Gold Price Forecast: XAU/USD needs to defend $1,977 support for a fresh upswing

- Gold price treads water below $2,000 amid a risk-on market environment.

- US Dollar pauses sell-off with the US Treasury bond yields after dovish Fed outlook.

- Gold price portrays a potential ascending triangle pattern on the daily chart.

Gold price is consolidating last Friday’s uptick below $2,000 at the start of the week on Monday, as the United States Dollar (USD) and US Treasury bond yields are trying hard to find their feet amid a risk-friendly market environment.

Focus on the US bond market, Treasury bond yields

Friday’s global risk rally is extending into Asian trading early Monday, as investors cheer increased odds of the US Federal Reserve (Fed) likely done with its rate-hiking cycle. Following less hawkish signals from the Fed last Wednesday, Friday’s weak US Nonfarm Payrolls (NFP) data release cemented expectations of no further interest rate hikes from the Fed while emphasizing the US central bank’s “higher interest rate for longer” stance.

The Labor Department said Friday that the US economy added 150,000 in October, slightly below the market forecast of 170,000. Average hourly earnings, an important measure of wage inflation, rose 0.2% last month, reporting a smaller-than-expected increase. The Unemployment Rate, meanwhile, climbed to 3.9% versus an expectation of 3.8%.

Asian markets are tracking the positive close on Wall Street last Friday, further capitalizing on the upbeat remarks from China’s Premier Li Qiang over the weekend. Qiang reaffirmed, "no matter how the world changes, China's pace of opening up will never stall, and its determination to share development opportunities with the world will never change."

The US Dollar Index tumbled to a two-month low of 104.94 while the benchmark 10-year US Treasury bond yields extended their sell-off, hitting a fresh five-week below the critical 4.50% level. Dialing down of the hawkish Fed bets combined with the US Treasury’s cut its refinancing estimate emerged as the main catalysts behind their weakness.

However, the Greenback is seeing a bit of a relief in Asia on Monday, drawing support from a minor rebound in the US Treasury bond yields, as investors adjust their positions heading into a new week. Therefore, the Gold price is struggling to regain the upside traction while an improved risk sentiment also acts as a headwind for the bright metal.

Looking ahead, it’s a relatively data-light week but the US bond market action will remain the central focus this week, as massive US bond auctions are on the cards. Further, the geopolitical developments surrounding the Middle, the return of the Fed policymakers and the Fed sentiment will continue to play a pivotal role behind the Gold price action.

Gold price technical analysis: Daily chart

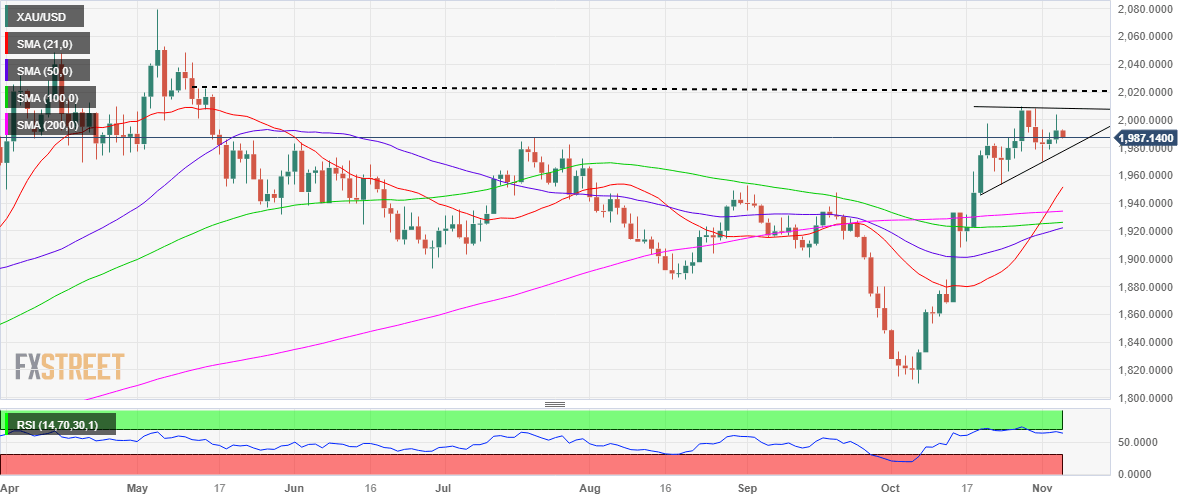

Having failed to sustain above the $2,000 threshold on multiple occasions last week and finding demand at lower levels, Gold price has carved out a potential ascending triangle on the daily chart.

The 14-day Relative Strength Index (RSI) indicator is edging lower but still remains above the 50 level, keeping the ‘buy-the-dips’ view intact for Gold price.

Adding to the Gold price optimism, the price trades above all the major Simple Moving Averages (SMA) on the said timeframe.

Immediate cushion awaits at the rising trendline support at $1,977, below which the November 1 low of $1,970 will be retested. A failure to resist above the latter will target the static support at $1,963, paving the way toward the $1,950 psychological level.

On the upside, acceptance above the $2,000 threshold is critical to initiating a meaningful uptrend. A strong topside barrier is aligned at around the multi-month high of $2,009, where the horizontal trendline resistance appears.

The next crucial contention point for Gold buyers is envisioned at the mid-May high near $2,020.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.