Gold Price Forecast: XAU/USD recovers on growth and geopolitical fears, $1,943 holds the key

- Gold price recovers on underlying recession risks and geopolitical fears fuelled by Russia.

- Weak US Dollar and US Treasury bond yields add to the rebound in Gold price.

- Gold price needs to regain 100-Daily Moving Average at $1,943 for a sustained recovery.

Gold price is building on Friday’s rebound early Monday as the United States Dollar (USD) retreats from weekly highs, tracking lower US Treasury bond yields and an uptick in the US S&P 500 futures.

US Dollar eases ahead of a light United States docket

Risk sentiment is improving in Monday’s Asian trading, reflecting the 0.25% gain in the US S&P 500 futures, fuelling a pullback in the US Dollar. The Greenback is also sold on profit-taking following two straight days of staggering recovery. The weakness in the US Treasury bond yields also weighs on the US Dollar, providing an extended boost to the Gold price.

Investors have shrugged off the emerging geopolitical risks in Russia after the dramatic weekend. The armed rebellion by Yevgeny Prigozhin, leader of the Wagner group of mercenary fighters, attempted insurrection in Russia, threatening Vladimir Putin’s two-decade-long grip on power. Tensions eased after the armed rebellion was abruptly called off on Sunday. However, the traditional safe-haven Gold will likely remain underpinned in the wake of Russia's mutiny and growing global recession fears.

Despite a substantial upsurge staged by the US Dollar on Friday, Gold price stood resilient. It rebounded from three-month lows of $1,911 as recession fears amplified and spooked investors after the Preliminary PMIs showed worsening business conditions in Europe, the UK and the US. US S&P Global Preliminary Composite Index fell to a three-month low of 53.0 in June, and the contraction in the manufacturing sector deepened to 46.3 in the reported month.

Concerns over a protracted global monetary policy tightening-induced risks of a recession added to the safe-haven flows in the Gold price. Broad risk-aversion boded ill for the US Treasury bond yields, which fell sharply across the time curve even though markets continued pricing more rate hikes from the US Federal Reserve (Fed).

Looking ahead, risk sentiment, the US Dollar price action and the Fed rate hike expectations will continue to drive Gold price amid a lack of top-tier United States economic data. Meanwhile, speeches from the European Central Bank (ECB) and Fed policymakers will also grab some attention.

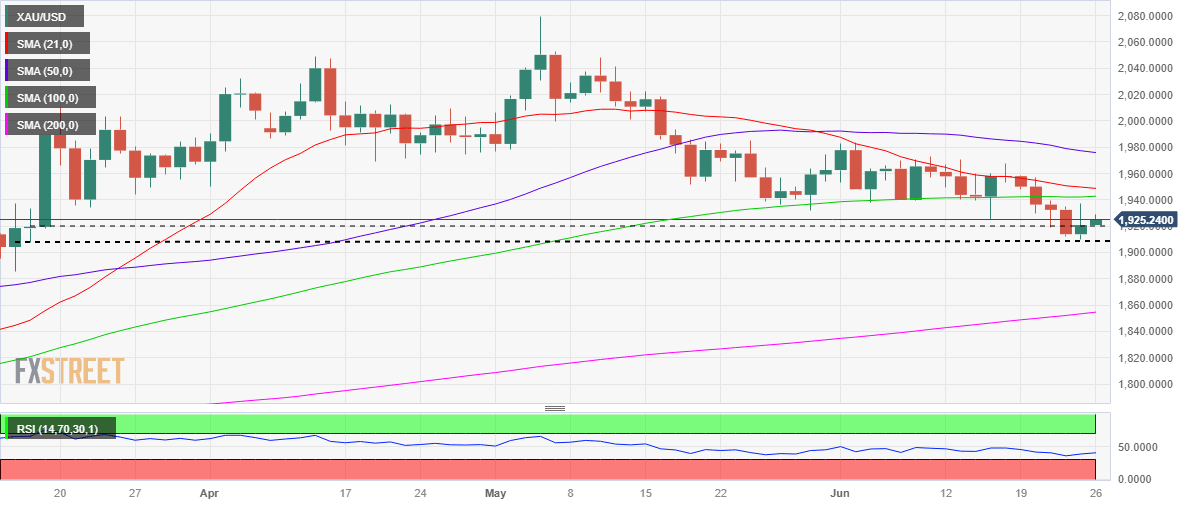

Gold price technical analysis: Daily chart

As observed on the daily chart, Gold price bounced off multi-month lows just above the March 16 low of $1,908 on Friday, but the upswing lost legs below the critical horizontal 100-Daily Moving Average (DMA) at $1,943.

The abovementioned two levels will likely confine Gold price toward Fed Chair Jerome Powell’s speech and the US Core PCE inflation data due later this week.

The 14-day Relative Strength Index (RSI) is edging higher but remains well below the midline, suggesting that any upside in Gold price is likely limited.

Adding credence to the bearish potential, the downward-sloping 21 DMA aims to cut the 100 DMA from above, charting an impending Bear Cross.

On the upside, immediate resistance is seen at the $1,930 round level, above which the 100 DMA at $1,943 will be a tough nut to crack for Gold buyers.

Alternatively, if Gold sellers fight back control, the March 17 low of $1,918 could be rechallenged. Further south, the multi-month low of $1,911 will come into play, below which the March 16 low of $1,908 will support bullish traders.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.