Gold Price Forecast: XAU/USD plunges to $3,950 on broad US Dollar demand

XAU/USD Current price: $3,958.49

- Financial markets entered panic mode after another batch of missing US data.

- The US Senate failed once again to pass a funding bill to lift the shutdown

- XAU/USD collapsed on broad US Dollar demand, lower lows at sight.

Spot Gold retreated from the record high of $4,059.36 posted on Wednesday, and plunged below the $4,000 mark in the American session. Broad US Dollar (USD) demand amid risk aversion dominates financial boards on Thursday, with fears revolving around the extended United States (US) government shutdown.

The US missed the release of another batch of employment-related data amid the shutdown, after another failed attempt to pass a funding bill on Thursday. The Senate rejected both the Democratic and the Republican bills, after holding a seventh round of voting.

Wall Street is under strong selling pressure, with the three major indexes trading in the red, also reflecting the market concerns. As for the Greenback, it stands victorious across the FX board, particularly firmer against commodity-linked currencies.

Other than that, speculative interest seems to have ignore the latest headlines related to the Gaza war. On Wednesday, US President Donald Trump announced a peace deal. The first phase is still to be approved by the Israeli Security cabinet, with a ceasefire expected within 24 hours of such approval. President Trump expects the remaining hostages to be released early next week.

XAU/USD short-term technical outlook

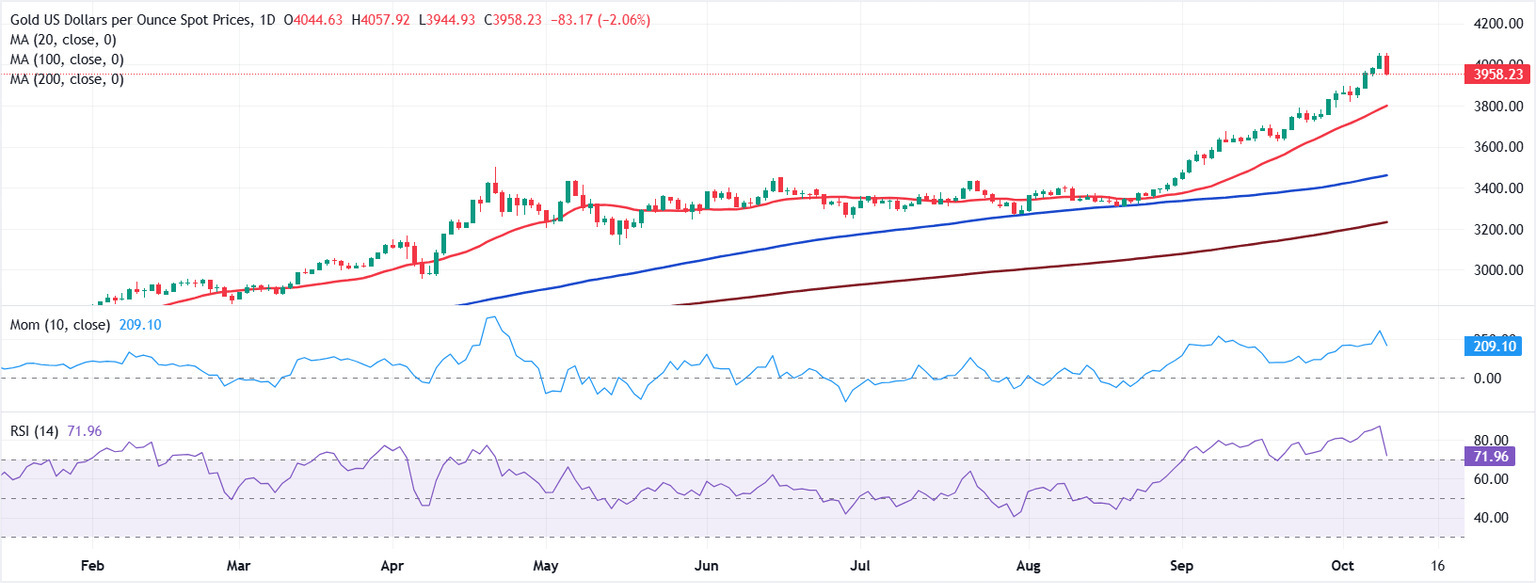

The XAU/USD pair fell towards the $3,950 area, maintaining the bearish momentum. Technical readings in the daily chart indicate that the metal is correcting extreme overbought conditions, but still far from confirming an interim top. The Relative Strength Index (RSI) indicator heads sharply lower, but holds above the 70 level. At the same time, moving averages maintain their sharp bullish slopes far below the current level, with the 20 Simple Moving Average (SMA) currently standing at around $3,800.

The near-term picture, however is bearish. In the 4-hour chart, technical indicators crossed below their midlines, with the Momentum heading south almost vertically. At the same time, XAU/USD fell below a now flat 20 SMA, providing dynamic resistance at around $4,001.00. Finally, the longer moving averages maintain their upward slopes far below the current level, limiting the bearish scope in the longer term.

Support levels: 3,944.60 3,931.90 3,918.70

Resistance levels: 3,984.00 4,001.00 4,020.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.