Gold Price Forecast: XAU/USD holds above $1780, capped by $1800

XAU/USD Current price: $1,793.20

- US Treasury yields decline on Monday ahead of US inflation data, helping gold.

- US dollar fails to hold to gains, DXY retreats from weekly highs back toward 92.50

- XAU/USD remains neutral-to-bearish in the short-term, under the 20-SMA.

Gold prices seesawed between gains and losses, holding within the recent range between $1,780 a troy ounce and $1,802. XAU/USD did not reach levels above $1,800, but it managed to rebound from $1,785, alleviating the bearish pressure. The move higher was boosted by a slide of the greenback. After a positive start of the week, DXY hit the highest level in two weeks and then turned to the downside, boosting gold.

No economic reports were released in the US on Monday. The focus is on Tuesday’s US CPI numbers for August that could weigh on Federal Reserve’s monetary policy expectations. The index is expected to show an increase of 0.4%, after rising 0.5% in July. No comments from Fed’s officials will be heard this week ahead of the September 21-22 FOMC meeting. US yields moved modestly to the downside on Monday, with the 10-year holding above 1.30%.

Gold price short-term technical outlook

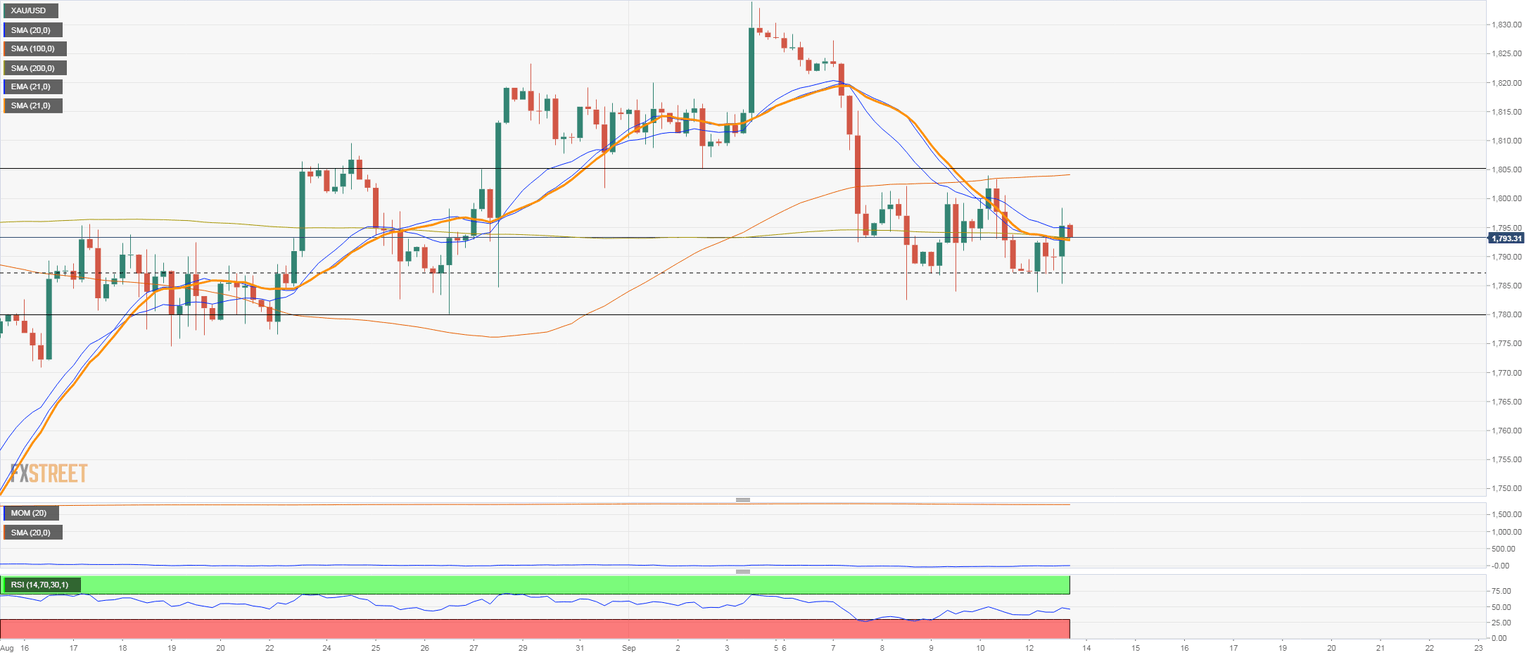

Gold prices continue to move in a range in the short-term with support at $1,780/85 and resistance around $1,800. The bias is to the downside as price remains under the 20-day simple moving average. Technical indicators in the daily chart show Momentum under 100 and the RSI steady. A close above $1,805 would increase the odds of a more strong recovery. The next resistance stands at $1,815; above attention would turn again to the critical barrier around $1,833.

In the near term, and according to the 4-hour chart, XAU/USD remains sideways. Indicators are modestly bullish, with price above the 20-SMA and technical indicators recovering from lows. Still, the upside seems limited and capped at around $1,800. A more positive sign would emerge with a breakout above $1,805. If the support around $1,780 is broken, it could trigger volatility and a quick decline to $1,770.

Support levels: 1,784.55 1,769.50 1,760.00 1,747.00

Resistance levels: 1,795 1,805.00 1,815.00 1,820.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.