Gold Price Forecast: XAU/USD ranges between two key barriers as eyes turn to US PCE inflation

- Gold price consolidates the previous rebound above key $3,225 support early Thursday.

- US Dollar hits fresh three-year lows across the board as President Trump attacks Fed’s credibility again.

- Gold price remains stuck between 21-day SMA and 50-day SMA amid a neutral daily RSI.

- All eyes now remain on Thursday’s mid-tier US data and the US PCE inflation data on Friday.

Gold price is struggling to build on the previous rebound from weekly lows early Thursday even as the US Dollar (USD) flirts with three-year lows against its major currency rivals.

Gold price appears split amid hawkish Fed bets and US Dollar weakness

The Greenback extends its four-day losing streak, with the latest leg south fuelled by US President Donald Trump’s fresh attack on the Federal Reserve’s (Fed) credibility.

Citing some sources, the Wall Street Journal (WSJ) reported early Thursday that President Trump is considering selecting and announcing a successor for Fed Chair Jerome Powell by September or October.

Markets scrutinize the list of likely candidates for the position of the Fed Chairman, including Fed Governor Kevin Warsh and National Economic Council Director Kevin Hassett, former World Bank President David Malpass and Fed Governor Christopher Waller, to gauge the potential policy tilt.

Despite the persistent US Dollar weakness, Gold is finding it difficult to extend the recovery as the Iran-Israel truce offers markets some reprieve.

Additionally, Gold price continues to face headwinds from the recent pushback against expectations of a July Fed rate cut by Chair Powell during his two-day congressional testimonies.

Powell told US lawmakers earlier in the week that he is in no hurry to cut interest rates until the Fed gets a clearer picture over whether Trump’s tariffs have pushed inflation to uncomfortably high levels.

Moving on, Gold price could regain upside traction if the Greenback loses further ground on growing concerns over the Fed’s independence.

Meanwhile, traders will closely eye the mid-tier US Durable Goods, Jobless Claims and Pending Home Sales data for fresh trading incentives.

However, Gold price could await Friday’s US Personal Consumption Expenditures (PCE) Price Index data before embarking on a clear directional path.

Gold price technical analysis: Daily chart

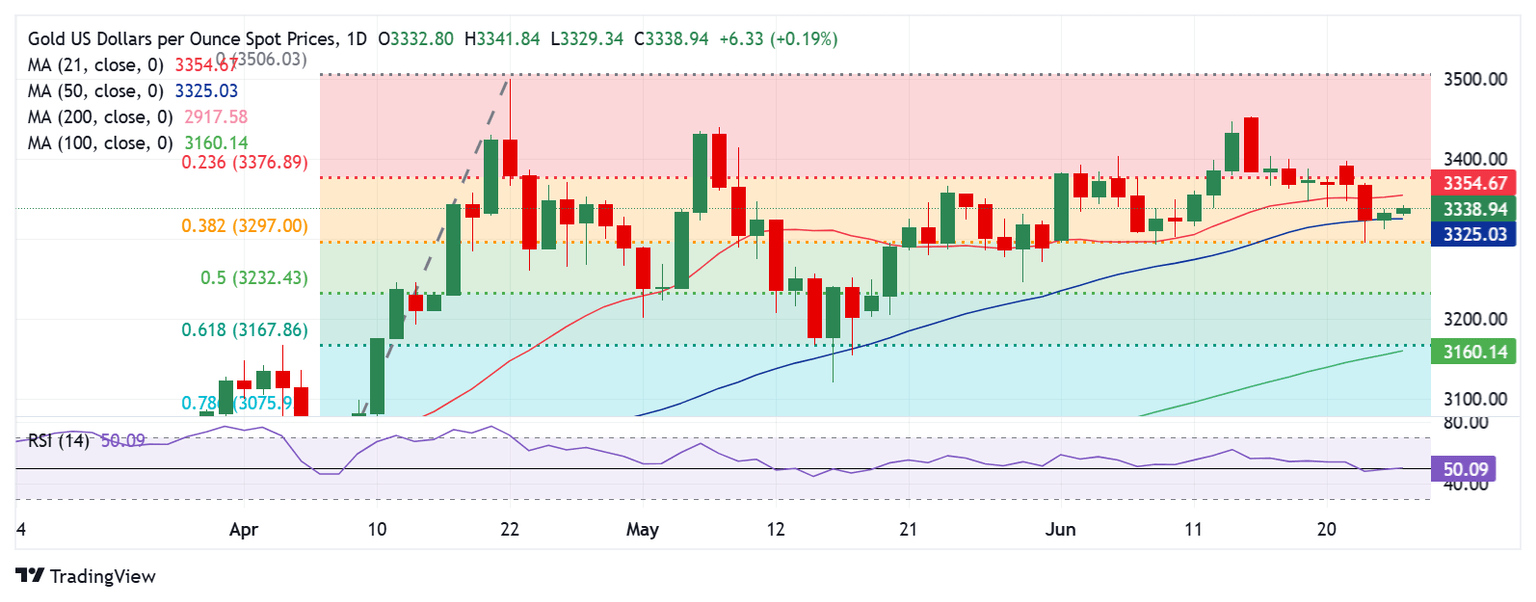

There is little change in the short-term technical outlook for Gold price.

The daily chart shows that Gold price is holding onto the strong support of the 50-day Simple Moving Average (SMA) at $3,325.

Meanwhile, the upside appears limited by the 21-day SMA at $3,355.

The 14-day Relative Strength Index (RSI) is gyrating around midline, currently trading near 50.20, suggesting two-way risks for the bright metal.

A failure to resist above the 50-day SMA on a daily closing basis will retest the 38.2% Fibonacci Retracement (Fibo) level of the April record rally at $3,297.

A sustained break of the latter could trigger a fresh downtrend toward the $3,250 psychological barrier, below which the 50% Fibo level at $3,232 will come into play.

Alternatively, recapturing the 21-day SMA at $3,352 is critical for a sustained recovery from two-week troughs.

The next upside hurdle is aligned at the 23.6% Fibo level at $3,377.

Gold buyers will then target the $3,400 threshold once the 23.6% Fibo resistance is decisively taken out.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.