Gold Price Forecast: XAU/USD looks north amid US tariffs uncertainty

- Gold price rebounds toward record highs of $3,246 after the previous pullback.

- Trump’s back-and-forth on tariffs creates uncertainty, underpinning Gold’s safe-haven appeal.

- Gold remains poised for a fresh leg higher on bullish technical setup on the daily chart.

Gold price is bouncing back toward the record highs of $3,246 set on Monday as buyers fight back control despite a sense of calm across the financial markets early Tuesday.

Gold price to remain at the mercy of tariff talks

The US bond market seems to have stabilized after a brutal last week as the benchmark 10-year US Treasury bond yields fell about 10 basis points (bps), reversing a part of the recent 50 bps relentless rally.

Investors take a breather, pausing the rotation out of the US assets, digesting the ongoing back-and-forth on US President Donald Trump’s tariff headlines while bracing for the earnings results from top American banks and tech companies.

The risk reset allows the US Dollar (USD) to find its feet following the massive sell-off to three-year troughs.

US President Donald Trump said on Monday he was considering modifying the 25% tariffs imposed on foreign auto and auto parts imports from Mexico, Canada and other places, noting that car companies "need a little bit of time because they're going to make 'em here."

This comes after the Trump administration announced exemptions on some technology imports, including smartphones, computers, laptops and disc drives, from reciprocal tariffs imposed on China. But Trump clarified that these products will be subject to the 20% existing tariffs on China, not the steep 145% tariffs. Trump said he “will announce the tariff rate for semiconductors over the next week.”

However, markets continue to remain wary amid uncertainty over Trump's trade policies, and his constant backpedalling on tariffs raises worries over the global economic outlook, keeping the sentiment around the traditional Gold price underpinned.

Further, increased dovish bets surrounding the US Federal Reserve (Fed) interest rate cuts also continue to act as a tailwind for the non-yielding Gold price. Fed Governor Christopher Waller said Monday that “the Trump administration's tariff policies are a major shock to the US economy that could lead the Fed to cut rates to head off recession even if inflation remains high,” per Reuters.

Meanwhile, markets ignored comments from Atlanta Fed Bank President Raphael Bostic, who suggested that the US central bank should stay on hold until there is more clarity. They continued pricing in about 85 bps of rate cuts by December, with an 80% probability that the Fed will hold rates at its May 7 policy meeting.

Gold price also draws support from increased investment flows into China’s physically backed gold exchange-traded funds (ETFs) so far this month, according to the latest data published by the World Gold Council (WGC).

Looking ahead, the further upside in Gold price will likely remain at the mercy of Trump’s tariff headlines and the upcoming Fedspeak as the US calendar remains devoid of top-tier economic data publication.

Investors also remain unnerved ahead of China’s first-quarter Gross Domestic Product (GDP) data release on Wednesday, which could significantly impact the broader market sentiment and the Gold price action.

On Monday, China Customs reported a 12.4% surge in the country’s exports in March from a year earlier as Chinese companies rushed to ship goods before higher US tariffs took effect.

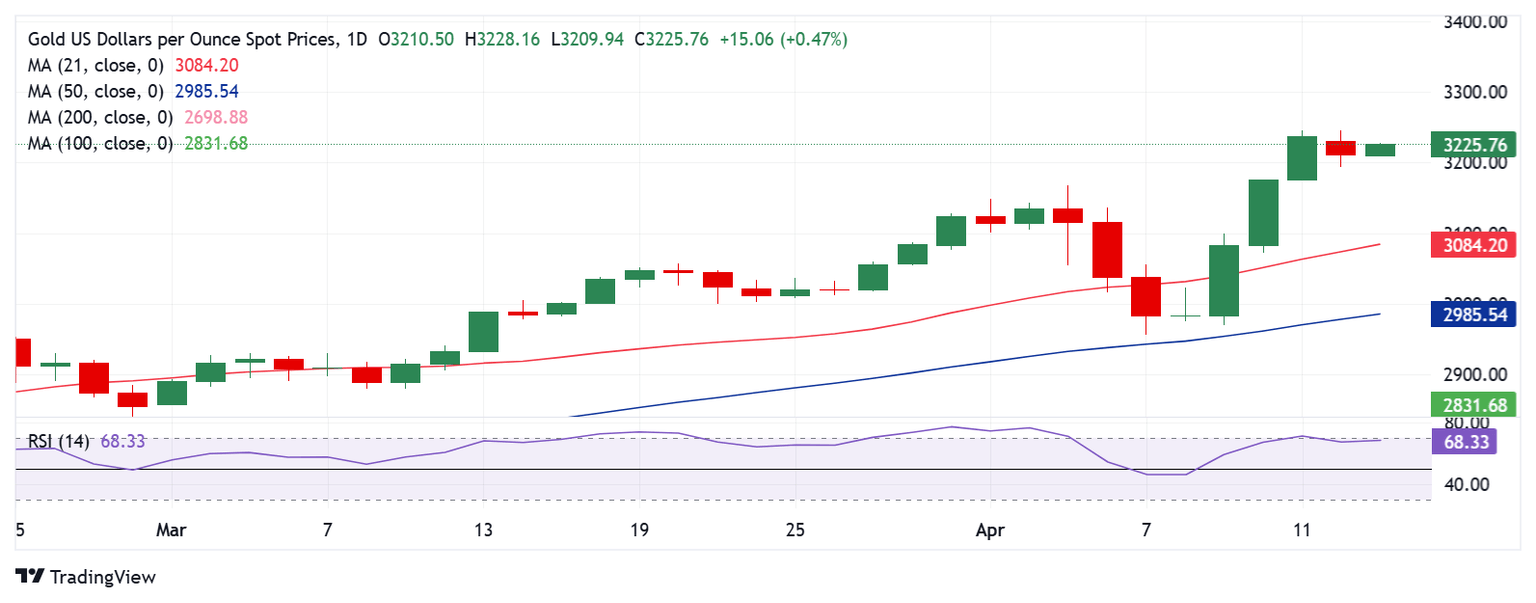

Gold price technical analysis: Daily chart

The daily chart shows that the 14-day Relative Strength Index (RSI) hovers just below the overbought region, currently near 69, pointing to more gains in the near term. T

The record high of $3,246 is the immediate topside barrier for Gold buyers. Scaling that level will open the door toward the $3,300 mark

Alternatively, the initial support aligns at the $3,200 threshold, below which the April 11 low of $3,176 will be challenged.

Additional declines could test the $3,100 round level, followed by the 21-day Simple Moving Average (SMA) resistance-turned-support at $3,084.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.