Gold Price Forecast: XAU/USD nears $3,200 as optimism reigns

XAU/USD Current price: $3,224.66

- De-escalating trade tensions between the US and China brought back optimism.

- The US will release the April Consumer Price Index (CPI) on Tuesday.

- XAU/USD nears May monthly low and aims to break below it.

Gold prices gapped lower at the weekly opening, falling towards $3,207.82, its lowest in roughly two weeks amid returning optimism. Financial markets welcome headlines indicating the United States (US) and China agreed to rollback tit-for-that tariffs for 90 days, de-escalating trade war tensions.

Beijing and Washington made a joint announcement reporting the US will cut extra levies on China from the current 145% to 30%. Reciprocally, China will charge 10% on US imports, down from the previously announced 125%.

The US Dollar (USD) holds on to most of its intraday gains across the FX board, albeit Wall Street retreating from intraday peaks put a halt to the USD rally. Still, US indexes retain substantial intraday gains, with the risk-on mood set to continue As per XAU/USD, the pair keeps pressuring the aforementioned low, and seems poised to extend the slide.

On Tuesday, the focus changes to US data, as the country will release the April Consumer Price Index (CPI), foreseen stable at 2.4% YoY. On a monthly basis, the CPI is foreseen up by 0.3% after falling 0.1% in March.

XAU/USD short-term technical outlook

As long as optimism prevails, XAU/USD would remain under pressure. The rally to record highs was due to fears over a global economic slowdown and mounting inflationary pressures due to tariffs. There are no fears without tariffs.

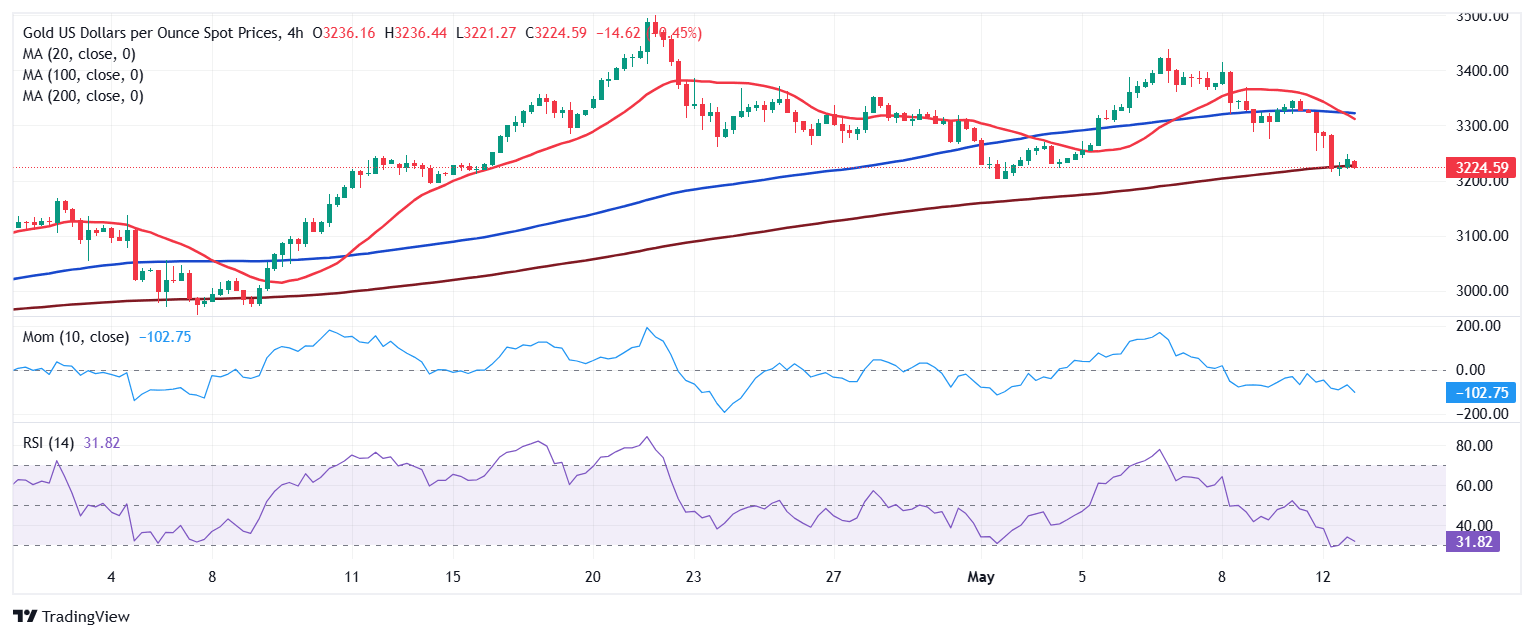

Technically, the daily chart for XAU/USD shows the pair fell below a now flat 20 Simple Moving Average (SMA) while still far above bullish 100 and 200 SMAs. Technical indicators, in the meantime, head firmly south after crossing their midlines into negative territory, anticipating lower lows ahead.

The 4-hour chart shows XAU/USD is battling around a mildly bullish 200 SMA, while a bearish 20 SMA crosses below the 100 SMA in the $3,320 area. At the same time, the Momentum indicator resumed its decline within negative levels, while the Relative Strength Index (RSI) indicator consolidates at around 29, without signs of downward exhaustion. A break through the daily low exposes May monthly low at $3,202.03, while once below the latter, a steeper decline is on the table.

Support levels: 3,202.00 3,187.20 3,176.45

Resistance levels: 3,234.40 3,248.50 3,263.85

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.