Gold Price Forecast: XAU/USD needs a sustained move above $2,005 to unleash additional upside

- Gold price is correcting lower but downside appears limited amid firmer oil prices.

- Risk sentiment has turned sour again amid fresh reports of the US planning a ban on Russian oil imports.

- Gold price looks to recapture the wedge hurdle at $2,005 on buying resurgence.

Gold price is on a corrective downside, in an obvious move after the three-day non-stop rally to the highest level in a year, reached at $2,003 on Monday. The bright metal faced rejection once again at the $2,000 mark, giving investors an excuse to take profits off the table. Meanwhile, oil prices eased from eight-year highs, offering some temporary relief to the market. Although risk-off flows seem to have returned and oil prices have resumed their uptrend following another report, citing that the US is likely to move ahead with their plan to ban the Russian oil imports, without the participation from their allies, per Reuters.

Looking ahead, gold price will continue to find the dip-buying demand, as the Russia-Ukraine crisis is far from over. Russia’s invasion of Ukraine will continue until Ukraine surrenders, according to Russia’s President Vladimir Putin’s statement. Tuesday’s data docket is light on both sides of the Atlantic, keeping the focus on the geopolitical developments and the oil price action, which will have a significant impact on gold trades.

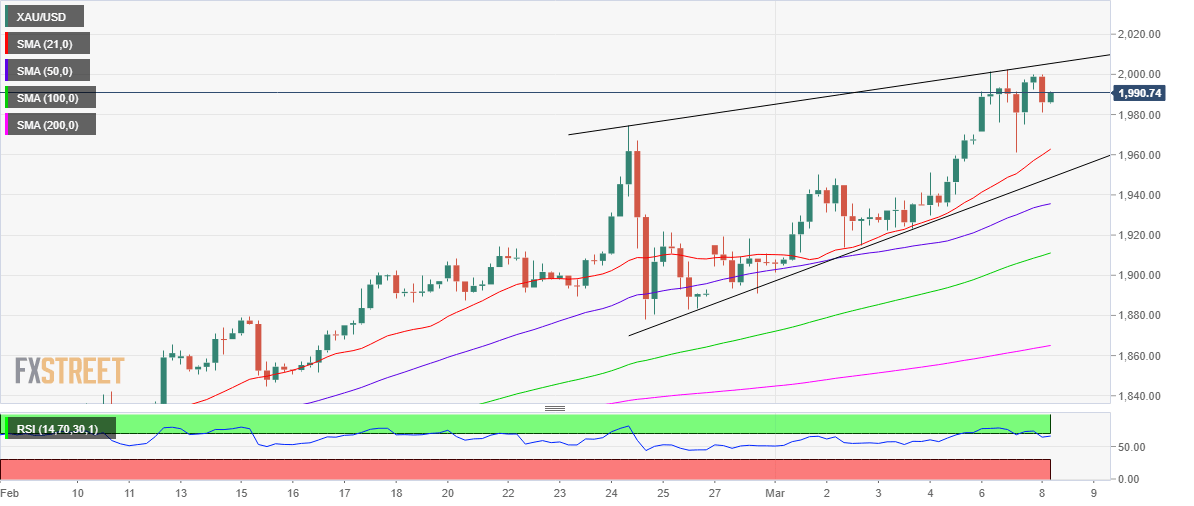

Gold Price Chart - Technical outlook

Gold: Four-hour chart

The overnight correction in gold price has offered the much-needed impetus to bulls, as they keep their sights on the $2,034 level.

Also, the Relative Strength Index (RSI) has retraced from the overbought territory while above 50.00, pointing upwards once again. The leading indicator suggests that there remains room to rise for gold price.

That said, the renewed upside could test a two-week-old rising wedge resistance at $2,005. That could emerge as a tough nut to crack for bulls, as the natural tendency of the rising wedge to yield a downside breakout.

If the bulls, however, defy the bearish odds, then a fresh advance towards $2,034, the previous triangle target, cannot be ruled out.

On the flip side, the intraday lows of $1,981 will be tested initially should the correction pick up pace.

The next downside target is seen at Monday’s low of $1,961, which also coincides with the bullish 21-Simple Moving Average (SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.