Gold Price Forecast: XAU/USD hovers around $3,020, bulls return

XAU/USD Current price: $3,022.75

- A partial cease fire between Russia and Ukraine could be shortly announced.

- US CB Consumer Confidence plummeted in March amid Trump-related uncertainty.

- XAU/USD struggles to extend gains but holds above the $3,000 mark.

Gold recovered part of its shine on Tuesday, helped by tariffs-related concerns. The XAU/USD pair advanced towards $3,036.04 early in the American session, as headlines related to United States (US) President Donald Trump's tariffs weighed on the US Dollar (USD).

Headlines indicated that Trump plans to adopt a two-step approach as his tariff strategy, seeking to ground the president’s reciprocal tariff regime in a more robust legal framework.

Meanwhile, fresh geopolitical headlines emerged, noting that a ceasefire between Russia and Ukraine is in the making. News point to a “ceasefire at sea,” meaning reviving the Black Sea Grain deal, allowing Ukraine to ship its grain and agricultural products to global markets.

Ukrainian President Volodymyr Zelenskyy said that Ukraine’s understanding is ceasefire is effective immediately following US announcement adding he will ask President Trump for weapons and sanctions on Russia if Moscow breaks the ceasefire.

Earlier in the day, the US reported that Consumer Confidence plummeted in March. The CB index printed at 92.9, missing the 94.2 expected and below the previous 100.1.

XAU/USD short-term technical outlook

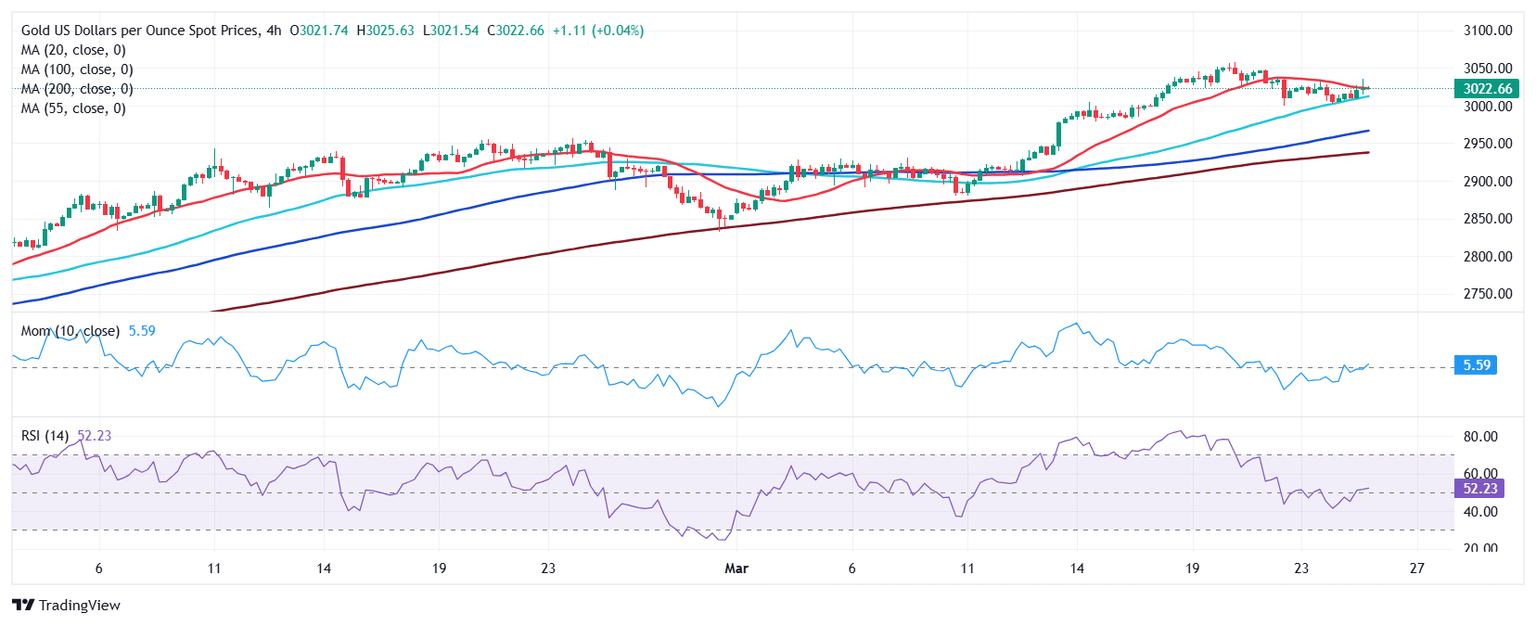

The daily chart for the XAU/USD pair shows bulls are regaining control. The pair has posted a higher high and a higher low, while advancing above all bullish moving averages. The 20 Simple Moving Average (SMA) picked up momentum and currently provides dynamic support at around $2,954.70. At the same time, technical indicators resumed their advances within positive levels after correcting extreme overbought conditions.

In the near term, and according to the 4-hour chart, XAU/USD bullish potential seems limited. The pair is battling a mildly bearish 20 SMA, but still well above bullish 100 and 200 SMAs. Technical indicators, in the meantime, are retreating from their midlines, heading marginally lower within neutral levels.

Support levels: 3,014.00 2,999.30 2,984.70

Resistance levels: 3,030.50 3,047.40 3,060.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.