Gold Price Forecast: XAU/USD recovering on fresh tariffs’ fears

XAU/USD Current price: $3,329.83

- United States President Donald Trump started sending letters to Asian counterparts.

- Gold fights US Dollar demand amid mounting tariff-related concerns.

- XAU/USD retains the downward bias in the near term, $3,350 caps.

Spot Gold trades at around $3,330, recovering from an early low of $3,296.50, yet holding on to modest intraday losses. The US Dollar (USD) surged throughout the first half of the day, backed by risk aversion. The market’s focus was on United States (US) President Donald Trump’s tariffs.

Trump and Treasury Secretary Scott Bessent have flooded the wires with announcements regarding trade deals, or the lack of progress on negotiations. President Trump announced massive retaliatory tariffs in May and set a 90-day pause right after, in the hopes they could achieve better trade deals. As the date looms, no major agreement has been announced.

In the meantime, President Donald Trump has started sending letters to different countries, announcing fresh tariffs to be implemented starting August 1. He also announced through Truth Social that “ Any country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff. There will be no exceptions to this policy. Thank you for your attention to this matter!”

Other than that, Trump sent letters to Korea, announcing a 25% tariff on all imports coming from the country, and a similar one to Japan, separate from all sectoral tariffs. The US Dollar soared in the American session, against all rivals but Gold, as Wall Street sank on the latest headlines.

XAU/USD short-term technical outlook

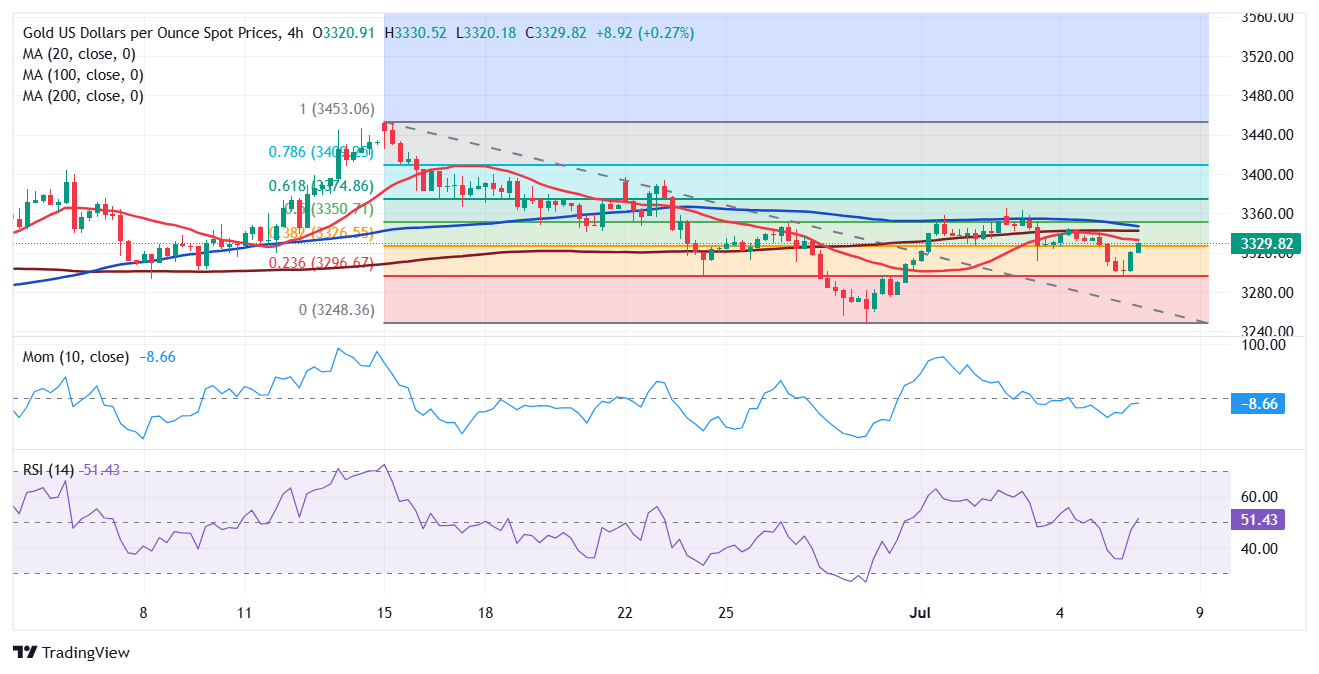

The daily chart for XAU/USD shows the pair is aiming to overcome the 38.2% Fibonacci retracement of the June slump at around $3,325, after finding buyers around the 23.6% retracement of the same decline. The same chart shows a flat 20 Simple Moving Average converges with the next Fibonacci level at around $3,350, reinforcing the resistance area, while the 100 and 200 SMAs maintain their firm bullish slopes far below the current level. Technical indicators, in the meantime, offer modest downward slopes within negative levels, not enough to confirm another leg south.

In the near term, and according to the 4-hour chart, the upward potential seems limited. The XAU/USD pair trades below all its moving averages, which offer neutral-to-bearish slopes. Technical indicators recovered from their early lows near oversold readings, but turned flat within negative levels, reflecting a limited bullish potential.

Support levels: 3,325.00 3,311.90 3,295.45

Resistance levels: 3,350.00 3,373.50 3,389.40

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.