Gold Price Forecast: XAU/USD is down starting out 2022 but not out

- Gold corrects from six-week highs as US dollar rebounds amid Evergrande, covid woes.

- US Treasury yields hold steady ahead of key economic releases.

- Gold’s four-hour technical setup suggests an extended pullback.

Gold price ended the final day of 2021 on a bullish note, at the strongest levels in six weeks at $1,830. The year-end profit-taking in the US Treasury yields from monthly peaks helped gold extend its two-day rebound while the dollar also bore the brunt of repositioning. The benchmark 10-year rates briefly dropped below the 1.50% level before recapturing the latter and limiting gold’s upside. A negative finish to 2021 for Wall Street indices also underpinned the bullish tone in the bright metal. Gold price, however, booked the worst year since 2015 amid fading coronavirus fears and expectations of monetary policy normalization by major global central bankers in the year to come. Holiday-thinned market conditions further helped gold buyers, as the price added 0.71% on the day.

Gold price has started out the first trading day of 2022 on the wrong footing, as investors take profits off the table ahead of a busy week, full of top-tier US economic events. The US ISM PMIs, the FOMC minutes and Nonfarm Payrolls are likely to cheer the Fed hawks. The build-up to these events is prompting a rebound in the US dollar across the board, pulling gold price lower from fresh six-week highs of $1,832. Meanwhile, the US yields are trading listlessly, as most Treasuries are on a holiday in Asia. Concerns over surging covid cases globally and resurfacing China’s Evergrande risks seem to be aiding the recovery in the safe-haven dollar at gold’s expense. Later in the day, the Euro area and the US Markit Manufacturing PMIs will offer some trading incentives to gold traders after a holiday season lull.

Gold Price Chart - Technical outlook

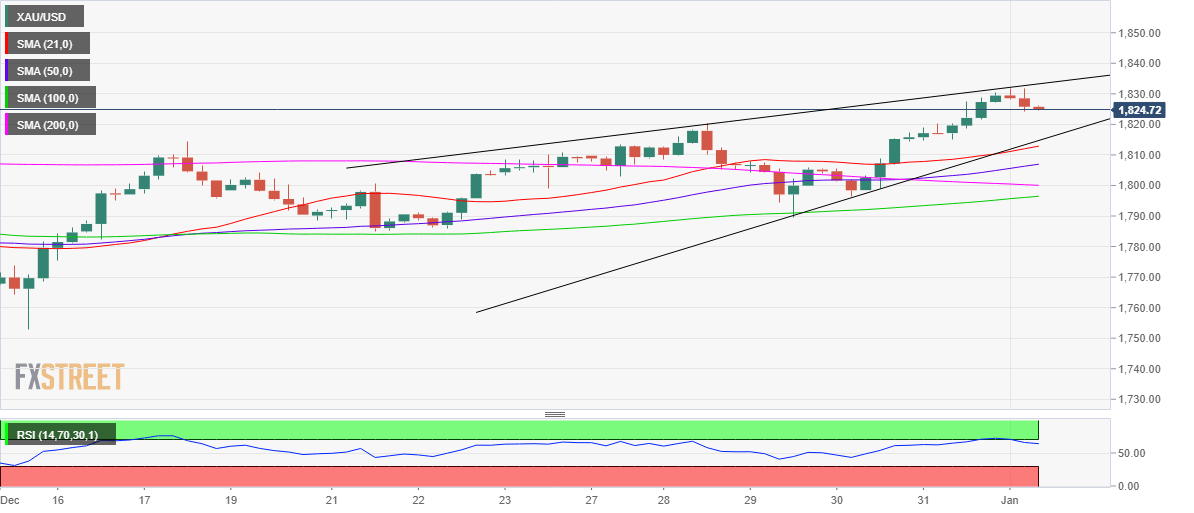

Gold: Four-hour chart

Gold’s four-hour chart shows that the price has turned south after running into a 10-day-old rising wedge hurdle at $1,832.

The retracement in gold price triggers a fresh drop towards the critical demand area around $1,814, which is the confluence of the wedge support and bullish 21-Simple Moving Average (SMA).

Ahead of that level, the 1,820 round number could get tested. If gold price yields a rising wedge breakdown on the said time frame, then a sell-off could kick in towards $1,800.

The Relative Strength Index (RSI) has edged lower, justifying the latest downtick. The leading indicator still remains in the positive zone, suggesting that the pullback could be a good buying opportunity.

Should the buyers regain control, the bright metal could see a retest of the multi-week highs of $1,832, above which a fresh upswing towards the November 22 highs of $1,849 cannot be ruled out.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.