Gold Price Forecast: XAU/USD reconquers $3,400 aims for record highs

XAU/USD Current price: $3,415.71

- Hopes the US will reach trade deals with other nations partially lifted the market mood.

- Market players await the Federal Reserve's monetary policy decision scheduled for Wednesday.

- XAU/USD is technically bullish and poised to revisit the $3,500 mark.

Spot Gold trades above the $3,400 mark on Tuesday, helped by broad US Dollar’s (USD) weakness and a sour market mood. Risk-off hit during European trading hours amid political noise in Germany. Friedrich Merz, the conservative leader who won the election over two months ago, was unable to secure a majority in parliament to become chancellor in a first round of voting, finally succeeding in a second attempt.

Wall Street started the day with a soft tone, but managed to trim part of its intraday losses mid-American afternoon, following comments from United States (US) President Donald Trump regarding progress in trade deals. In a joint press conference with Canadian Prime Minister Mark Carney, Trump said he wants to be friends with Canada, and anticipates a big announcement coming in the next few days, following a “very friendly conversation.”

Trump also referred to potential trade deals with other nations and upcoming talks with China. However, his words lacked substance, and US indexes keep trading in the red at the time of writing.

Adding to the dismal sentiment, market players are in a wait-and-see mode ahead of the Federal Reserve (Fed) monetary policy announcement on Wednesday. The Fed is widely anticipated to keep the benchmark interest rate on hold amid uncertainty about the impact of Trump’s levies on the economy. Policymakers are also concerned tariffs could put upward pressure on inflation, and hence, refuse to trim interest rates, something that “frustrated” President Trump recently, and ended up putting at doubt Fed’s independence.

XAU/USD short-term technical outlook

The daily chart for the XAU/USD pair shows it is sharply up for a second consecutive day, and on its way to re-test the record high at $3,500.14. The pair develops well above a bullish 20 Simple Moving Average (SMA) currently at $3,275.80, while the 100 and 200 SMAs gain upward traction far below the shorter one. At the same time, technical indicators head firmly higher after bouncing from around their midlines, anticipating higher highs ahead.

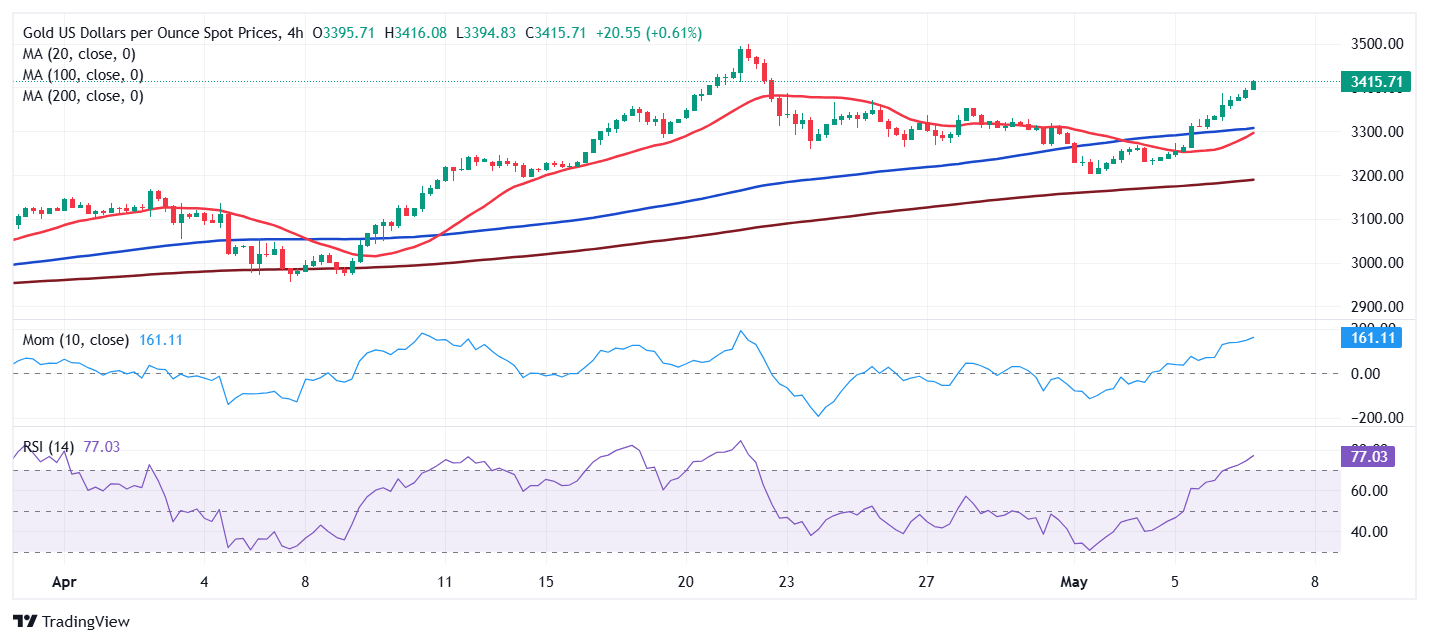

In the near term, and according to the 4-hour chart, Gold is on its way to extend its advance. The pair trades well above all its moving averages, with the 20 SMA gaining upward traction and about to cross above the 100 SMA. Even further, the XAU/USD pair pressures intraday highs in the $3,410 region, while technical indicators maintain their bullish slopes within overbought levels.

Support levels: 3,392.25 3,277.60 3,263.10

Resistance levels: 3,430.20 3,444.25 3,468.30

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.