Gold Price Forecast: XAU/USD now points to some consolidation

- Gold prices dropped for the third day in a row on Wednesday.

- The US Dollar extended its trade-led recovery to multi-day highs.

- Alleviated trade jitters and a stronger US Dollar weighed on the yellow metal.

Gold prices added to the weekly leg lower on Wednesday, breaking below the $3,300 mark per troy ounce on the back of the persistent recovery in the US Dollar (USD) and the mild bounce in US yields across different time frames.

Absent relevant data releases on both sides of the Atlantic midweek, the better tone in the Greenback prevailed once again, putting the precious metal under extra downward pressure.

It is worth mentioning that the improved sentiment around the Greenback resurged almost exclusively after President Donald Trump pushed back the deadline for US-EU trade talks to July 9 on Monday.

Also adding to the Dollar’s appeal, the most-watched Conference Board's Consumer Confidence Index unexpectedly rose to 98.0 in May, also showing a marked improvement in the Expectations Index, which measures short-term expectations for income, economic activity, and employment.

The corrective day in the yellow metal also comes in tandem with the small pullback seen in the major US stock markets.

Meanwhile, investors are expected to closely follow the publication of the FOMC Minutes of the May 6-7 meeting. At that gathering, the Federal Reserve (Fed) decided to keep the Fed Funds Target Range (FFTR) unchanged at 4.25%-4.50%, while Chief Jerome Powell delivered his usual cautious tone at the press conference.

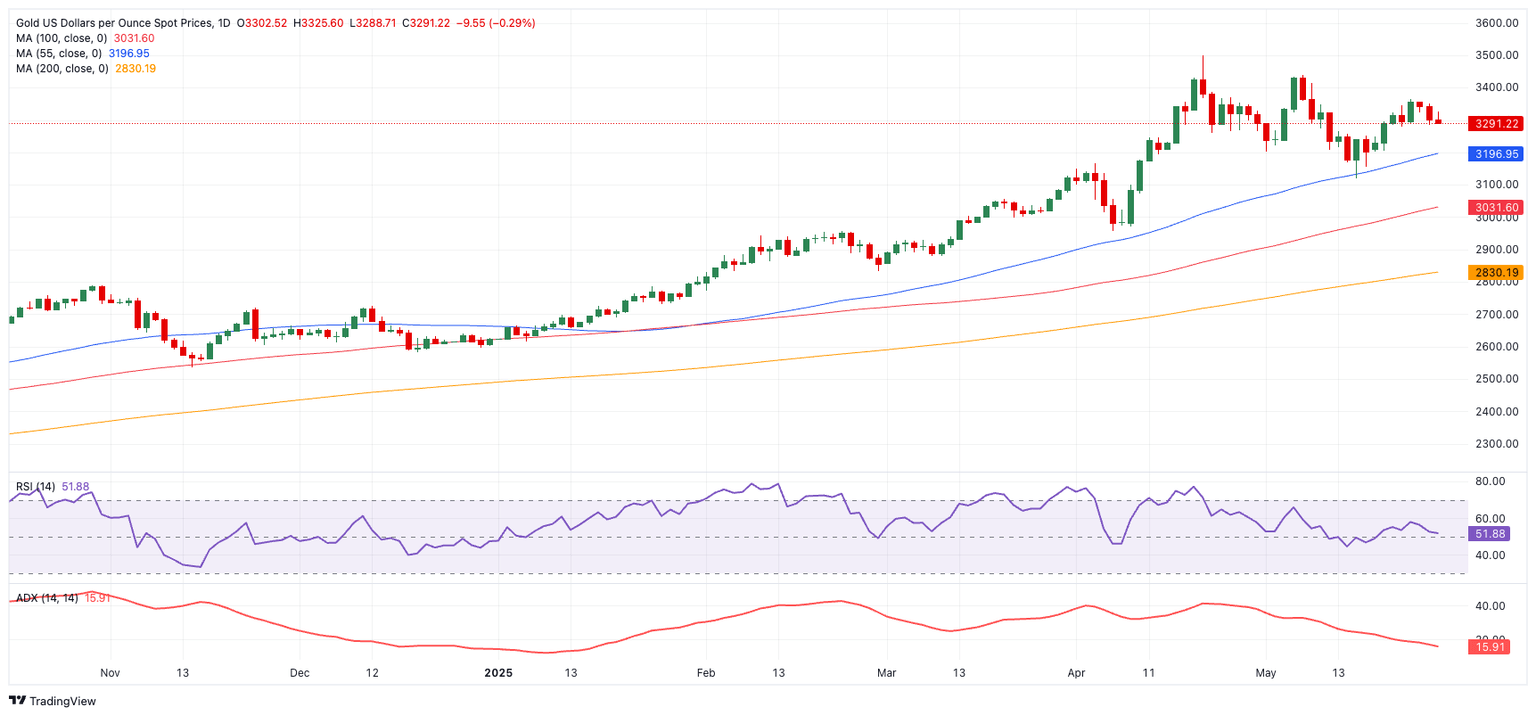

Gold's short-term technical forecast

A fresh bullish bias might bring Gold back to its May high of $3,438 (May 7), which is just ahead of the all-time high of $3,500 (April 22).

The continuation of the selling bias could prompt the metal to visit the transitory 55-day SMA at $3,196, followed by the May low of $3,120 (May 15) and the short-term 100-day SMA at $3,031.

Meanwhile, the Relative Strength Index (RSI) eased below 52, and the Average Directional Index (ADX) near 15 shows that the trend lacks strength.

XAUUSD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.