 15% of countries that trade heavily with the US and have high tariffs. However, late Tuesday, Bessent clarified that the amounts announced on Wednesday are the highest the tariffs will reach, adding that the countries could then take steps to lower the tariffs.

Additionally, traders are looking forward to the automobile tariffs, which are set to take effect on April 3. In anticipation of these US tariffs and the uncertainty surrounding them, Gold investors prefer to park their capital in the traditional safe-haven Gold price, fuelling another run to fresh record highs of $3,149 set on Tuesday.

That said, if the details of Trump’s ‘reciprocal tariffs’ disappoint, in terms of the President announcing lower or targeted tariffs or leaving the door open for negotiations, risk sentiment is likely to rebound sharply, diminishing the appeal of safe-havens such as Gold price. In such a case, Gold price could see a steep corrective decline toward the $3,050 level.

On the other hand, if Trump’s tariffs signal a deepening of the global trade war and economic headwinds for the US economy, Gold price could stage a fresh uptrend toward the $3,200 level.

All in all, the US tariff announcement will dictate the Gold price action in the sessions ahead.

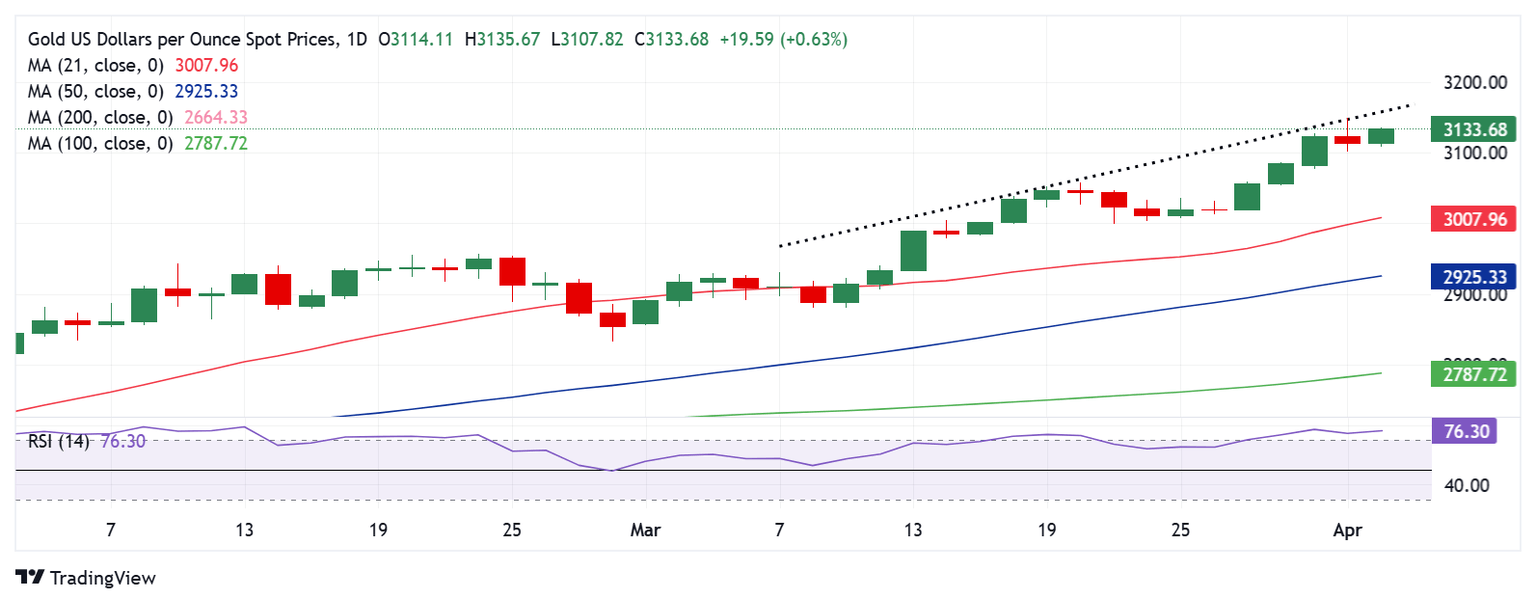

Gold price technical analysis: Daily chart

Following Tuesday’s brief pullback, Gold price is reverting toward the record high of $3,149 early Wednesday.

The next upside target is at the rising trendline resistance at $3,158. Only a sustained move above that level will initiate a fresh uptrend to test the $3,200 threshold.

However, with the 14-day Relative Strength Index (RSI) having re-entered the highly overbought region, currently at 76.30, risks remain in place for a decent Gold price correction.

On the downside, Gold price could challenge the $3,100 round level, below which this week’s low of $3,077 will be tested.

The $3,050 psychological barrier will be next on sellers’ radars.

(This story was corrected on April 2 at 06:53 GMT to say that "In the countdown to Trump’s tariffs announcement from the Rose Garden at 20:00 GMT,, not 19:00 GMT.)

Economic Indicator

US Liberation Day Tariff Announcements

US President Donald Trump is set to announce wide-ranging tariffs in an event he named "Liberation Day." The moves could significantly affect global trade and financial assets.

Read more.Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.