Gold Price Forecast: XAU/USD outshines amid panic, targets $1,794

- Gold price extends the uptrend amid recession fears and geopolitical woes.

- The USD keeps falling with Treasury yields amid fading aggressive Fed tightening hopes.

- XAU/USD bulls remain on track to conquer the 50 DMA hurdle at $1,794.

Gold price is extending its winning streak into a fifth trading day on Tuesday, having hit the highest level in four months near $1,780. Gold bulls are rejoicing the reducing bets for a 75 bps Fed rate hike in September amid a combination of factors affecting the market’s perception of risk sentiment in recent times. Firstly, risk-off flows continue to dominate on rising concerns over a potential global recession following the US Q2 GDP contraction. Another catalyst hurting investors’ confidence is the brewing US-China tension over Taiwan. Tensions mounted as US House of Representatives Speaker Nancy Pelosi is scheduled to visit Taiwan during the day. Several Chinese warplanes fly close to the median line of the Taiwan Strait while Taiwan's military has strengthened its readiness for combat from Tuesday until Thursday. Meanwhile, the US has maintained that it wouldn't be intimidated by Chinese threats to never "sit idly by" if she made the trip to the self-ruled island claimed by Beijing.

That said, fears dominate and the bright metal now appears more attractive as a store of value than the US dollar. The greenback’s appeal has been dented by shallower Fed rate hike expectations and discouraging US economic data. Monday’s US ISM Manufacturing PMI topped estimates with 52.8 in July but its Prices Paid component for July dropped dramatically to 60.0 vs. 75.0 expected. The renewed sell-off in the US Treasury yields also added to the dollar’s misery while benefiting the non-yielding bullion.

Also read: Don’t be misled by gold’s recent upswing

Looking ahead, developments surrounding the US-China conflict over Taiwan will be closely followed amid a data-light US calendar. The US JOLTS Job Openings will be reported, although the speeches from the Fed officials Evans and Bullard will also grab some attention. The precious metal will likely remain underpinned, in the face of growth fears and escalating geopolitical tensions. Only hawkish Fed commentary could put a pause in the ongoing XAU/USD price rally.

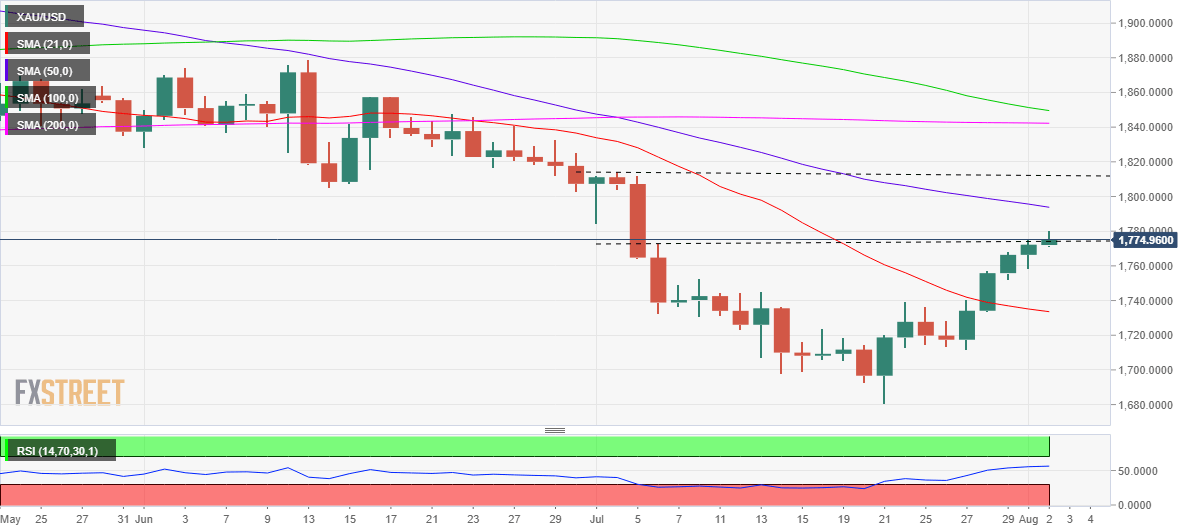

Gold price technical outlook: Daily chart

Gold price broke above the July 6 high of $1,773 and briefly recaptured $1,780 the round figure amid the extended upsurge.

The 50-Daily Moving Average (DMA) at $1,794 remains on buyers’ radars, as they gather strength for a fresh leg higher.

Fresh buying opportunities will emerge above the latter, opening doors for a test of the horizontal trendline resistance around $1,810.

The 14-day Relative Strength Index (RSI) is inching higher while holding above the midline, suggesting that there is more room to rise for the metal.

On the flip side, bears need to find acceptance below the daily low of $1,771 to extend any retreat towards the previous day’s low of $1,758.

A sharp sell-off below the latter could be in the offing, which will expose the downward-sloping 21 DMA at $1,734. Ahead of that the $1,750 psychological level could come to the rescue of bulls.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.