Gold Price Forecast: XAU/USD holds below $3,400, awaits a catalyst

XAU/USD Current price: $3,374.30

- Federal Reserve officials hint at upcoming interest rate cuts starting September.

- US President Donald Trump hits India with an additional 25% tariff.

- XAU/USD loses its near-term momentum, trades within familiar levels.

Spot Gold trades uneventfully around $3,380 a troy ounce on Wednesday, holding within familiar levels for a third consecutive day. Gold eased throughout the first half of the day as Asian and European indexes advanced in the absence of negative news, weighing on Gold demand.

The XAU/USD pair, however, remained within familiar levels, as demand for the US Dollar (USD) also remained subdued amid mounting speculation that the Federal Reserve (Fed) will deliver interest rate cuts starting in September.

In the absence of relevant news, market players keep focusing on the dismal US Nonfarm Payrolls (NFP) report released last Friday, which erased concerns related to a tight labor market. Other than that, comments from Fed officials put pressure on the USD after Wall Street’s opening.

Minneapolis Fed President Neel Kashkari hinted at two interest rate cuts this year due to the current slowdown in the US economy. In an interview with CNBC, Kashkari said it may still be appropriate to begin adjusting the policy rate in the near term, as the Fed needs to respond to the slowing economy.

Late on Tuesday, Fed’s Mary Daly had a similar posture, saying the time for a rate cut is near and that they may need more than two trims. Additional comments from different Fed officials are in the docket ahead of Wall Street’s close.

Meanwhile, US President Donald Trump escalated tensions with India. The White House imposed an additional 25% tariff on the Asian giant, lifting levies to 50%. “I find that the Government of India is currently directly or indirectly importing Russian Federation oil,” President Donald Trump said in an executive order. “Accordingly, and as consistent with applicable law, articles of India imported into the customs territory of the United States shall be subject to an additional ad valorem rate of duty of 25%,” the executive order adds.

Thursday will bring the Bank of England (BoE) monetary policy announcement, with the central bank expected to trim interest rates from the current 4.25% to 4.% despite inflation at one-year highs. Other than that, the Asian session will bring the Chinese Trade Balance and the Reserve Bank of New Zealand (RBNZ) Inflation Expectations report.

XAU/USD short-term technical outlook

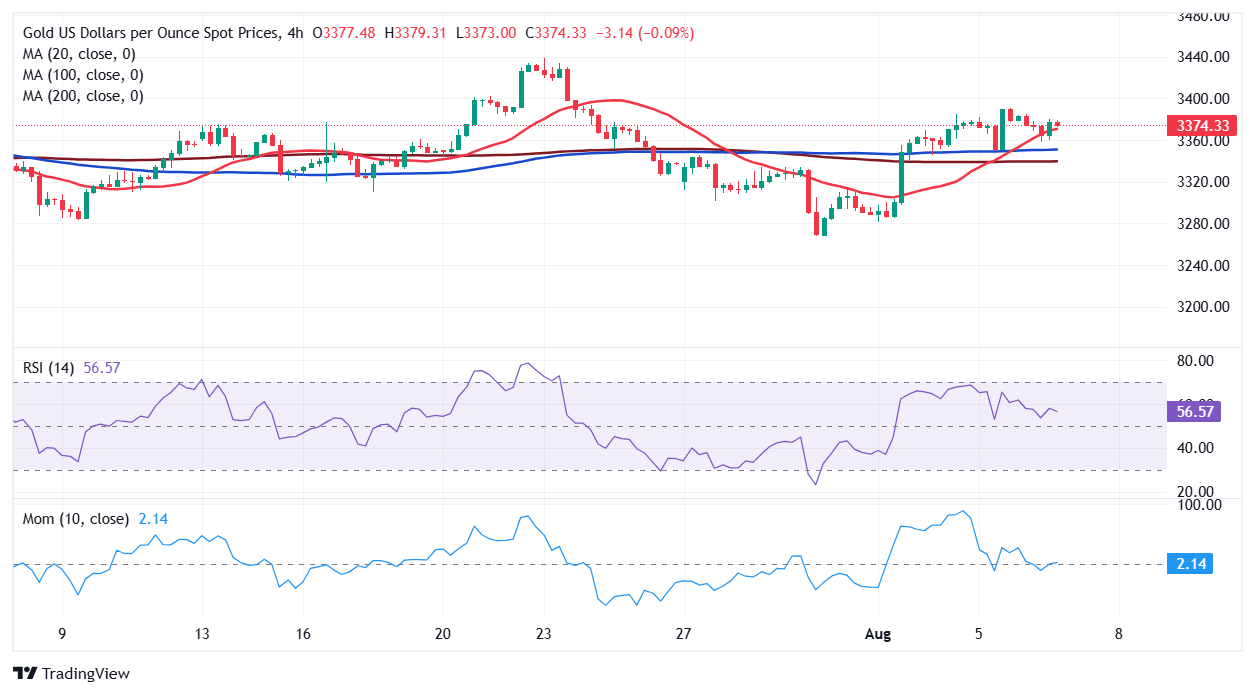

From a technical point of view, the XAU/USD is neutral-to-bullish. Technical readings in the daily chart show no actual progress, as the pair keeps finding buyers around a mildly bullish 20 Simple Moving Average (SMA) for a second consecutive day, with the indicator currently at around $3,350. Meanwhile, the 100 and 200 SMAs maintain their bullish slopes below the shorter one, maintaining the risk skewed to the upside in the longer run. Finally, technical indicators remain directionless within positive levels, reflecting the ongoing consolidation.

In the near term, and according to the 4-hour chart, XAU/USD offers a similar picture. A bullish 20 SMA provides intraday support at around $3,368 while maintaining its upward slope above directionless 100 and 200 SMAs. Technical indicators, however, head nowhere above their midlines, reflecting the absence of speculative interest around Gold.

Support levels: 3,368.00 3,350.00 3.338.60

Resistance levels: 3,396.90 3,407.75 3,420.10

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.