Gold Price Forecast: XAU/USD extends record rally towards $2,850

XAU/USD Current price: $2,840.28

- Relief headlines related to US President Trump's tariffs helped to lift the mood.

- The JOLTS Job Openings report stood at 7.6 million in December.

- XAU/USD is overbought, but the record rally is far from over.

Spot Gold keeps reaching all-time highs on a daily basis, with XAU/USD hitting $2,845.54 on Tuesday and trading nearby in the mid-American session. The risk-averse environment triggered by United States (US) President Donald Trump’s tariffs fueled demand for the bright metal. Relief headlines on that front, however, put mild pressure on the US Dollar (USD) ahead of the American session opening, further pushing XAU/USD north.

After pushing tariffs on China, Mexico and Canada over the weekend, US President Trump postponed applying levies for 30 days to both neighbouring countries after the respective governments committed to increasing their border security with the US. Meanwhile, China announced retaliatory tariffs, although those won’t come into effect in the upcoming days, which means China and the US may strike a deal before trade tensions escalate.

Financial markets are clearly in a better mood, with most global indexes posting gains. Wall Street stands in the green, with the Nasdaq Composite leading the way up.

Additionally, the US published the December Job Openings and Labour Turnover Survey (JOLTS), which showed that the number of job openings on the last day of December stood at 7.6 million, down from the 8.09 million posted in November and below the 8 million anticipated. The news put additional pressure on the USD ahead of the release of the Nonfarm Payrolls (NFP) report on Friday. The US is expected to have added 170K new jobs in January, down from the 256K gained in December. The figure, despite softer, still hints at a strong labor market. Additionally, the Unemployment Rate is expected to remain steady at 4.1%.

XAU/USD short-term technical outlook

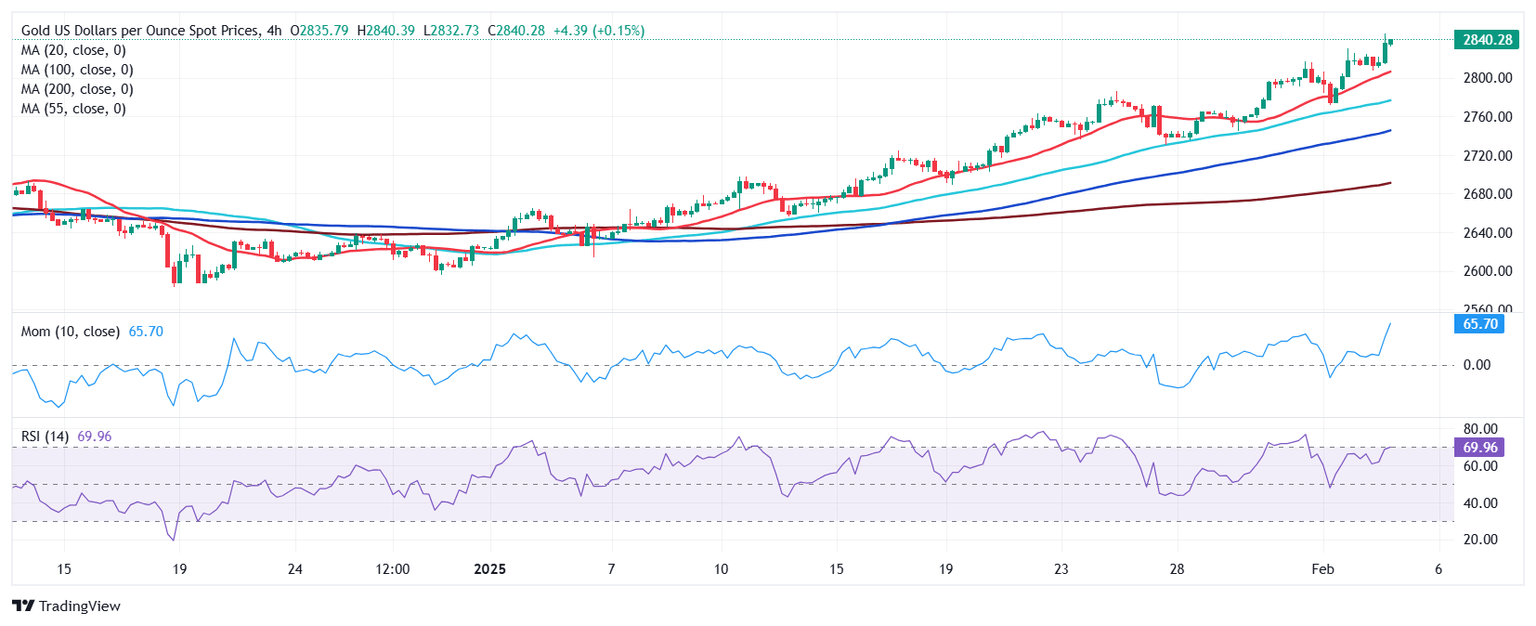

XAU/USD pressures the upper end of the ascendant channel, coming from the January 6 low at $2,614.44, indicating the bullish run may continue in the upcoming days. The pair is overbought according to technical readings in the daily chart, although the Momentum indicator has turned flat. At the same time, Gold develops far above all its moving averages, with the 20 Simple Moving Average (SMA) accelerating north far above the longer ones, currently at around $2,735.90.

Gold is set to keep rallying in the near term. The 4-hour shows approaches to a bullish 20 SMA attract buyers and result in higher highs, suggesting buyers are willing to add on dips. The 100 and 200 SMAs gain upward traction below the shorter one, also in line with the dominant upward strength. Finally, technical indicators aim north, with the Relative Strength Index (RSI) indicator entering overbought territory.

Support levels: 2,828.90 2,812.60 2,800.00

Resistance levels: 2,845.60 2,860.00 2,875.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.