Gold Price Forecast: XAU/USD risks a pullback amid overbought conditions, focus shifts to Fed minutes

- Gold recedes from multi-month tops as Treasury yields attempt a bounce.

- The US dollar bears take a breather, as the focus shifts to the FOMC minutes.

- Overbought conditions on gold’s 4H chart warrant caution for the bulls.

Gold (XAU/USD) strengthened its bullish streak and hit fresh three-month highs just shy of the $1870 mark on Monday, as the sell-off in the US dollar alongside the Treasury yields continue to bolster gold’s appeal. After the US Retail Sales debacle, markets believed that the Fed is likely to maintain lower rates for a longer period while keeping its tolerance for higher inflation. However, no growth in the US consumer spending last month downplayed the fears over rising inflation. Meanwhile, the Dallas Fed Chief Robert Kaplan reiteration that the US central bank Is unlikely to hike rates until next year boosted the gold price at the dollar’s expense.

Additionally, gold also found support from the ongoing Middle East tensions and rising covid cases in Asia and the resultant lockdowns, which tempered expectations of a faster global economic recovery.

Looking ahead, gold prices will continue to take cues from the US dollar price action amid a lack of significant US economic data release. The Fedspeak will be closely followed ahead of Wednesday’s FOMC minutes. At the press time, gold is reversing from fresh multi-month tops of $1874 reached earlier in the Asian session. The retreat in gold comes on the back of a minor pullback in the US dollar and yields. The upbeat market mood on encouraging vaccine developments also seems to dull gold’s safe-haven appeal. The FOMC minutes this week hold the key for gold’s next moves.

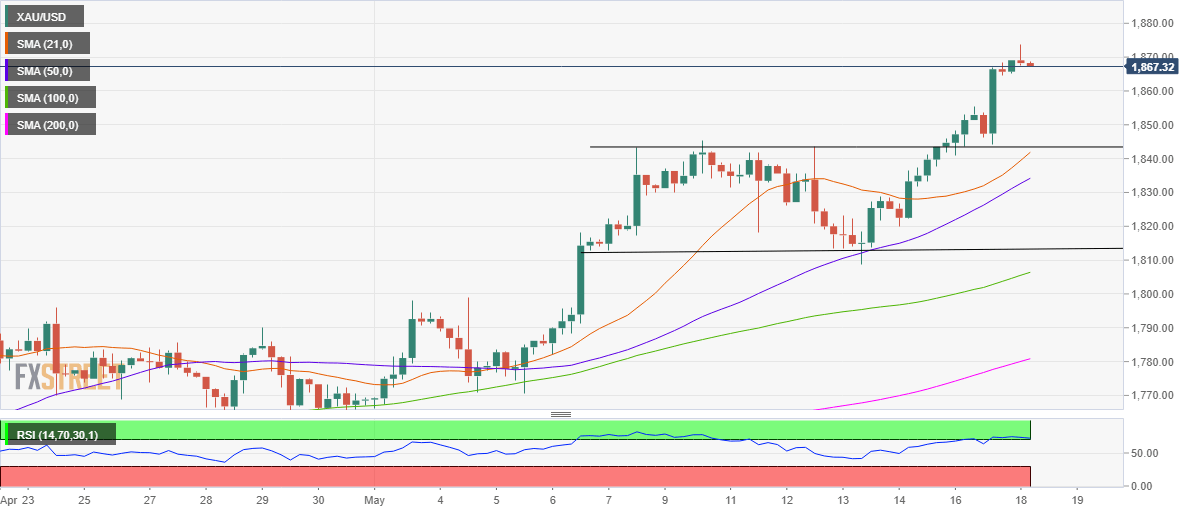

Gold Price Chart - Technical outlook

Gold: Four-hour chart

Having confirmed a rectangle breakout a day before, gold prices almost tested the pattern target at $1880.

The Relative Strength Index (RSI) has moved into the overbought territory, suggesting that the gold price could see a pullback before it resumes the uptrend.

Therefore, an immediate cap is seen at the $1850 psychological level.

The pattern resistance now support at $1844 could be tested if the pullback picks up pace.

The bullish 21-simple moving average (SMA) also coincides at the level.

Alternatively, the gold bulls need to crack the $1880 target on a sustained basis, in order to extend their journey towards the $1900 threshold.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.