Gold Price Forecast: XAU/USD looks to regain $3,400 as focus shifts to Fed decision

- Gold price extends the recovery rally toward $3,400 early Tuesday.

- The US Dollar stays defensive amid Asian FX woes and Fed speculation.

- Technically, the path of least resistance appears north for Gold price.

Gold price extends its recovery rally into the second straight day on Tuesday as buyers appear unstoppable amid a bearish sentiment around the US Dollar (USD) and escalating geopolitical tensions in the Middle East.

Gold price keeps pushing higher on safe-haven flows

Despite renewed optimism of the US reaching trade deals with some of its trading partners as early as this week, US President Donald Trump’s erratic trade policies continue to unnerve markets, allowing Gold price to recover lost ground.

Trump said late Monday that he would announce pharmaceutical tariffs in the next two weeks after signing an executive order to incentivize drug manufacturing in the United States (US).

Additionally, the Asian forex exchange chaos also keeps the haven demand for the precious metal alive and kicking. Markets are speculating that some of the Asian central banks are planning to revalue their currencies to shield against the impact of the US tariffs.

In this regard, the Taiwan Dollar (TWD) leapt 8% against the USD on Monday, contributing to the Greenback’s renewed downside. Earlier on, the Hong Kong central bank sold the local currency to restrain it from strengthening against the USD.

Furthermore, escalating geopolitical tensions between Israel and Yemeni Houthi rebels and Russia-Ukraine continue to act as a tailwind for the traditional store of value Gold price. In the latest developments, Russian officials said that Ukraine launched drones at Moscow for the second night in a row, forcing the closure of the capital’s three major airports. Adding to it, they reported that Ukrainian forces were trying to advance in Russia’s western region Kursk.

Meanwhile, “Israel, reportedly in coordination with the US, launched airstrikes on Yemen's Hodeidah port in response to Houthi rebel's ballistic missile attack that hit Ben Gurion International Airport on Sunday,” FXStreet’s Analyst Haresh Menghani said.

Therefore, Gold price seems to remain in a constructive space heading into the two-day US Federal Reserve (Fed) policy meeting starting later on Tuesday. Commenting on the upcoming Fed event, Nick Timiraos, the Wall Street Journal’s Fed whisperer, noted that the Fed "prepares for difficult judgments and emerging divisions regarding when to cut interest rates.”

Gold optimists shrugged off easing bets of a June interest rate cut amid an improving economic outlook, as trade headlines and geopolitics dominate, in anticipation of the Fed rate call and Chair Jerome Powell’s comments.

Data showed on Monday that the Institute for Supply Management’s (ISM) Services PMI Index rose to 51.6 from 50.8 in March. Steve Miller, chair of the ISM services survey, said, "April change in indexes was a reversal of March's direction," noting rises in new orders, employment, and supplier deliveries indices.

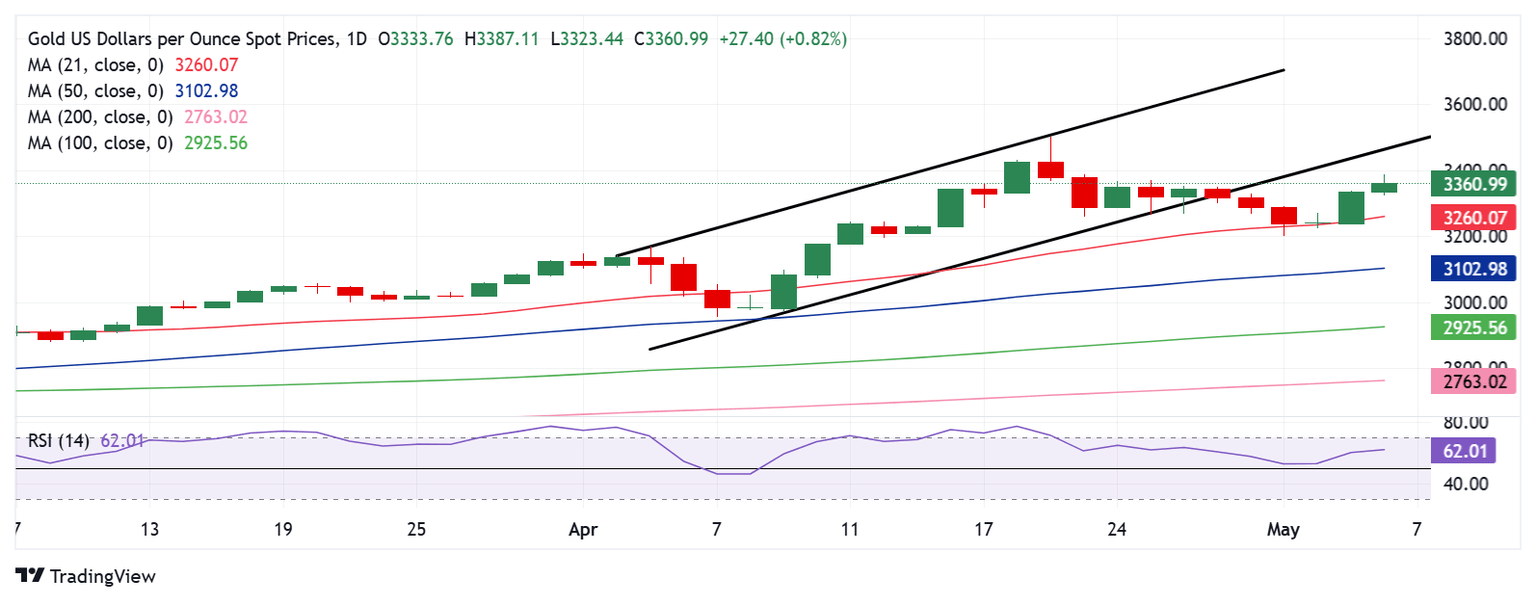

Gold price technical analysis: Daily chart

Gold price holds the bounce from the critical 21-day Simple Moving Average (SMA) support, now at $3,260.

The 14-day Relative Strength Index (RSI) holds firm above the midline near 62, suggesting that there is more room to the upside.

The latest leg higher needs acceptance above the $3,400 barrier for Gold buyers to flex their muscles toward the channel support (now resistance) at $3,467.

Further up, the record high of $3,500 will come into play.

On the flip side, the immediate support is seen at $3,300 on a pullback, below which the 21-day SMA at $3,260 will be challenged again.

A failure to defend the latter will fuel a fresh downside move toward the $3,150 psychological level.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.