Gold Price Forecast: XAU/USD holds the key support as the Fed week kicks in

- Gold price sets off the Fed week on a positive note, looking at $3,300.

- The US Dollar returns to the red amid trade uncertainty and pre-Fed repositioning.

- Technically, Gold buyers defend 21-day SMA support as RSI stays bullish.

Gold price is holding onto its rebound above $3,250 early Monday as buyers return with a bang alongside uncertainty over potential trade deals between the US and its Asian trading partners.

Gold price finds demand on trade uncertainty, geopolitics

Despite China confirming on Friday that the US had reached out to them for trade negotiations and US President Donald Trump stating over the weekend that he would lower tariffs on Chinese imports ‘at some point’, uncertainty remains high over a thaw in US-Sino trade relations.

Additionally, doubts over a potential US-Japan trade deal heightened after Japanese Finance Minister Katsunobu Kato walked back comments last Friday that seemed to suggest Japan might threaten to sell some of its Treasury holdings as part of trade negotiations with the White House.

Fresh questions lingering on the trade front revive the selling interest in the US Dollar (USD), rescuing Gold buyers from a critical level. Further, the renewed USD weakness could be also linked to repositioning ahead of the US Federal Reserve (Fed) policy announcements on Wednesday.

Reuters reported that “many investors are still wagering on further dollar weakness with speculative short positions rising further in the latest week.”

The traditional safe-haven Gold price also draws support from intensifying geopolitical tensions in the Middle East and between Russia and Ukraine.

On Sunday, Israeli Prime Minister Benjamin Netanyahu vowed to retaliate against the Houthis after a missile fired by the group struck the grounds of Israel's main terminal of Ben Gurion airport. Later, the Houthis said they would impose "a comprehensive aerial blockade" on Israel by repeatedly targeting its airports, in response to Israeli military plans to expand operations in Gaza.

Meanwhile, Russian President Vladimir Putin said Russia has the strength and the means to bring the conflict in Ukraine to a “logical conclusion.” As it stands, Russia and Ukraine are at odds over competing ceasefire proposals.

Looking ahead, all eyes remain on any clarity on US trade talks and their impact on the USD performance, even as markets pare back June Fed interest rate cut expectations. Markets are now pricing in only a 37% chance of a Fed cut in June, down from 64% a month ago. Goldman Sachs and Barclays both shifted their cut calls to July from June.

Yet another stellar US Nonfarm Payrolls report helped calm fears over a potential recession in the United States (US) while reviving bets that the Fed could remain patient on the policy outlook, leaning hawkish at its policy meeting this week.

That said, trade headlines will continue to dominate and remain the primary market driver in the week ahead.

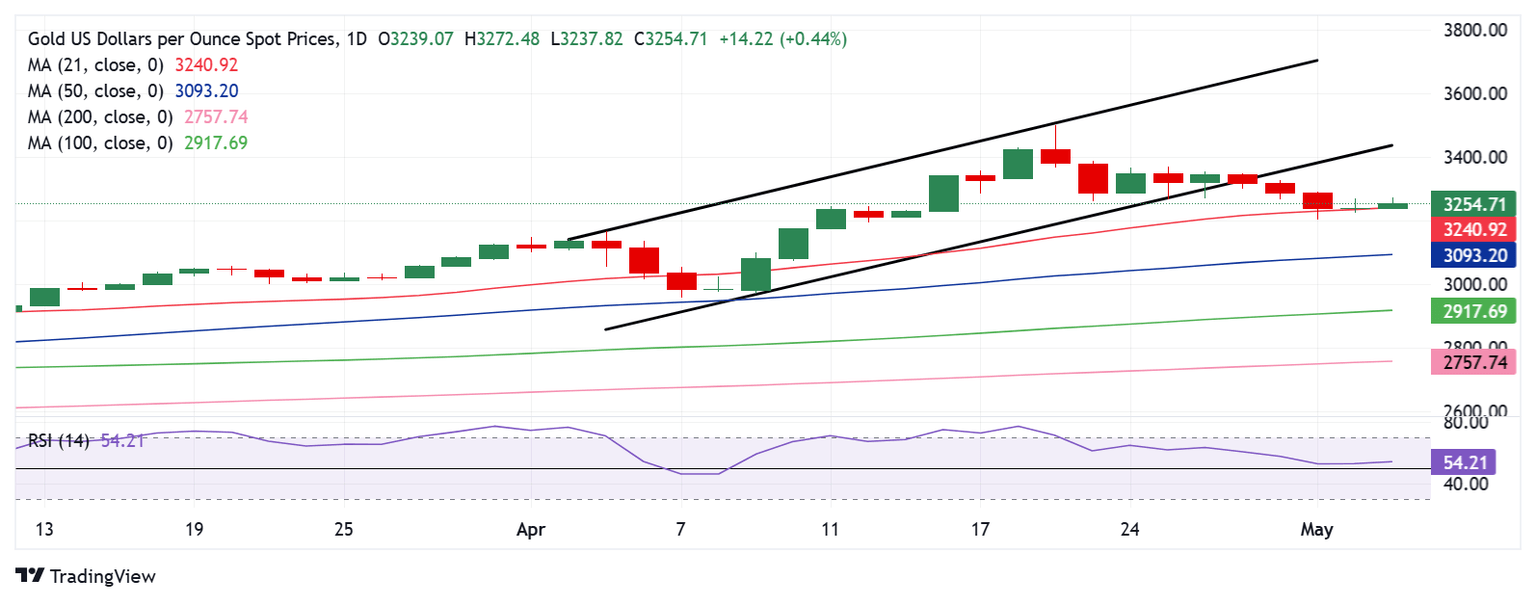

Gold price technical analysis: Daily chart

Gold price defended the critical 21-day Simple Moving Average (SMA) support, now at $3,242, rebounding following the downside break of a three-week-long rising channel last Wednesday.

The 14-day Relative Strength Index (RSI) points north while above the midline near 55.50, suggesting more room for recovery.

The latest upswing needs acceptance above the $3,300 barrier for Gold buyers to flex their muscles toward the channel support (now resistance) at $3,442.

Ahead of that, the $3,350 could be a tough nut to crack.

On the flip side, a failure to resist the aforesaid 21-day SMA at $3,242 on a daily closing basis, a fresh downside will open toward the $3,150 psychological level.

Further down, the 50-day SMA at $3,087 will be put to test.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed May 07, 2025 18:00

Frequency: Irregular

Consensus: 4.5%

Previous: 4.5%

Source: Federal Reserve

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.