Gold Price Forecast: XAU/USD holds on to gains ahead of first-tier events

XAU/USD Current price: $3,324.03

- The US Dollar fell in the American session following dismal US data.

- The US will release the preliminary estimate of Q1 GDP on Wednesday.

- XAU/USD is technically neutral in the near term, although odds favor the upside.

Spot Gold trades uneventfully within familiar levels on Wednesday, currently hovering around the $3,325 level. The bright metal shed some ground at the beginning of the day amid near-term US Dollar (USD) demand, yet buyers took their chances around the $3,300 mark.

The USD turned lower following the release of dismal United States (US) data, as Consumer Confidence, as measured by CB, fell to 86 in April, its lowest since October 2021. Additionally, the number of job openings in the country on the last business day of March stood at 7.19 million, as reported in the Job Openings and Labor Turnover Survey (JOLTS), easing from the previous 7.48 million openings (revised from 7.56 million) reported in February and below the market expectation of 7.5 million.

Still, the positive tone of equities limited demand for Gold, maintaining the XAU/USD within familiar levels.

Market players are waiting for Wednesday’s data before committing to a certain direction, given that the macroeconomic calendar will be filled with first-tier events. Australia and Germany will publish inflation updates, while Germany, the Eurozone, Canada and the US will release Gross Domestic Product (GDP) figures. The US economy is expected to have grown at an annualized pace of 0.4% in the three months to March, sharply down from the 2.4% posted in the last quarter of 2024.

XAU/USD short-term technical outlook

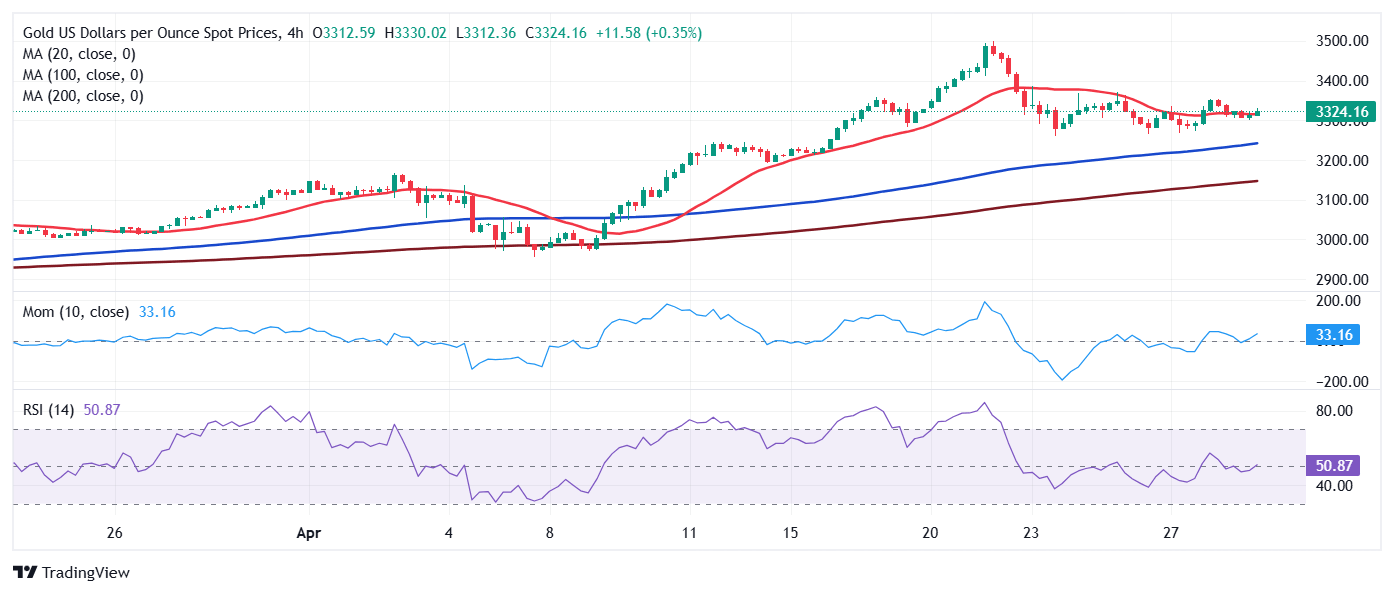

From a technical point of view, the daily chart for the XAU/USD pair shows the risk skews to the upside, yet the momentum is missing. The pair develops well above all its moving averages, with the 20 Simple Moving Average (SMA) currently at around $3,220, while far above the 100 and 200 SMAs. Technical indicators remain well above their midlines, but turned modestly lower, not enough to suggest an upcoming slide.

The 4-hour chart shows XAU/USD keeps seesawing around a directionless 20 SMA, while the 100 and 200 SMAs keep heading higher over $100 below the current level. Finally, technical indicators turned flat just above their midlines, reflecting the absence of directional strength. The bullish case could gain adepts if XAU/USD extends gains beyond its recent range’s top in the $3,370/80 region.

Support levels: 3,314.50 3,301.40 3,288.70

Resistance levels: 3,344.60 3,358.10 3,375.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.