Gold Price Forecast: XAU/USD poised to challenge record highs

XAU/USD Current price: $2,943.03

- Concerns about the potential effects of US tariffs on the global economy hit financial markets.

- S&P Global will release the preliminary estimates for the February PMIs on Friday.

- XAU/USD keeps finding buyers on dips, higher highs likely before the week is over.

Spot Gold traded as high as $2,955.18 a troy ounce on Thursday, a fresh all-time high. The bright metal kept rallying despite a dismal market mood as market players weighed in on the potential negative effects of United States (US) tariffs on the global economy.

XAU/USD retreated early in the American session as the dismal mood temporarily boosted demand for the US Dollar (USD), yet persistent fears and a free-fall in Wall Street limited the slide. The pair currently trades around $2,940, retaining its overall positive tone.

Fears rotate around US President Donald Trump’s plans for massive tariffs. Trump announced plans to impose tariffs on automobiles, semiconductors and pharmaceuticals shipped to the US as early as April 2. He also noted that tariffs could go higher throughout the year.

Concerns intensified after the Federal Open Market Committee (FOMC) released the Minutes of the January meeting, which showed officials are worried about the potential effects of tariffs on the economy.

The focus shifts now to the Hamburg Commercial Bank (HCOB) and S&P Global preliminary estimates of the February Purchasing Managers’ Indexes (PMIs) for most major economies. The PMI reports are a measure of local economic health. The US will also release the final estimate of the January Michigan Consumer Sentiment Index, while a couple of Federal Reserve (Fed) speakers will hit the wires.

XAU/USD short-term technical outlook

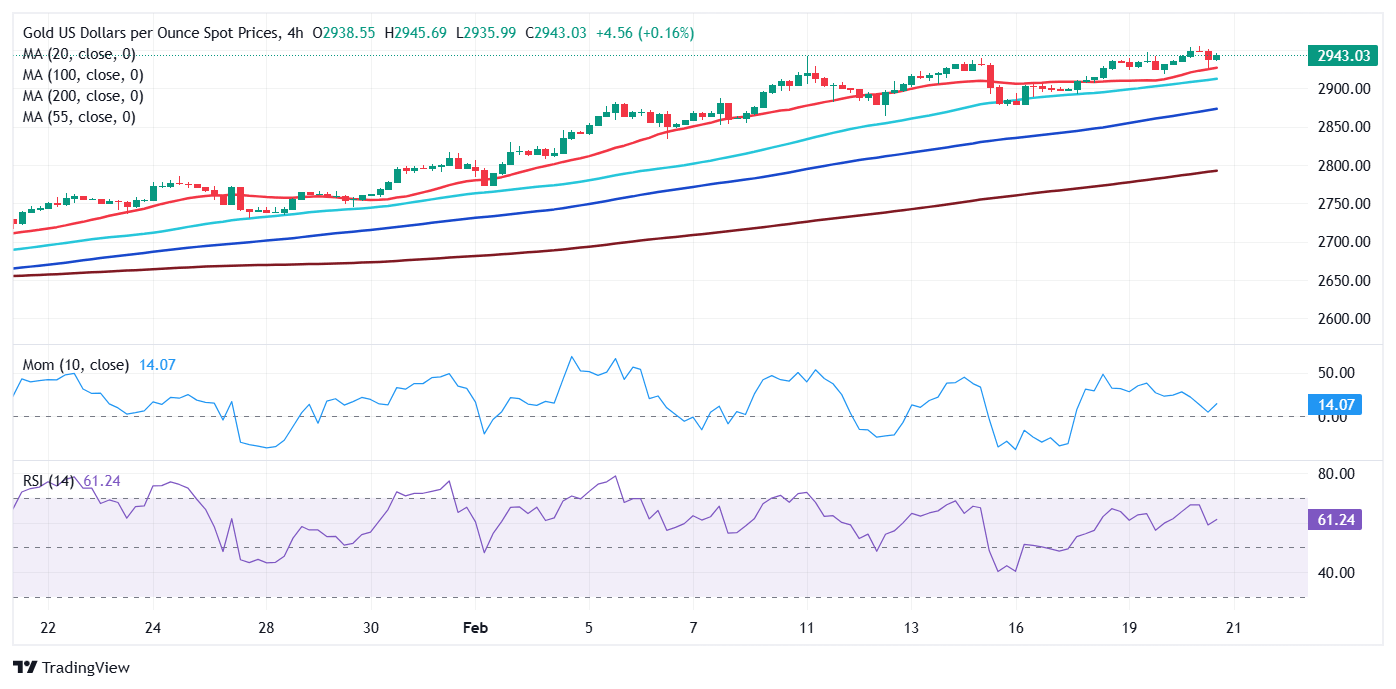

Technically, the daily chart for the XAU/USD pair shows it keeps posting higher highs and higher lows, which is in line with the dominant bullish trend. Technical indicators, in the meantime, remain within overbought levels, lacking clear directional strength yet heading north, suggesting buying pressure is still strong. Finally, the same chart shows Gold develops above all its moving averages, with the 20 Simple Moving Average (SMA) heading firmly north, roughly $100 below the current level.

In the near term, and according to the 4-hour chart, XAU/USD is poised to extend its advance. The pair met intraday buyers at around a bullish 20 SMA, while the 100 and 200 SMAs head firmly north far below the shorter one. Technical indicators, in the meantime, resumed their advances after correcting overbought conditions, supporting higher highs ahead.

Support levels: 2,924.10 2,913.05 2,909.60

Resistance levels: 2,960.00 2,975.00 2,990.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.