Gold Price Forecast: XAU/USD remains vulnerable to slide further, FOMC awaited

- Gold failed to capitalize on a modest Asian session uptick to the $1735 region.

- The risk-on mood kept a lid on any strong gains for the safe-haven XAU/USD.

- The recent runaway rally in the USD bond yields further capped the upside.

Gold built on the previous session's goodish rebound from sub-$1700 levels and edged higher during the Asian session on Monday, albeit lacked any follow-through buying. The optimism over a strong global economic recovery from the pandemic remained supportive of the underlying bullish sentiment in the financial markets. This was seen as one of the key factors that kept a lid on the early uptick for the safe-haven XAU/USD.

Meanwhile, the passage of a massive US stimulus package has been fueling inflation fears and raised doubts that the Fed will maintain ultra-low interest rates for a longer period. It is worth reporting that US President Joe Biden signed the $1.9 trillion stimulus package into law on Friday. This, in turn, resulted in a runaway rally in the US Treasury bond yields, which further collaborated to cap gains for the non-yielding metal.

The precious metal retreated over $10 from daily tops and was last seen hovering near the lower end of its intraday trading range, around the $1723-22 region. The downside, however, remains cushioned, at least for the time being, as investors now seemed reluctant, rather preferred to wait on the sidelines ahead of a slew of policy decisions this week. The Fed will announce its policy decision on Wednesday, which will be followed by the Bank of England on Thursday and the Bank of Japan meeting on the last day of the week.

The Fed will also provide a fresh update on its economic outlook. Given that the Fed Chair Jerome Powell recently downplayed expectations for an immediate action to curb the sharp rise in long-term borrowing cost, a hawkish tilt could prove negative for the commodity. This, in turn, warrants some caution for aggressive bullish traders and positioning for any meaningful upside. In the meantime, the broader market risk sentiment, the US bond yields and the USD price dynamics will be looked upon for some trading opportunities.

Short-term technical outlook

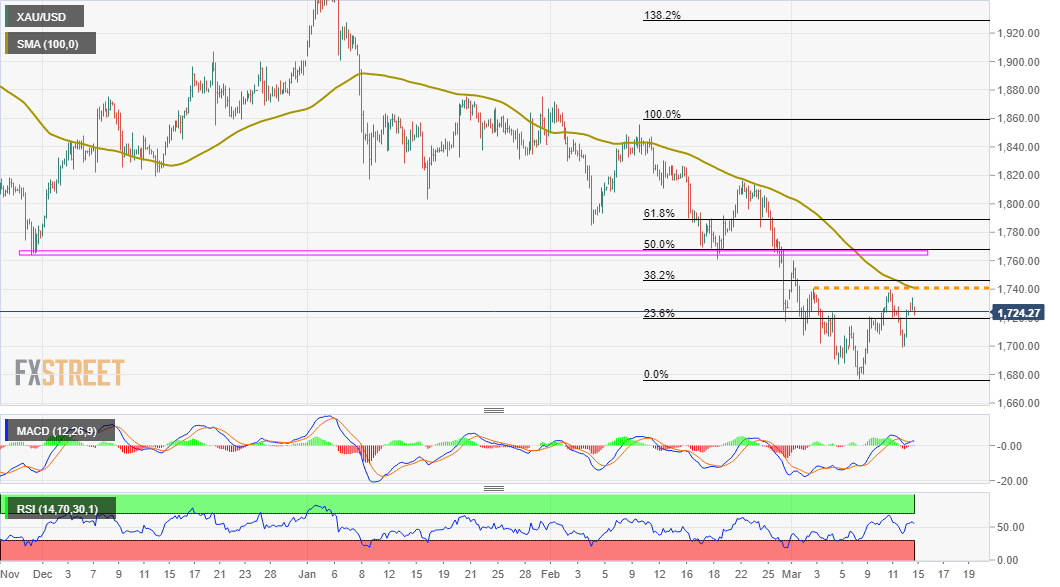

From a technical perspective, the commodity has been oscillating in a trading range over the past four days or so. The range-bound price action seemed to constitute the formation of a rectangle on short-term charts, marking a brief pause in the trend. Against the backdrop of the recent sharp fall from YTD tops, the rectangle might still be categorized as a bearish continuation pattern. This, in turn, suggests that the path of least resistance for the commodity remains to the downside.

That said, any downfall might continue to find decent support near the $1700 mark. Sustained weakness below now seems to accelerate the fall back towards multi-month lows, around the $1675 region. Some follow-through selling should pave the way for a slide towards the $1625 area with some intermediate support near the $1650 level.

On the flip side, immediate resistance is pegged near the $1738-40 supply zone. Any subsequent positive move might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly near a previous strong horizontal support breakpoint, now turned resistance around the $1760-65. Only a sustained strength beyond the latter will negate the near-term bearish outlook and prompt some aggressive short-covering move.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.