Gold Price Forecast: XAU/USD recovered above $3,300 with higher highs still likely

XAU/USD Current price: $3,315.82

- The European Central Bank trimmed interest rates as expected in the April meeting.

- US President Donald Trump threatened to fire Federal Reserve Chair Jerome Powell.

- XAU/USD corrective declines keep attracting buyers, higher highs still in sight.

Gold price retreated further from its record high on Thursday, trading as low as $3,284.10 early in the American session. The US Dollar (USD) maintained its bearish bias against all major rivals throughout the day, with XAU/USD easing on the back of profit-taking. The pair, however, bounced from the mentioned low and regained the $3,300 mark ahead of the long Easter weekend.

It was quite a busy day, despite limited reactions across the FX board. On the one hand, the European Central Bank (ECB) announced its monetary policy decision. As widely anticipated, ECB officials trimmed the three benchmark interest rates by 25 basis points (bps) each. Officials refrained from giving clear hints on what’s next for monetary policy, yet highlighted the risks related to the trade war while noting uncertainty remains high.

On the other hand, United States (US) President Donald Trump jumped into social media and took aim at Federal Reserve (Fed) Chairman Jerome Powell, complaining he is moving too slow on interest rate cuts while stating that his "termination cannot come fast enough."

Trump's words came as an answer to Powell's speech on Wednesday, warning of the potential consequences of the Trump administration's trade war, while reiterating that the central bank plans to hold interest rates steady for now.

On a positive note, the White House welcomed talks with Mexico and Canada regarding a trade deal, albeit no specific details were offered.

Other than that, Wall Street trades mixed, with the Dow Jones Industrial Average (DJIA) sharply down but the Nasdaq and the S&P 500 holding on to modest gains.

XAU/USD short-term technical outlook

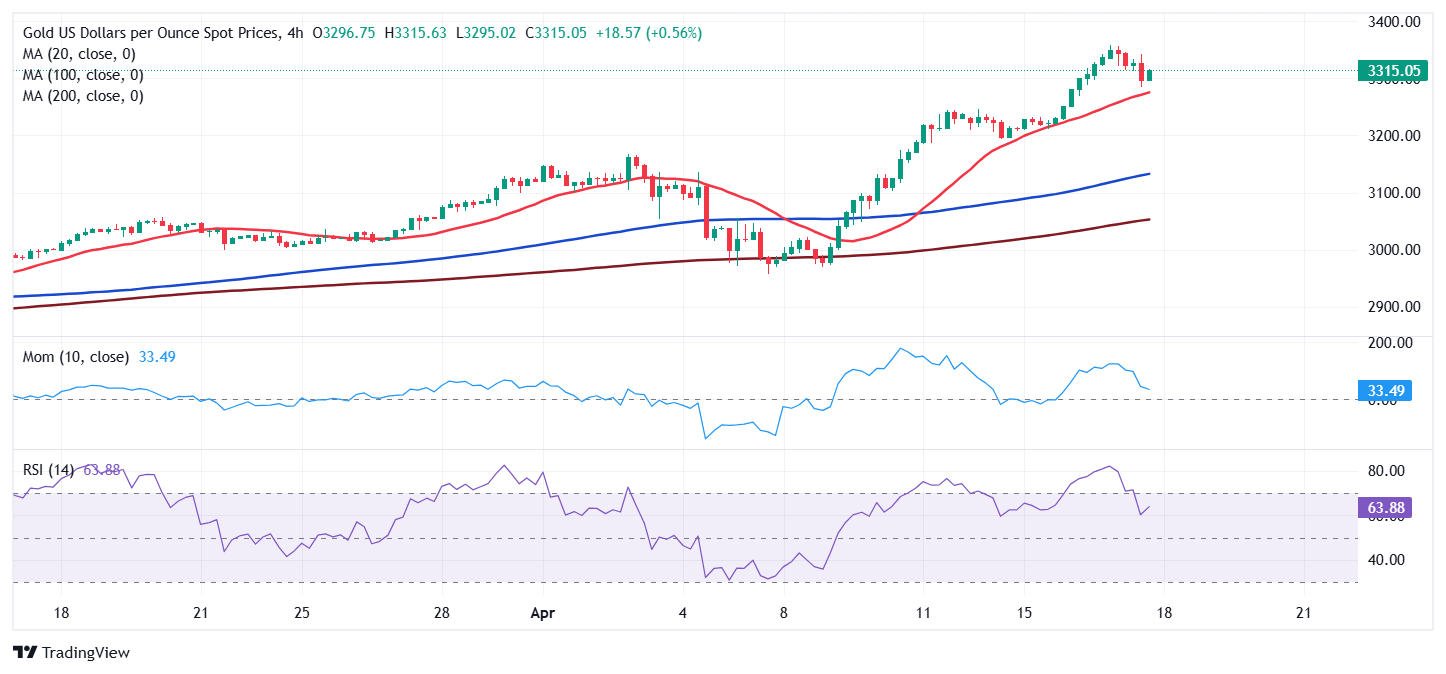

The daily chart for the XAU/USD pair shows it posted a higher high and a higher low, maintaining the bullish trend alive despite the intraday slide. At the same time, technical indicators eased from extreme readings, but remain in overbought territory. Finally, the pair trades above all its moving averages, with a bullish 20 Simple Moving Average (SMA) currently at $3,114.60.

Support levels:3,317.20 3,305.65 3,292.80

Resistance levels 3,335.00 3,350.00 3,375.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.